Public cloud services revenues have grown faster in 2016 and 2017 than expected. The major providers post high earnings in changing markets and build strategic partnerships for hybrid cloud offerings while cloud and IoT are key drivers of digital transformation and mutually strengthen each other in combination with other technologies. An overview.

UPDATE: PUBLIC CLOUD SERVICES SPENDING 2021-2022

Cloud computing remains essential for, among many others, scalable digital transformation projects. Moreover, ample technological evolutions which are gaining speed further drive the cloud market.

As mentioned in a previous article, covering findings regarding global CEO digital transformation goals, according to surveyed CEOs the main digital trends for at least 2018 and 2019 will be respectively IoT (the Internet of Things) with 41 percent of respondents, followed by cloud computing (35 percent).

Other surveys with other questions and audiences (e.g. IT professionals instead of CEOs of leading multinationals, other industries and so forth) might show different results of course. Yet, all in all it’s pretty clear that IoT and the essential building blocks of the third platform, including big data analytics, mobile computing (key for 31% of the mentioned CEOs) and, indeed cloud computing are among the technologies that will see most growth in the next years.

Add to that, depending on industry and use case, edge computing, artificial intelligence (less mainstream than we are made to believe but becoming it soon), blockchain, the immersive experiences that virtual and augmented reality should bring, digital twins and a few more technologies and you’re pretty close to the list of some important technology trends.

There are of course more. However, there is also a difference between important trends and where many companies plan to put their money. And then you best stick to cloud, big data analytics, IoT and mobile technologies to name a few.

So, let’s look at cloud investments and dynamic and specifically public cloud services.

Public cloud providers and hybrid cloud partnerships

You’ve probably seen how end October 2017 Microsoft, Amazon, Alphabet (Google) all posted impressive quarterly earnings, not just showing the success of their cloud strategies but also the ongoing shift towards the public cloud that has started accelerating since quite some time now.

While Microsoft always had a strong partnership model especially Google needs to pick up speed though if it wants to dethrone the number one in public cloud land, Amazon Web Services. The question is of course if that’s even possible with Amazon having such a lead, compared to its main competitors, Microsoft included. And a second reason why that might not be possible is that you can’t fully compare the main public cloud providers who all have their own focus. For Microsoft it’s responding to customer demand for hybrid cloud and it’s in this area that we see new alliances being announced.

Partnerships indeed seem to be the term you’ll hear more and more. On October 31, 2017, BT Global Services, known for its ‘cloud of clouds’ portfolio, struck a strategic deal with Amazon Web Services as part of the next stages in that ‘cloud of clouds’ strategy which includes a hybrid cloud landing zone. Just a few days earlier Cisco announced its own strategic partnership with a public cloud player in order to deliver hybrid cloud solutions: the Google Cloud Platform.

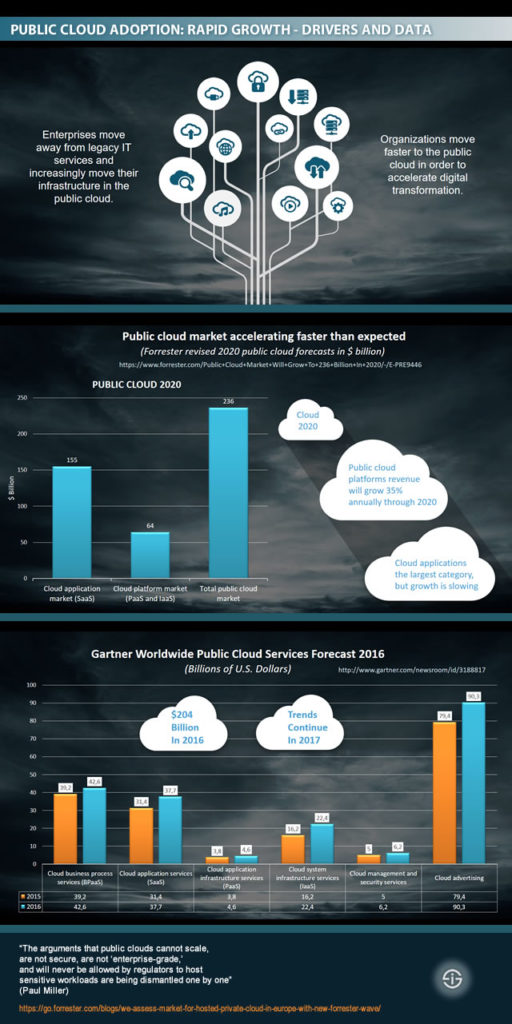

The increasing adoption of public cloud services, also for business-critical workloads, as said has started since quite some time. Living in a de facto multi-cloud reality where hybrid cloud for now is the main cloud deployment model, public cloud remains a fast grower.

Drivers of public cloud adoption and a look at cloud and IoT

There are many reasons for that growth as we mention on our cloud computing page. Among them are growing investments in infrastructure, business process services and middleware as Gartner stated in 2016.

To understand the evolutions in public cloud we also need to look at the other technological priorities of both the providers and their customers. Artificial intelligence and IoT are two of them and in 2017 we’ve seen ample initiatives and announcements in that regard.

Given the importance CEOs see for respectively cloud computing and IoT for the next 2-3 years it’s good to remind that growing IoT investments and the increase of large-scale IoT projects inevitably have their impact on the public cloud market. The other way around, IoT initiatives by public cloud vendors and by cloud services providers in launching IoT solutions and in building partnerships with large IoT players also drive IoT investments.

While everyone rightfully mentions edge computing as a key driver and enabler to solve many challenges of the IoT data deluge and cloud moves edge, the cloud is of course omnipresent in virtually all IoT evolutions.

As the adoption of IoT, certainly Industrial IoT, increases, the demand for IoT platforms (in the cloud) goes up; IoT data exchange and IoT monetization platforms are on the rise; more IoT-powered applications are built in the cloud and new solutions for faster application deployment in Industry 4.0 environments such as HPE’s Express App Platform (which is on-premises but fully integrated with its Cloud28+) or Intel’s Secure Device Onboard emerge, cloud and IoT prove to be as inseparable as cloud and digital transformation, IoT and big data, IIoT and industrial transformation, increasingly IoT and artificial intelligence, and the combination of IoT, AI and big data analytics to name just a few. It’s indeed all in the mix.

As the public cloud wars continue and CEOs plan to invest in cloud and IoT, the public cloud market continues to grow as is clear. However, it’s also growing faster than expected.

Worldwide public cloud services spending: growing faster

Previously we briefly mentioned Gartner. Mid-october the research firm sent out a press release on its forecasts for worldwide public cloud services revenue.

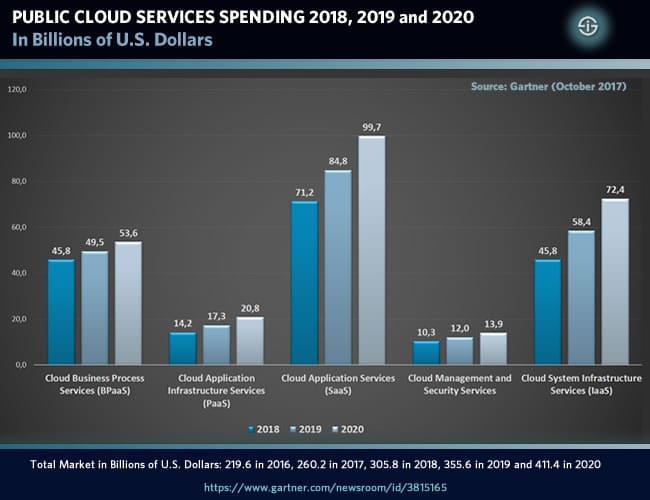

According to the announcement public cloud services revenue will be $260 Billion for this year. That’s a growth of 18.5 percent compared with 2016. Interesting is that both in 2016 (final data) and 2017 SaaS (Software as a Service) revenue is higher than expected which also lifts up overall public cloud revenue numbers.

- Saas would grow 21 percent this year and reach $58.6 billion. This unexpected higher growth obviously means that SaaS by far remains the biggest category of public cloud services from a revenue perspective. Gartner’s Sid Nag explains the acceleration in SaaS adoption by, quote “Providers delivering nearly all application functional extensions and add-ons as a service. This appeals to users because SaaS solutions are engineered to be more purpose-built and are delivering better business outcomes than traditional software is.”

- Platform as a Service (PaaS), however, is also growing faster than expected. It’s another factor adding to higher than forecasted growth in the public cloud space.

- Last but not least, the highest growth in public cloud services comes from IaaS (Infrastructure as a Service) which is in line with the forecasts made earlier by the company.

The high numbers reflect the earlier mentioned quarterly earnings of end October. Gartner looks at the different vendors from the perspective of their share in SaaS, IaaS and PaaS as you can read in the press release.

Expect the current trends to go on in 2018 and also an increasing impact on public cloud services of infrastructure, middleware, application and business process services shifting to cloud whereby the public cloud market revenue for this segment will increase to more or less 28 percent of all public cloud services through 2021 when, according to Gartner, 70 percent of public cloud services revenue to be dominated by the top 10 public cloud providers.

Interesting times ahead for public cloud providers on all levels indeed: specific services for evolutions in among others IoT, partnerships with hybrid cloud service providers, increasing growth in the most interesting segments and an ongoing race to belong to those top public cloud providers.

Feature image: Shutterstock – Copyright: Blackboard