Blockchain technology is often used as a synonym of distributed ledger technology (DLT) although both are not the same. A blockchain uses several technologies, including distributed ledger technology, to enable blockchain applications.

Other technologies and computational/mathematical techniques that are used in blockchains include digital signatures, distributed (peer-to-peer) networks, and encryption/cryptography methods, among others linking the records (blocks) of the ledger.

- Blockchain technology from hype to reality

- The growth of distributed ledger technology business initiatives

- The scale and transformation of transactions in a decentralized digital age

- Blockchain technology: an encoded and decentralized database

- Where blockchain technology is used – application areas

- Blockchain in business 2018-2021: data and action plans for the near future

- The limitless applications of blockchain – revisiting transactions in the digital age

- How does blockchain technology work?

- Some benefits of blockchain technology

- Additional resources on blockchain in business

Blockchain technology is a form of distributed ledger technology. A blockchain is a distributed and immutable ledger to transfer ownership, record transactions, track assets, and ensure transparency, security, trust and value exchanges in various types of transactions with digital assets.

Distributed ledger technology (DLT) revolves around an encoded and distributed database serving as a ledger whereby records regarding transactions are stored. At the core DLT is an innovative database approach with a data model whereby cryptography is utilized in each transaction update and verification become possible across the specific blockchain network, depending on its goal and stakeholders.

A look at distributed ledger technology in practice and beyond cryptocurrencies – how blockchains and DLT work, industries, applications, evolutions, networks and the business reality.

Is there still something that blockchain, a Distributed Ledger Technology (DLT), and known as the technology that powers cryptocurrency Bitcoin, doesn’t promise to change in digital business and transaction processing and digital services requiring trust in one shape or another? Or perhaps better: is there still some challenge, organizational or other, whereby blockchain isn’t hyped as the ultimate solution?

Blockchains are immutable digital ledger systems implemented in a distributed fashion (i.e., without a central repository) and usually without a central authority. At its most basic level, they enable a community of users to record transactions in a ledger public to that community such that no transaction can be changed once published (NIST Blockchain Technology Overview Draft NISTIR8202, January 23, 2018)

Blockchain technology from hype to reality

Although indeed being hyped in this stage (and for most applications being in the early stages of hype cycles) blockchain technology is part of the arsenal of software and solutions which are highly relevant in the scope of, among others, digital transformation.

It certainly isn’t the solution for everything (well on the contrary) as one might believe when seeing the hype but it is highly valuable in specific circumstances where its use is relevant.

Do note that today many opinions on what blockchain could mearn for “xyz” (whereby blockchain really means DLT) as you can see them in popular media and vendor talk are indeed just about that “what it could mean”. Terms such as ‘potential’ and even ‘revolutions’ are very frequently used when the possibilities, rather than the realities of DLT are covered. As you know, between potential and reality there is a big gap – and there seem to be quite some revolutions these days: the Industry 4.0 revolution, the artificial intelligence revolution (really an umbrella term), you name it.

Blockchains (indeed, plural) are tested and deployed across several use cases of digital trust and exchanges in all industries, in and beyond cryptocurrencies, and as a contractual backbone of trust in a digital age. DLT is poised to be one of the fastest growing digital technologies and evolutions for several years to come and has a key role in ample relevant use cases in the digital transformation of several processes and industries.

Real blockchain contains five elements: Distribution, encryption, immutability, tokenization and decentralization (Gartner)

Blockchain technology hype also leads to big difference between what a technology could possible do and what it really can do, or even better, does. However, there is no doubt about it: distributed ledger technology is becoming big business and big in business, some business that is.

There are several reasons why DLT adoption is poised to be grow across use cases and industries of all kinds faster than expected while in many others it will not meet expectations or simply will not be needed. And even if it is still relatively early days for DLT for most companies, all signs are clear (as are the roadmaps of some of our partners, de facto implementations and industry initiatives): distributed ledger technology is among the top evolutions, albeit with adoption, testing and effective usage at different speeds, depending on context, industry, use case and maturity of the organizations as tends to be the case with all technologies.

The growth of distributed ledger technology business initiatives

In 2017 and 2018 literally hundreds of companies, including leading global companies and leaders within their respective countries or regions across various sectors have joined important blockchain and DLT initiatives.

If you only look at the partners of a few more or less recent initiatives which we mention below such as IBM’s cross-border payment blockchain initiative which mainly has companies from the Asia Pacific region on board as that’s where it starts and which was announced in October 2017 you already have close to 100 companies. Yet, at the same time many of these initiatives (will) fail to meet their objectives while others are becoming more important.

Blockchain is not yet enabling a digital business revolution across business ecosystems and may not until at least 2028 (Gartner)

However, before we start looking more in depth at some use cases and projects (or, at least, link to them) we need to give a small overview of DLT for business. For many distributed ledger technology is still relatively new, certainly outside of its Bitcoin and cryptocurrency scope (and that’s the scope OUTSIDE of which most business initiatives want to leverage DLT, leading to discussions about which terms we should really use).

And since we only tackled blockchain technology from the financial services industry perspective in the past (because that is where the attention outside the cryptocurrency context started and loads of transactions are involved) and the Internet of Things (IoT) perspective (because that is our second digital trend in our list to really watch in case you don’t yet and involves even more transactions), we also want to look at what blockchain technology is and how it gets adopted in more applications and sectors than the mentioned ones (from government to legal and supply chains). Use the table of contents above to jump to the section that interests you most.

The scale and transformation of transactions in a decentralized digital age

As technologies and business approaches get distributed in virtually all digitalized areas, so do transactions. Moreover, new digital services pop up where there is a need for integrity, trust and security and existing services can be transformed using those same essential principles in a digital transaction context.

From transactions in the de facto distributed reality of the Internet of Things (IoT) to an increasing distributed transaction processing in business processes: the scale, speed, volumes and data involved are on the rise as we speak, with transactions in some applications and use cases being more than just on the rise.

The question is how do you deal with ever more and faster transactions as the core of digital business in a reliable way that doesn’t slow down transactions in any way but, on the contrary, offers the speed they need in a trustworthy and cost-efficient way? Using a distributed technology and a different data model is the answer for many. Enter blockchain technology.

Blockchain technology: an encoded and decentralized database

As mentioned, blockchain revolves around an encoded and decentralized or distributed database (the ‘distributed’ part of distributed ledger technology) which serves as a ledger whereby records regarding transactions are stored and cryptography is used for each update in transactions.

Blockchain technology is rooted in the world of cryptocurrencies, more specifically Bitcoin. That connotation will disappear and we will not speak about the blockchain but about blockchains (note the letter ‘s’), blockchain technology or distributed ledger technology. Although today decentralization and the absence of a predefined central authority are often mentioned now in times where cryptocurrencies still have most attention, they aren’t the strict essence (moreover, even in Bitcoin there are central authorities so to speak, the Bitcoin miners, but that’s a different story).

Companies are urged to focus on private blockchains for commercial deployments (Juniper Research)

Blockchain technology is being tested and implemented across a broad range of applications, industries and use cases for endless applications. Examples, on top of the Internet of Things and financial services (banking, insurance and reinsurance, capital markets) include Industry 4.0, fraud management, digital identities, information management and far more areas and industries where it fits in a context of transactions, payments, contracts (smart contracts), proof, trust and so forth in the decentralizing nature of digital transformation technologies.

These records can’t be changed as the model is distributed: there isn’t a central authority but there also isn’t any involved party (those doing transactions) that can change information. Blockchain relies on peer-to-peer network principles whereby each encrypted block in the chain is linked to the next. Why the peer-to-peer network and absence of a central authority? Because blockchain was precisely ‘invented’ to solve the challenge of the lack of a central authority in cryptocurrency Bitcoin.

However, this doesn’t mean that blockchain is only used for very decentralized applications. Blockchain is used by organizations and/or groups of organizations for specific services where trust from other parties is needed or to build a blockchain network with other parties without traditional intermediaries. It’s also important to differentiate between public and private blockchains and between blockchain networks from the perspective of the relevance of the goal and context in which they are used, which organizations and/or groups of organizations use them and what those exact services are.

The attention for blockchain from a security and secure transaction perspective is, among others, related to the fact that blockchain is a cryptographic ledger whereby the chain consists of encrypted blocks and after the validation of the transaction (peer-to-peer and across the network) it is added as a block to the chain as a permanent and unchangeable record of transaction in digital ecosystems with heavy transaction processing whereby transactions, data and speed increase and meet the need for a layer of trust.

Where blockchain technology is used – application areas

Below are some examples of where blockchain or distributed ledger technology is tested and implemented with some details per mentioned industry or area of application.

Blockchain in banking, insurance and finance services

Especially since 2015-2016, many initiatives were taken by large financial service providers and institutions, as well as FinTechs, regarding blockchain for finance.

Distributed ledger technology is among others used and/or tested for insurance applications such as claims management and for banking applications where digital identity and smart contracts are just a few use cases that fit in myriad financial operations. The transfer of funds and financial transactions are other areas which are also closer to the roots of blockchain.

Among the companies that can benefit most from blockchain are those with a current dependence on paper-based legacy storage systems and/or a high volume of transmitted information (Juniper Research)

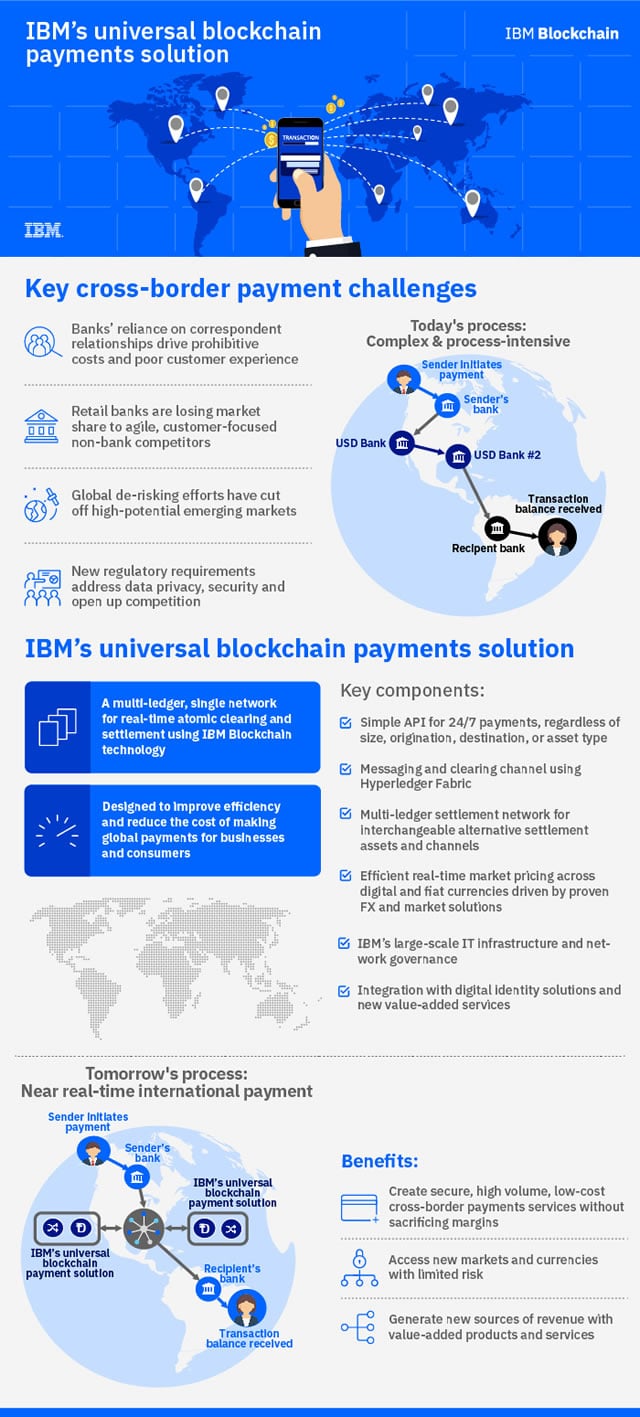

A token of the rapid evolutions in banking is the earlier mentioned IBM blockchain-based cross-border payment solution which the company announced on October 16th, 2017. The solution aims to solve cross-border payment challenges and offers real-time clearing and settlement.

Over a dozen banks and institutions were involved in the development and deployment process. Cross-border payments are undoubtedly a key use case as in 2017 also SWIFT, Mastercard and the R3 consortium took initatives, the latter two and IBM did so in October 2017.

Digital identity is one of many applications that can be very useful in specific banking applications and even totally change the way we onboard customers, solving the identity problem and enabling full mobile onboarding as we explained at the occasion of the launch of Alastria, the first nation-wide and multi-sector blockchain ecosystem ever which was announced in Spain in October 2017 and where digital ID is an initial priority.

The Internet of Things and blockchain technology

The combination of blockchain and IoT is looked at and effectively leveraged for myriad reasons, ranging from smart contracts and IoT data monetization models across complex chains of connectivity where trust is crucial.

There are already blockchain applications in the context of the Internet of Things and some vendors have specific solutions to enable the use of blockchain for IoT to, among others increase trust, save costs and speed up transactions. IBM is a frontrunner here, although several vendor and industry initiatives have been launched with new solutions and actual deployments.

IoT is all about transactions, contracts and trust in a distributed environment. Blockchain is, among others, the missing link to settle privacy and reliability concerns in IoT as the IEEE’s Ahmed Banafa writes. Do note that IoT and blockchain convergence also touches upon the various other technologies (e.g. AI), industries (e.g. insurance and telematics) and activities (e.g. supply chain management, security) we mention on this page. In other words: IoT and blockchain needs to be seen in context and isn’t just a matter of how blockchain can boost IoT and help solve challenges we see in IoT.

Blockchain is, among others, the missing link to settle privacy and reliability concerns in IoT

Supply chain management, logistics and blockchain

There is a very long road between manufacturing or even the design of a product and buying it in a retail store or online.

By keeping track of all transactions, again endless applications arise, for example with regards to where the product was made. There are several existing projects with regards to the usage of blockchain in supply chain management, logistics, transportation and so forth.

If there is one major part of global business where there is a high volume of transactions, an ecosystem with many players (certainly in cross-border trade) and still a high dependence on paper in a fast evolving and highly inter-connected ecosystem it’s everything related to end-to-end supply chains.

So, it’s not really a surprise that, after the financial sector, blockchain spending is poised to be largest in the distribution and services sector on a global level according to IDC’s blockchain spending forecasts.

With blockchain, logistics and the various stakeholders in trade we are really in pretty much all areas of the by definition connected supply chain ecosystem where speed and accuracy matter more than ever. From outbound logistics and all the way (with several forms of transportation) to distribution or export with even more intermediaries, forms of transportation, freight forwarders, container shipping, import and inbound logistics, depending on the supply chain.

Simply moving a container from one point to another often involves over 30 different parties, with an average of 200 interactions between them. These interactions and transactions often use traditional channels and information carriers, including even fax and of course paper. Paperwork is estimated to account for up to half of the cost of container transport. Ample improvements are possible to make supply chains smarter, more secure, faster and more efficient across use cases ranging from customs declarations and marine insurance to secure container release, cross-border shipping cases and tamper-free smart contract cases or transportation document/data flows.

In order to really function we should have blockchains encompassing all these stakeholders and the many others we left out of this simplified ecosystem picture, or at the very least and certainly in a global supply chain context interoperability would be key as stakeholders such as customs, to name just one also have their systems.

In the past few years we’ve seen blockchain supply chain, logistics and transportation efforts and consortiums pop up, sometimes with a more global cross-border shipping focus and sometimes with a more specific focus such as container release and cargo flows in ports or dispute resolution in logistics.

Gradually these efforts are coming to fruition and existing initiatives announce new members. These also include e-commerce giants. In February 2018, for instance, Chinese retailer JD.com which is preparing to compete with Amazon in Europe and opened offices in Australia in 2018, all part of a major international push, joined BiTA, the Blockchain in Transport Alliance that has been announcing new members since the beginning of 2018 at an astonishing rate.

A major announcement in the context of global trade and supply chain digitization leveraging blockchain concerned the start of a joint venture between container shipping giant Maersk and IBM end January 2018.

IBM and Maersk have been working on blockchain possibilities for quite some time now and started their collaboration in the Summer of 2016. Several companies, ports and authorities already conducted pilots with the platform and several more are planning to join.

Yet, blockchain initiatives are also realize on a perhaps what less encompassing scale but with an ambition of growth that does beyond the initial goals which solve specific real challenges and then lead to more applications and blockchain use cases in a specific logistics context. A good example is this blockchain smart port case in the port of Antwerp where real challenges in the scope of maritime logistics and especially container release are tackled.

Industry 4.0 and blockchain

This is partially related to the previous area. If you thoroughly study the key aspects of Industry 4.0 and its Reference Architecture Model you no doubt will see how data-intensive and transaction-intensive it is.

The life cycle and value stream dimension of the architecture starts with early data collection and provisioning and maps data acquisition of production objects across the entire lifecycle. Blockchain technology is already used in Industry 4.0 applications and not just for industrial data. It is also a building block of intelligent ERP.

Other blockchain technology application areas

Some other application areas with a focus on transactions and security (the potential of blockchain also stretches to cybersecurity as such) include the use of blockchain in the public sector and government (even including voting) and myriad industries and use cases where rights management, trust and reliability, data protection and contracts are concerned in the increasingly digitized environments of sectors going through digital transformation: from the music and media industry to digital health, the legal sector and more.

This list is far from exhaustive. In the next sections you can find some predictions (end 2017) with regards to the adoption of blockchain services and networks among large companies and a few of the major industries.

Blockchain in business 2018-2021: data and action plans for the near future

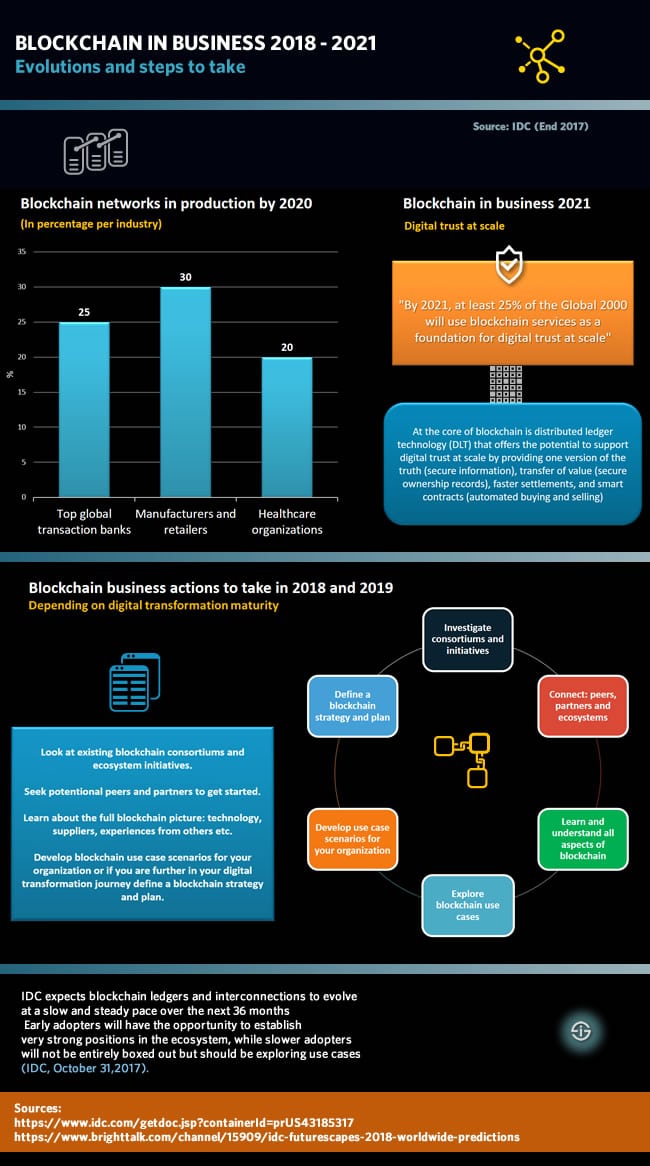

Analysts across the globe see an important future for blockchain in myriad organizations and use cases. On top of Juniper Research, which we mentioned earlier and several others, also IDC states that blockchain services are poised to become the foundation for digital trust at scale IDC stated end 2017. You could already see that much in the infographic above of course.

According to IDC’s 2018 IT industry forecasts, fully entitled “IDC FutureScape: Worldwide IT Industry 2018 Predictions“, revealed in a webcast (which you can still watch for a year) with a press release on October 31st, 2017, by 2021 at least 25 percent of the G2000 would use blockchain services with exactly that purpose.

When looking at some industries and the data from IDC mainly global transaction banks, the manufacturing industry, retailers and healthcare organizations would be along the earliest movers to have blockchain networks in production (so no tests or proof of concept).

Blockchain networks in production by 2020: main industries

Below are the forecasts for the mentioned industries (note that IDC looks at 2020 here and not at 2021 as in the earlier mentioned prediction).

- Top global transactions banks: 25 percent with a blockchain network in production.

- Manufacturers and retailers together: a blockchain network in production by 2020 for close to 30 percent.

- Healthcare organizations: 20 percent of healthcare organizations with a blockchain network in production by 2020.

Another interesting finding, this time from IDC’s “FutureScape: Worldwide IoT 2018 Predictions” concerns blockchain and the Internet of Things, a topic we covered earlier.

Most of us look at blockchain as one of the ways to solve multiple IT data exchange and IoT monetization challenges, among others through using smart contracts. Well, IDC predicts that by 2020 up to 10 percent of pilot and production blockchain distributed ledgers will incorporate IoT sensors as you can read here or hear when you listen to the appropariate webcast in the IDC FutureScape 2018 series.

What does a business have to do in 2018 order to get ready for blockchain?

Although being a first mover doesn’t always mean being in the best position, with regards to the adoption of blockchain in business things could be different.

Early blockchain adopters will have the opportunity to establish very strong positions in the ecosystem, while slower adopters will not be entirely boxed out but should be exploring use cases (IDC, October 31, 2017)

According to the research firm early adopters can establish very strong positions while organizations that are not participating in blockchains and the industry ecosystems they require, will encounter significant disadvantages with regards to, among others, speed and costs.

- Start by looking at all the blockchain consortiums and initiatives out there and see which could bring the benefits of blockchain within their specific industries, use cases and ecosystems.

- In the case there isn’t such an ecosystem and there is a case and benefit to do so, investigate the opportunity, which by definition obviously also means finding the right peers and partners that can help start one (or, less ambitious, join or start a blockchain network or a pilot).

- Companies that are slower in their digital transformation efforts, which really is the majority of organizations today, have to do their homework, start learning, experience the potential, talk with their peers and so forth in 2018. More importantly they need to develop use case scenarios for blockchain that make most sense for them. Those who are ahead in their digital transformation journey should put a blockchain strategy and plan and place in 2018 IDC states.

Blockchain 2018: forecasts and industries

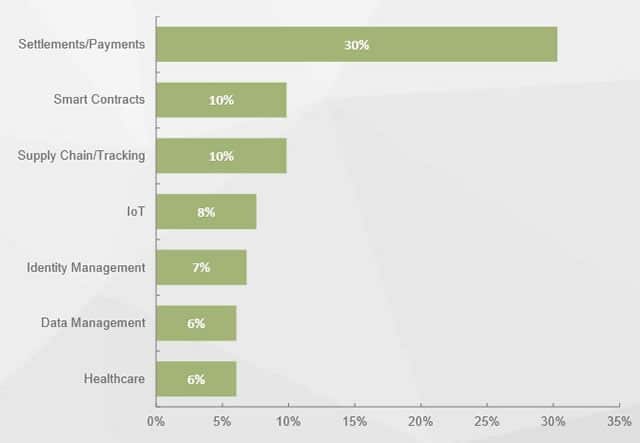

In our article on blockchain in the EU and Western Europe we mentioned some data regarding the adoption of blockchain across several industries as per the Cambridge Centre for Alternative Finance (research end 2017, see SlideShare at the bottom of this page).

The results as depicted below are part of the EU blockchain factsheet which was presented at the occasion of the EU Blockchain Observatory and Forum, covered in the article. However, the 2017 Global Blockchain Benchmarking Study of the Cambridge Centre for Alternative Finance.

However, the authors came to this result by looking at the largest number of identified DLT use cases, whereby “132 blockchain use cases were grouped into industry segments that have been frequently mentioned in public discussions, reports and press releases”.

In the meantime IDC announced its inaugural Worldwide Semiannual Blockchain Spending Guide (January 24th, 2018) and a version for Western Europe as also mentioned in that same article which looks more into detail from the spending rather than identified DLT use case perspective.

According to IDC, global blockchain spending is expected to reach $2.1 billion in 2018 and total spending of $9.2 billion in 2021. In the scope of this section of industries and blockchain use cases, it’s interesting to note that, according to IDC, spending per industry for 2018 shows the following picture:

- The financial sector leads with blockchain spending of $754 million in 2018. Mainly the fast adoption in the banking industry is key here.

- The distribution and services sector ranks second with $510 million in 2018, with retail and professional services showing strong blockchain investment.

- The manufacturing and resources sector ranks third with $510 million in 2018. Here most blockchain investments in 2018 will happen in the discrete and process manufacturing industries.

As per usual there are geographical differences though. Looking at the different regions from a blockchain spending perspective the chart below shows the split and evolutions until 2021: the US leads, followed by Western Europe.

However, while in the US the distribution and services sector will account for most blockchain investment in Western Europe the financial services sector is the main driver. The latter is also the case in China (PRC) and the APeCJ region (Asia Pacific, excluding Japan).

The fastest growers in blockchain spending globally are, respectively, professional services (85.8% CAGR), discrete manufacturing (84.3% CAGR), and the resource industries (83.9% CAGR).

The limitless applications of blockchain – revisiting transactions in the digital age

Time to move beyond the better known potential and current applications of blockchain and get the broader picture by revisiting transactions in this digital age – and look at more areas where a new system of contracts, keeping track and ultimately recording and being able to control or prove in complex digital ecosystems is needed.

Let’s use the definition of Merriam-Webster of a transaction to make it clear: “an exchange or transfer of goods, services, or funds”. Now, let’s elaborate on that and look at two key aspects.

Goods and services mean many things

As you know we live in a data-intensive age of information where data has become a key business asset.

Think about how important data sharing and monetization has become, for instance IoT data monetization. Or think about how data is turned into actionable intelligence or business process outcomes, how important it is to have an audit trail and how automated processes which are moving data across the value chain and across ecosystems really are transactions. In order to leverage, let alone ‘exchange’ data it is key to have mechanisms in place, for instance to make sure that pieces of crucial data have not been tampered with and are reliable and trustworthy original versions which can be leveraged for whatever purpose. We can go on, even on this level of data alone.

Companies which would benefit most from blockchain include those with a need for transparency and clarity in (trans)actions (Juniper Research)

Now start thinking about the goods and services in this day and age in the broadest sense and the number of transactions that happen regarding them as well as the need to record those, for instance from a regulatory perspective in the transfer and exchange of personal and sensitive data or how essential information is as it gets shared and used for critical medical purposes or for actions, decisions and transactions for myriad digital services. And we haven’t even really started exploring the services in this as-a-service economy yet. You see the vastness and it’s far from done yet.

Transactions don’t just happen between people

There are far more transactions between systems, between devices and between devices and systems in an increasingly hyper-connected reality.

Devices communicate with each other, intelligent building components take decisions based on data exchanges or changes/triggers of any sensor-measured external state, information gets automatically sent from one system to another in the scope of a business process or a “case” in the sense of case management, a trigger caused by a change in a system leads to a result, the list goes on.

If you entirely remove the human element and several changes in status and transactions between systems and devices lead to ever more autonomous – and decentralized – decision making as they increasingly do in industrial automation, building automation, IoT, advanced analytics with AI-driven actions and much more you really start seeing why blockchain is seen as key to the digital transformation economy by so many.

How does blockchain technology work?

Each stage of a transaction is generating a set of data which are called blocks. As the transaction progresses, more blocks get added, forming a chain, hence the name.

Just as in cryptocurrencies like Bitcoin and others, which are based on blockchain technology, encryption software guarantees no one can ever delete or change blocks.

Despite its apparent complexity, a blockchain is just another type of database for recording transactions – one that is copied to all of the computers in a participating network (Deloitte)

Several computers across a network have the blockchain software installed. Each transaction is shared to these nodes in the network and they compete (in Bitcoin jargon ‘mining’) to verify the transaction. The first one that verifies it also adds the block of data to the chain and gets an incentive for being first. The other nodes next check the transaction, agree that it’s correct and replicate the record. All the computers then keep an updated copy of the ledger, and this acts as a form of proof that the transaction occurred.

As said, blockchain relies on peer-to-peer agreement as opposed to a central authority to validate a transaction. Until now, if you wanted to make a transaction, you informed a central authority who checked the details with everyone involved and holds a central record such as a bank, a notary or any other central certifying authority. In the blockchain model there is no such central authority. Transacting parties rely on an open register, the ledger, to validate the transaction. Authority comes from the fact that numerous computers, ‘miners’, have looked at the broadcast data, checked it and found it correct. Trust comes not from a notary’s stamp, but the presumption that those computers can’t all be wrong. You can imagine that there is quite some discussion here as well.

In the earlier mentioned press release regarding its series of IDC FutureScape 2018 webcasts and report, IDC described blockchain as follows: “At the core of blockchain is distributed ledger technology (DLT) that offers the potential to support digital trust at scale by providing one version of the truth (secure information), transfer of value (secure ownership records), faster settlements, and smart contracts (automated buying and selling)”.

Some benefits of blockchain technology

In the blockchain model transacting parties rely on an open register to validate the transaction. This has some consequences for transactions of all kinds.

Speed

The absence of a central authority in theory makes blockchain faster. If you’re relying on a central certifier, you depend on limited resources. Clearing and settling stock trades, for instance, can take days and usually involves some human intervention. With blockchain you have lots of computers competing to process your transaction as quickly as possible. Today they can do it in a matter of minutes. In the future it may only take seconds.

Cost

Blockchain is also cheaper. All the computers holding the blockchain are paid for by the participants in the hope that they will earn the incentive for being the first to validate the transaction.

Transparency

Blockchain is more transparent. It can give regulators and compliance officers clearer insight into the provenance of financial transactions, helping them to combat money laundering and manage risk.

Tracking

As nothing can be changed and the ledger is present across multiple nodes, blockchain is easier to track. It won’t come as a surprise that blockchain is often used for asset tracking as a consequence (more below).

Blockchain in business: looking back at 2017

As mentioned in the introduction, several large (and less large) firms, research bodies, start-ups, universities and so forth have launched or joined industry initiatives, blockchain research groups and alliances with roadmaps and standardization projects in 2017.

This happened in an increasing variety of areas, ranging from a secure and blockchain-based IoT project and vendor-led supply chain initiatives to a trucker association blockchain consortium, the mentioned cross-border payments blockchain initiative and Spain’s national blockchain project – to name a few. After the Summer of 2017 the number of pilots, projects and initiatives grew fast, not just in number but also in business scope. This isn’t going to stop in 2018 of course, well on the contrary. In the end, on top of new initiatives, existing ones enter in stages with solutions. That’s when it really becomes interesting.

The sheer list of companies testing blockchain or having implemented it in 2017 is huge. From giants such as Maersk, dozens of insurance companies, the Port of Rotterdam, Lufthansa that recently announced a project to customers of a growing list of blockchain technology providers and hundreds of companies which you find in one or several of the associations, alliances and vertical/topical research groups.

The big blockchain technology leaders

Earlier we said that IBM is a frontrunner in the IoT and blockchain space but IBM also has the strongest credentials of all players in the blockchain sector and is quite ahead of its closest competitors.

That’s at least what Juniper Research found in a survey. The results were announced in September 2017 (and in several other releases throughout the Summer) and it seems that over 40 percent of respondents cited IBM as being ranked first by enterprises that either consider or are in the process of deploying blockchain technology. According to Juniper’s Blockchain Enterprise Survey, IBM is followed by Microsoft (20 percent of respondents) and Accenture.

Among the reasons for IBM’s leadership position:

- High-profile R&D engagement with initiatives such as Hyperledger.

- A big list of actual blockchain clients across several verticals and use cases such as banking, asset tracking and the music industry.

Blockchain business adoption, investments and practices

The announcement of the Blockchain Enterprise Survey wasn’t just about which technology players are recognized most when it boils down to blockchain, nor was the survey by Juniper (more findings in the infographic below).

There are some interesting numbers on the market and success factors, based upon the answers of some of the approximately 400 responding executives and IT leaders.

- Among the respondents prepared to share their investments in blockchain, 67 percent said already having invested over $100,000 by the end of 2016.

- Of those respondents, a whopping 91 percent said to at least spend the same amount in 2017.

The reason why spending continues or grows is related with the fact that the first results of the first investments were convincing/positive enough to conduct more extensive tests or integrate on a more extensive level. If this is a trend, then it’s another token that in 2018 we’ll see more spending and initiatives as the predictions of IDC clearly indicate.

A final takeaway: Juniper Research urges companies to focus on private blockchains for commercial deployments instead of public ones.

Where is blockchain a potentially good business fit?

End July 2017, Juniper Research released some other findings from the report showing that (as you can also check in the infographic below) 57 percent of organizations with over 20,000 employees is either ‘actively considering’ or in the process of deploying blockchain technology.

34 percent doesn’t know and 9 percent is not actively considering or deploying. That picture completely changes when looking at all companies, including those with over 200,000 employees where we see that the majority of respondents is still saying ‘yes’ but instead of 57 percent that number considerably drops to 39 percent (play with the interactive infographic below).

That brings us to the question for which kind of companies, industries and use cases blockchain is a good fit. And that’s also what Juniper Research wanted to know. The result is a white paper with the apt name ‘Which Industries are the Best Fit for Blockchain?‘.

From the press release we remember a few things. According to the research, companies which would benefit most from blockchain include those with:

- a need for transparency and clarity in (trans)actions,

- a current dependence on paper-based legacy storage systems

- and/or a high volume of transmitted information.

So, indeed transactions, trust, transparency and a lot of data with the need for speed in a decentralizing technology landscape. With regards to the paper aspect don’t think that tomorrow we’ll live in a paperless society with blockchain, trust us. On the other hand, in various applications blockchain can indeed speed up a higher independence from paper-based legacy storage systems (especially when powered by a consortium and a private blockchain that is de facto changing the game in areas where those who want to remain relevant simply have no choice).

Disruption and underestimation of the blockchain challenge as risks

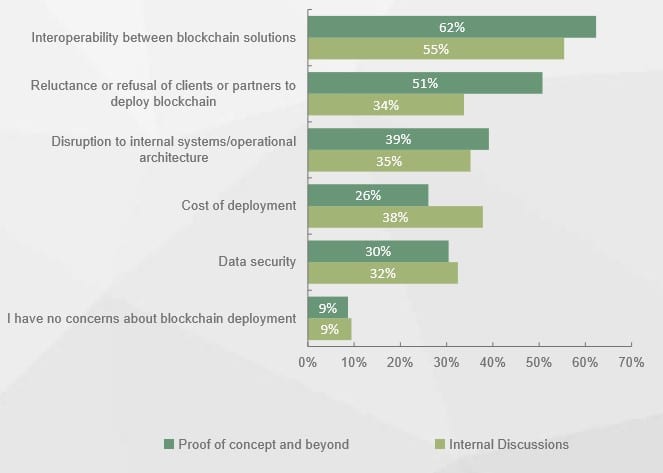

When we talk about changing the game there are also the human, cultural and other contextual transformation parameters. And here Juniper research really hits the nail when saying that, despite growing awareness of (the benefits of) blockchain and more initiatives, it might be dangerous to leverage blockchain without first looking at other options as there is an element of disruption as the survey shows.

And that might also slow down the current enthusiasm a bit as, quoting the press release “the research found that companies may have underestimated the scale of the blockchain challenge”. Without interoperability, clients and partner ecosystems wanting to collaborate and so forth you might indeed get in trouble and underestimating the scale and complexity of internal and external disruption through the adoption of blockchain might be your blockchain party pooper.

That is the very reason why big names put their shoulders under blockchain and blockchain associations across various use cases and industries and why you’ll see more and more client cases coming, ideally within an ecosystem context. If you have a feeling of déjà-vu: indeed, it feels a lot like the early days of IoT and so many other technologies. But this time it seems that the stakeholders are moving way faster. After all, history has a tendency to repeat itself but companies like the leading ones above now and then also learn from history.

Additional resources on blockchain in business

Blockchain enterprise survey

Below is a screenshot of the interactive infographic from the blockchain enterprise survey of Juniper Research, presented in the Summer of 2017 and tackled in this blockchain overview.

Blockchain technology report for IT managers

End January 2018 the US National Institute of Standards and Technology published a draft report regarding blockchain technology as covered in our NIST blockchain technology report article.

The report gives a great overview of blockchain technologies and more. Although it aims to target IT managers who want to take decisions with regards to blockchain in business applications it does offer a great introduction to blockchain in a somewhat more technical context but also with ample use cases and more.

Blockchain Global Benchmarking Study

Last but not least, below is the previously mentioned SlideShare of the Global Blockchain Benchmarking Study by the University of Cambridge Judge Business School (Cambridge Centre for Alternative Finance).

It was presented end 2017. Authors Dr. Garrick Hileman and Michel Raus tackle, among others, the difference between blockchain and distributed ledgers, the key components of a blockchain (cryptography, peer-to-peer network, the consensus mechanism, the ledger and the validity rules), benefits and blockchain use cases, some common blockchain myths, the main types of blockchains, the various DLT ecosystem partners, use cases and far more. Where the report covers the main industries do keep in mind what we mentioned previously in the scope of blockchain spending (and IDC’s January 2018 forecasts).

- Quote NIST Blockchain Technology Overview Draft NISTIR8202 – NISTIR 8202 (DRAFT) Blockchain Technology Overview

- Quotes IDC press release inaugural Worldwide Semiannual Blockchain Spending Guide January 2018: “New IDC Spending Guide Sees Worldwide Blockchain Spending Growing to $9.2 Billion in 2021“

- Quotes IDC press release “IDC Predictions Provide a Blueprint and Key Building Blocks for Becoming a Digital Native Enterprise” (October 31, 2017)

- Quotes Juniper Research press release: Nearly 6 in 10 (57%) large corporations are either actively considering, or are in the process of, deploying blockchain technology (July 31, 2017)

- Quotes IDC, press release: Blockchain Technology: Disruptive Forces in Financial Services (20 Jun 2016).

- Quotes Deloitte: Blockchain. Enigma. Paradox. Opportunity.

Top image: Shutterstock – Copyright: NicoElNino – All other images are the property of their respective mentioned owners.