The traditional sourcing market remains stable globally in Q1 2018 but slumps in EMEA with the General Data Protection Regulation (GDPR). The global sourcing market breaks records with digital transformation and as-a-Service driving growth for the remainder of 2018 as traditional business process and information technology outsourcing remain relatively stable and the market is influenced by technological evolutions.

While some business process outsourcers (BPOs) and information technology outsourcers (ITOs), combined the so-called ‘traditional sourcing market’, have certainly moved fast, early and smart enough to guide their customers on the journey towards GDPR compliance, many haven’t.

We’ve seen ITOs and BPOs start to communicate about the GDPR with (kind of) a service only as of late 2017 and some even in 2018, while others had already long forged the proper ecosystems on the front of solutions, strategy, training, technologies and all the pieces needed in order to deliver end-to-end GDPR compliance services to their corporate customers.

Today those outsourcing companies that were early/smart enough have reaped or are reaping the fruits while others suffer in a declining traditional outsourcing market in the EMEA region while all other regions go up.

The reason why EMEA goes down? You guessed it: budgets are allocated elsewhere; in getting ready for the GDPR, its requirements on the level of international data transfers (e.g. with binding corporate rules), ensuring data subject rights and getting the legal bases for lawful processing of personal data right in the complex corporate environments which leading BPOs and ITOs indeed serve.

Traditional sourcing when the money goes to GDPR compliance

Of course there are also other reasons why GDPR negatively affects outsourcing in the EMEA region such as the ways in which enterprises prepare and the partners (and models) which they seek to guide them through the journey.

That journey in enterprises typically is a collaborative multi-discipline mix with internal resources and reliance on external partners offering the proper services on myriad levels such as IT systems, information management applications, cybersecurity measures and technologies/solutions with special attention for pseudonymization and encryption in the GDPR, GDPR awareness programs, strategy, policies and the drafting of internal rules and sometimes adhering to approved codes of conduct, to name just a few. It’s clear that in some of these areas (certainly IT), legacy plays as do existing partnerships.

Nevertheless, all that preparing of course takes money. It’s as Rick Gruijters, head of Enterprise Information Management at IRIS Professional Solutions, that clearly got the ecosystem end-to-end GDPR compliance opportunity early enough, said in an interview on the strategic and information management – EIM and ECM – aspects of GDPR: “Organizations are already busy and time is money. It’s not as if they have a department that has the bandwidth to suddenly add the GDPR business challenge to their tasks.”

That’s the opportunity for outsourcers but if you replace the word bandwidth with the word money you see the essence of the reason why many outsourcers now suffer.

GDPR and traditional sourcing: the DPO opportunity from paper and multi-channel to process

With information management, business process outsourcing and so forth we’re also close to the evolving market of document processing outsourcers (DPOs, not to be confused with data protection officers in the GDPR acronym soup) and that of BPOs with a heavy focus on moving information and data into business processes as many of course do – but some do more than others.

Several years ago we wrote our first post on the GDPR in the scope of paper documents (as these contain personal data as well, get processed, stored etc. and fall under the scope of GDPR) and because of 1) the fact that this was a challenge for organizations and opportunity for the DPO and even service bureau industry and 2) the fact that the GDPR also offered an opportunity for service bureaus, DPOs and specialized BPOs as it was clear that quite a bunch of paper documents would become digitized (where document imaging or capture comes in with multi-channel and multi-format capture to storage and to business process in an increasingly intelligent automation context comes in and where robotic process automation, artificial intelligence and so forth increasingly pop up) in order to reduce the risks of paper (and slowness of paper-based processes) on one hand and increase efficiency, enhance compliance capabilities and enable digital transformation overall on the other.

This is still the case. While of course paper documents sometimes need to be stored for whatever legal requirements and more, in general it’s pretty obvious that those paper documents that aren’t needed in a paper format offer far more insights and ways to centralize your overall view on the personal data you hold/process when turned digital, with the inherent benefits of digital platforms in responding to the requirements of the essential data processing rules (limitation of purpose, storage and so on) and the exercise of data subject rights such as the right to erasure faster, better and according to pre-defined rules to name some benefits.

In the ongoing efforts regarding digital transformation (not the same as digitization yet without digital information there is little sense in digitally transforming, ask all factory owners who want to start with Industry 4.0 efforts but are still struggling with mountains of paper) we expect this to continue after the so-called GDPR deadline and not just in the EMEA region. There is still ample work in that regard. in a scope of GDPR this is even more so when looking at the simple fact that many organizations will not be ready for GDPR and are as slow as some outsourcers (a look at the traffic on our website shows that GDPR-related content has been exploding since end April so it’s last-minute for many as per usual, although the whole Facebook and Cambridge Analytica scandal ironically plays a key role here too as it boosted global awareness of GDPR and the ePrivacy Regulation).

The sourcing market: boosted by digital transformation, as-a-service and new technologies as traditional sourcing stagnates globally and declines in EMEA

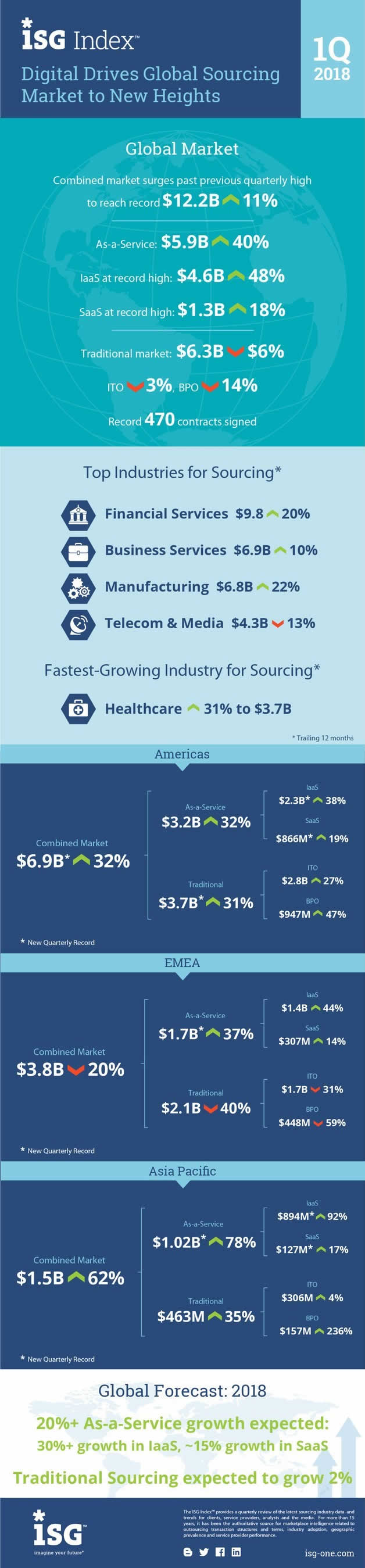

In the meantime, however, the facts are what they are. According to the Q1 ISG Index™, which measures commercial outsourcing contracts with annual contract value (ACV) of $5 million or more, the strong demand for digital transformation services boosted the overall global sourcing market in the first quarter of 2018. And for the first time ever ACV exceeded $12 billion according to ISG (Information Services Group).

The main reason is a 40 percent increase in the as-a-service sector since ITO and BPO (traditional outsourcing) is relatively stable, with small and less small decreases nevertheless. However, when looking at the EMEA sourcing market, it slumped in the first quarter and saw combined ACV decrease with 20 percent to the worst three-quarter stretch since 2007 (to a combined Annual Contract Value of $3.8 billion).

The worst performing markets are at the same time the two largest ones: the UK and DACH (Germany, Austria and Switzerland). Other, smaller markets did OK. From an industry perspective the worst declines came from the banking and financial services sector, along with the energy and telecommunications sectors.

And it’s especially traditional sourcing (so BPO and ITO) that shrunk, going down 40 percent. Just as in other markets the as-a-service market sees record growth, in both the IaaS and SaaS segments.

What does all this have to do with the GDPR again? While the announcement from Information Services Group (ISG) focused on the global sourcing market where, in general digital transformation leads to records and as-a-service booms, the exception for EMEA in the traditional sourcing market of BPOs and ITOs has everything to do with the GDPR as ISG stated in a second announcement. As for the impact on DPOs we have no data.

GDPR and traditional sourcing: a 40 percent plunge with the as-a-service space continuing to add to the decline after the GDPR in EMEA

The main cause for the 40 percent plunge in traditional sourcing in the EMEA region: European enterprises focused attention and discretionary spending on preparations for the GDPR.

Quoting ISG EMEA partner and president Steve Hall: “The focus on preparations for the sweeping GDPR data privacy regulation and the impact this will have on business relationships is front of mind for many organizations and has led to a shift in priorities. The recent demise of Carillion and the financial uncertainty of some high-profile outsourcing companies has been extensively reported and has added a new degree of caution in the market.”

ISG also offers some insights into the poor performance in the UK and the DACH region:

- In the UK traditional sourcing ACV did rise 3 percent on a sequential basis in the first quarter of 2018 but compared with Q1 2017 it’s over 60 percent down.

- The DACH region has been doing poorly for three quarters in a row, among others because of declining interest for traditional sourcing, as mentioned the GDPR (goes for most European countries) and a shift towards new technologies.

Although small, France keeps growing well. For the rest of the year, Steven (Steve) Hall states that “while traditional sourcing may have a bumpy ride in coming quarters, the trend toward as-a-service will continue to accelerate across Europe through 2018.”

In other words: traditional sourcing will suffer, regardless of the GDPR, the GDPR just adds dramatically to its decline with some clear victims. It seems that traditional business process outsourcing and IT outsourcing are becoming less inevitable – in their traditional shape that is – than just a few years ago.

The global sourcing market 2018: key takeaways – industries, segments and regions

As mentioned, globally the sourcing market is performing extraordinarily well. Here too the shift away from traditional sourcing with as-a-Service on the rise.

Steve Hall: “If the numbers this quarter tell us anything, it is that digital transformation is a very real and growing phenomenon. Digital technology is lowering costs and changing business models for virtually all the world’s leading enterprises, and there is no end in sight. How organizations are adopting new business models, how they have shifted toward a product-oriented mindset and what that means to the broader sourcing market all point toward optimism for continuing growth.”

The as-a-service sector reached $5.9 billion of ACV in Q1 2018 with IaaS good for $4.6 billion (+48% compared to the same period last year) and SaaS accounting for $1.3 billion (+18%). The ACV of information technology outsourcing was down 3 percent, that of business process outsourcing down 14 percent, which is relatively stable when looked at over a longer period.

From an industry perspective the financial services sector remained the largest global market for combined sourcing services over the trailing 12 months ISG states.

It is followed by business services and manufacturing (here is our leading Industry 4.0 market with smart manufacturing and the industry leading in IoT spending and in overall industrial transformation and Industrial IoT). The fastest grower, however is the healthcare industry, also in full digital transformation, while telecommunications and media was down 13 percent.

While the EMEA region is suffering in traditional sourcing, certainly in the UK and in the DACH Region, the Americas are and remain the largest sourcing market. In the APAC region, the ASEAN countries and China lead with traditional sourcing up 35%.

Just as is the case in EMEA for the rest of 2018 the as-a-service segment remains strong with overall 20% ACV growth and the traditional differences per region and industry.

Mega-trends and technological evolutions in global sourcing

At the occasion of the release of the global sourcing market update ISG also looked at five mega-trends impacting the industry as you can see in the SlideShare presentation below:

- A first one, fitting in the as-a-service scope (public cloud and SaaS) revolves around the enterprise workloads that are as-a-service. This would already be the case for 50 percent to 70 percent of enterprise workloads.

- For those who believe that no jobs are or will be lost due to transformation: 20 to 40% of labor seems to be removed through extensive automation (where you can again think the future impact of robotic process automation or RPA, certainly in combination with AI which is not the same, in a business process context).

- The agile enterprise is becoming the dominant operating model according to ISG. That needs little explanation. The agility message we hear since cloud and long before (again the as-a-service).

- Digital becomes the business. The shifting business role of IT fits here, a topic we covered ample times – ISG speaks about the Revenue Generation Engine.

- IoT is swallowing Enterprise IT and moves to integrated platforms, whereby we doubt that IoT platforms are meant as described in our IoT platform market overview but probably are more about IoT as it is about to be embedded in close to all business platforms and in what IDC would call digital transformation or DX platforms (compare with the evolutions in i-ERP, for instance).

There is more on topics such as networking as an enabler of digital transformation with, among others, a look at SD-WAN, NaaS (Network-as-a-Service), telecom market trends and, how else could it be in this day and age, and looking at the main industries with financial services leading the sourcing pack, blockchain, which in business still is mainly a matter of that industry although of course there are others, such as logistics.

More findings from the global overall sourcing market report for Q1 2018 in the press release and the infographic below. More on the EMEA findings with additional data and an industry view in the second press release.

The sourcing market in Q1 2018 visualized

Top image: Shutterstock – Copyright: ESB Professional – All other images and embedded presentations are the property of their respective mentioned owners.