The AEC industry (architecture, engineering, and construction industry) is often seen as rather slow in terms of digitization and digital transformation.

That’s a generalization since larger AEC players in recent years realized true business model transformations and a few years before COVID-19 disrupted our lives business analysts zoomed in on accelerating digiti(al)ization moves in the engineering and construction (E&C) segment.

On a side note: on top of the acronyms AEC and E&C you might also encounter AECO (Architecture, Engineering, Construction, and Operation). In AECO we include companies and experts in the maintenance and operation part of the built asset lifecycle.

The architecture, engineering, and construction (AEC) industry continues to rapidly shift from siloed old technology to data-driven, digital, and model based (IDC)

With, among others, the impact of the pandemic, the increasing complexity of building construction and infrastructure works, changing demands of ever more stakeholders, and maturing technologies, things are now changing for many smaller players in the AEC market and even faster for the larger ones, although the construction industry faces several challenges due to several factors, including the pandemic, at the same time.

It’s certainly not that the technologies to transform planning, operations, collaboration, and innovation in the AEC industry, in which architects, engineers, and contractors work together, are new.

An obvious example is BIM (building information modeling and management) which was born a long time ago and, although not adopted as fast as once believed, in its mature, modern version is essential for digital transformation in the AEC industry (more about the ‘why’ in a subsequent article). BIM is evolving too and will become even more critical, also for other stakeholders than the main parties in the AECO industry.

Speeding up the slow journey to Construction 4.0

Why has digitization and digital transformation, let alone the migration to what has been dubbed Construction 4.0, in analogy with Industry 4.0, been relatively slow for several actors?

After all, the AEC sector is not exactly small either. Construction accounted for 13.2 percent of global GDP, as you can read and see in our overview of research on data strategy in construction.

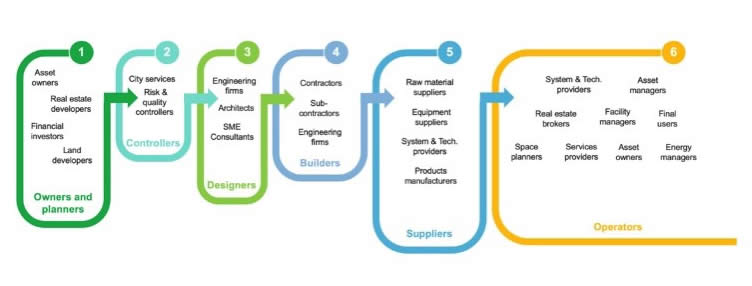

As per usual, there are several reasons, but the way construction works/worked is undoubtedly one. A traditional construction project is typically relatively linear/sequential, and each partner plays its role before passing on to the next to put it simply.

That sequential – and fragmented (see further) – construction value chain is nicely depicted in the illustration below by Olivier Lépinoy. Olivier, who works for BIM leader Autodesk as a member of the business development team for the AEC industry, further describes an alternative model with other names for the actors in the new ecosystems that emerge and how he sees the future of construction and Construction 4.0 in an article for the Autodesk University.

Collaboration challenges, a lack of data management skills and tools (big data analytics and data management are among those cornerstones of most digital transformation strategies), budget issues (cost pressures, low R&D budgets), cybersecurity risks, and the occasional lack of buy-in for technology-driven change, however, are hindering factors.

Still, the industry has a wealth of tools and technologies at its disposal that enable it to realize quite some transformations, regardless of how mature the companies are. And the pace of change will definitely increase for the reasons explained below, with data as the fuel for many of the – required – evolutions.

Data and transformation: the importance of building information modeling for the construction industry

Several vendors in the AEC market point to digital twins as the enablers of the next transformation wave in architecture, engineering, and construction. That seems logical since, in the end, digital twins are a logical evolution of BIM – and what it is about.

Yet, we need to briefly look at BIM since it’s a cornerstone of transformation in many countries. We clearly see that the pandemic boosts BIM and the capability it offers to move towards a very data-intensive virtual collaboration. The same goes for cloud computing and BIM in the cloud.

Moreover, BIM isn’t known equally well by all stakeholders in construction projects yet. And then there’s the reality in the field: even some large contractors who started leveraging BIM and related solutions at times remained stuck in the pilot stage or returned to the old ways of working.

The building life cycle is complex and multifaceted, yet design, preconstruction, cost estimation, bidding, project management, and operations often are often disconnected. This is changing, as organizations in this market strive to establish a unified view of data-rich models that can be used to ensure quality, safety, and project execution. (IDC)

In other words: while technologies such as digital twins, AR/VR, 3D-printing, and many others become ever more important in the AEC industry (certainly digital twins), there are still quite some companies that need to understand BIM or even solve more fundamental challenges in a digitization context. The adoption of digital twin technology in some segments nevertheless goes quite fast as the quote below indicates, especially among those larger players.

The BIM market is looking at solid growth as the market matures, awareness of the (many) benefits of BIM increases, government mandates for BIM usage grow in several countries, demands of stakeholders change, and integration possibilities between BIM and more recent technologies increase. Examples of integrations include IoT, drones, artificial intelligence, augmented reality, 3D scanning (acquiring data from an object, building or site using a laser scanner to generate a BIM model) and 3D mapping, 3D printing, and far more.

The pandemic contributes to the growth of BIM, as does the fact that collaboration between stakeholders and solid and information-rich data models are becoming a must in the scope of intelligent and green building projects, advanced maintenance requirements, and cost-cutting efforts. The government mandates and industry initiatives in countries where there are none yet play too. In 2022, Italy, for instance, will join the list of countries where BIM is required for government infrastructure projects.

Manufacturers of products and solutions for the AEC industry know the growing importance of BIM all too well as they are expanding their information-rich libraries of 3D objects and tools with plug-ins for BIM applications, enabling to enhance efficiency, collaboration, and risk mitigation across the entire lifecycle of the building/construction, with additional benefits for facility management and maintenance.

From a fragmented construction industry with different maturity levels to a collaborative and holistic approach

At the same time, however, several actors in the AEC industry are indeed still mainly in the digitization stage, trying to get rid of paper and manual processes.

That brings us to one of the critical transformation challenges for the AEC industry: it’s a very fragmented market with numerous players in construction and infrastructure projects, who often still work in silos or focus on some specializations. Moreover, it’s a market that moves at different speeds with many smaller companies.

With the evolutions in the context of smart buildings, smart factories, smart cities, and so forth, we also often see new players who master one specific aspect of a project, often a more technologically advanced one that fits in this increasing demand for anything smart/connected (e.g. smart digital locks in hotels). There are also new types of players disrupting existing business models.

Managing all this ain’t easy and is one of many reasons strong collaboration, where BIM again plays a role, is critical: bringing together all the stakeholders around a common digital model, right from the very start and across the facility’s lifecycle with clear agreements.

Numerous factors such as growth in infrastructure projects, owing to rapid urbanization and increase in productivity through exchange of information drive the AEC market globally. (Allied Market Research)

The days that construction was a sequential and even a project-based process are ending, and AEC players will have to acquire the skills to be part of ecosystems that shape around virtual, digital platforms and methods. The construction industry also doesn’t stand on its own and needs to adapt to the evolution towards smart buildings and infrastructure that, in the end, is all about connecting data – and ranks high on the agenda of end customers who also have their changing challenges and needs.

The fact that end clients increasingly want smart buildings has a significant market impact, as mentioned in an interview on commercial real estate.

Other changes in customer demand with a transformative impact include a focus on sustainability, the desire for integrated systems and dashboards, efficiency gains on all levels, increased flexibility/adaptability (e.g., to be able to change the purpose of a building later on), more focus on costs, and regulations in several areas.

So, among those pushing the agenda towards a more holistic, data-driven, and less linear way of working are large vendors of solutions for the AEC industry. Think about building and energy automation vendors, for instance. They often create ecosystems of partners with certification programs to up the skills of these partners, bringing together the right ones for specific projects and thus generating business for AEC industry players. This way, they can sell their more advanced solutions by selecting and training these various partners who become their resellers. Schneider Electric’s EcoXpert is an example (with BIM libraries and players in its Schneider Electric Exchange environment).

It is expected that the AECO industry, building automation companies, and providers of technologies such as BIM and digital twins will enter a new stage of mergers and acquisitions as the market progresses rapidly and digital transformation accelerates, driven by the pandemic.

The global AEC market size was valued at $7,188.00 million in 2020, and is projected to reach $15,842.00 million by 2028, growing at a CAGR of 10.7% from 2021 to 2028 (Allied Market Research)

Schneider Electric and AVEVA Group, with which it merged in 2018, for instance, have been quite active in that area. In 2012 AVEVA acquired the Bocad group of companies, active in BIM. In 2020 Schneider completed the voluntary takeover of RIB Software, which offered the first enterprise cloud technology based on 5D BIM with AI integration for construction companies, industrial companies, developers, and project owners. And, as we reported, Schneider joined forces with ToughtWire for digital twins in 2019.

AECO market players also seek partnerships with specialists in other technologies/solutions that fit in the BIM and digital twin – or let’s say advanced data – picture, such as augmented reality, GIS, platforms used in the context of construction projects and workflows, and solutions in emerging ‘smart’ areas or in the scope of the overall building/lifecycle (asset and maintenance, contract management, project information management, energy management, etc.) The same goes new entrants in the construction software space who are also quite active in M&A activities. The acquisition of VisualLive by Unity (3D, AR, and BIM workflows) is an excellent example.

Do remember ‘holistic’, data in action, and integration/convergence.

Next steps and additional information on construction industry transformation

In the current context, focusing on collaboration, upskilling, acquiring new capabilities, joining ecosystems, solving pain points, and achieving the types of outcomes that have become even more important with the pandemic will remain instrumental. Government initiatives will play an additional role that goes far beyond BIM with changing building requirements and regulations. And last but not least, ecosystems will continue to broaden as the end client faces additional pressures on several levels, also often accelerated by the pandemic.

For many players in the AEC industry, the message remains to start small and gradually scale while those who are further in their transformation journey show the possibilities of the technologies and platforms enabling that more holistic digital transformation of the industry and, more importantly, what their clients nowadays seek. Because change, in the end, is inevitable as the way we look at buildings, cities, transportation, work, and the whole built environment changes too.

Although construction firms are relatively immature in their digital transformation journey, after progressing through the downturn of the pandemic, they are planning to adopt big data and analytics, AI, IoT, and robotics to automate and improve decision making as they work with increasingly complex data sets. (IDC)

These aren’t certainly the only aspects to cover in the context of the digital transformation of the AEC industry. In follow-up articles, we’ll cover the impact of the pandemic on construction, some examples of ‘leaders’, the technologies and applications that are expected to drive transformation in the ‘Construction 4.0’ context and – an important one – the evolution of future of work approaches that definitely is a hot topic here as well, again with the pandemic as an accelerator.

Spending on future of work technologies is in fact expected to grow fastest in the construction industry with a CAGR of 23.7 percent in the period through 2024 as mentioned in our article on the future of work.

Sources AEC market quotes and data:

- AEC Market by Component (Solution, Service), Deployment Mode (On-Premise and Cloud), Enterprise Size (Small & Medium Scale Enterprises and Large Scale Enterprises), and Application (Construction & Architecture Companies, Education, And Others): Global Opportunity Analysis and Industry Forecast, 2021–2028 – Allied Market Research

- The AEC Industry Transforms Through Digital and Data (IDC)

- Digital Twins and Digital Thread for Buildings and Infrastructure (IDC)

All images belong to their respective mentioned owners. Top image acquired via Shutterstock. Infographic via Cosential (Unanet CRM). Images serve illustration purposes only.