Guide to Industrial IoT (the Industrial Internet of Things or IIoT) with definitions, market evolutions, use cases, standardization efforts, challenges and strategic approaches across the globe.

Industrial IoT, short for the Industrial Internet of Things, originally described the Internet of Things (IoT) as it is used across several industries, such as manufacturing (Industry 4.0), logistics, oil and gas, transportation, energy/utilities, mining and metals, aviation and other industrial sectors and the use cases which are typical to these industries.

Just like the Internet of Things in general, the Industrial IoT covers many use cases, industries and applications. Initially focusing on the optimization of operational efficiency and rationalization/automation/maintenance, with an important role for the convergence of IT and OT, the Industrial Internet of Things opens plenty of opportunities in automation, optimization, intelligent manufacturing and smart industry, asset performance management, maintenance, industrial control, moving towards an on demand service model, new ways of servicing customers and the creation of new revenue models, the more mature goal of industrial digital transformation.

At the center of it all: as per usual in this data age, connected and aggregated data from assets and machines and how all that big data is turned into knowledge, intelligence, action, value and thus Industrial IoT use cases (remember the DIKW model).

The definition(s) of Industrial IoT

Although most Industrial IoT projects are about automation, optimization and tactical or strategic goals in a mainly internal context – and will continue to be, we’ve seen some really transformational Industrial IoT (also known as IIoT) projects as well. More about the initial goals of many IIoT projects below. For now, back to what the Industrial IoT is.

Industrial IoT as the leverage and reality of IoT in a context of industrial transformation

Industrial IoT in the earlier mentioned sense was mainly used to make a distinction between the use cases, actual usage and specific technologies as leveraged for initially mainly smart manufacturing (smart factory) and, later, other industries on one hand and enterprise IoT and consumer IoT applications on the other.

This distinction obviously is somewhat artificial and on all levels there are overlaps. The fastest growing categories of IoT use cases, for instance, are cross-industry. Moreover, although some technologies, architectural frameworks and applications across all IoT layers differ (edge computing and fog computing are typical in Industrial IoT, there are different types of network and connectivity tools, IIoT gateways serve other purposes, Industrial IoT platforms support other use cases than IoT platforms overall, digital twins are mainly about industrial markets, the use cases for augmented reality are not the same and so forth) between Industrial IoT and Consumer IoT an average large IIoT project will leverage several forms of connectivity and solutions of which some are used in consumer IoT as well.

GE and Industrial IoT as a synonym of Industrial Internet

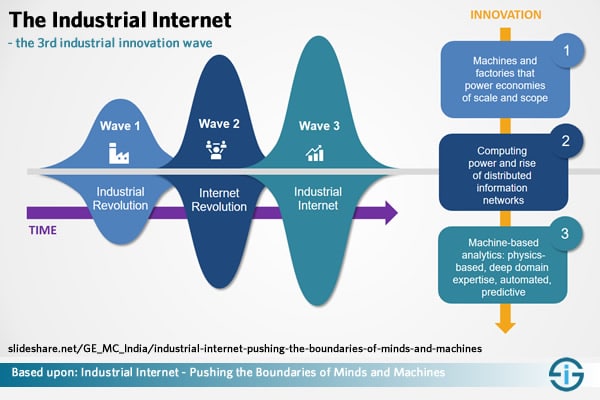

The Industrial Internet of Things also has a second meaning to complicate things. Industrial giant GE coined the term Industrial Internet which really describes industrial transformation in the connected context of machines, cyber-physical systems, advanced analytics, AI, people, cloud, IoT edge computing and so forth.

Although you won’t find the term cyber-physical systems (essentially Industrial IoT in the first sense in action and in a context of autonomous and semi-autonomous decisions and actionable intelligence) we added it because Industrial Internet in many ways is the same as Industry 4.0 (more about that and the links between IIoT and Industrial Internet at the bottom of this article).

What does this have to do with Industrial IoT? Well, GE and the Industrial Internet Consortium or IIC it (co-)founded decided that the Industrial Internet of Things or IIoT was a synonym for the Industrial Internet.

One can wonder why you need two terms to describe the same thing. When vendors are involved one can then think marketing and compare how often the term Industrial Internet is searched for and how often terms such as Industrial Internet of Things, IIoT and Industrial IoT are searched for. That doesn’t mean that Industrial IoT in the sense of Industrial Internet doesn’t make sense, well on the contrary of course. Yet, it does lead to confusion, depending on where you live. More about these terminology and definitions below in this article in case you are interested.

What matters most to us isn’t the jargon but the results although it would be nice if everyone spoke the same language and didn’t toss up new terms the whole time. In that regard you can also compare with the Internet of Everything, a term Cisco coined and used up until 2016. In many regards the Internet of Everything in an industrial context is closer to Industrial IoT, the GE way, than to Industrial IoT in the first sense.

The Industrial Internet of Things in evolution: from operational efficiency to innovation

The core focus in most Industrial Internet of Things deployments and in the majority of organizations de facto is still on operational efficiency, along with cost optimization. Or as IDC called it: efficiency optimization and linking islands of automation as key drivers. However, a more holistic approach with additional revenue and innovation goals is needed.

Such a holistic strategy already exists in more ‘mature’ industrial organizations, which have shifted to the business model, service and new revenue opportunity side with tangible results and innovative solutions. They are poised to be disrupters in their respective industries where competition is already intensive and market conditions uncertain and complex.

The power of the Internet of Things comes from the ability to collect a lot of data and convert that into useful information (Bertil Thorvaldson, ABB Robotics)

On the other hand, in order to move up in the IIoT maturity and possibility/opportunity reality, industrial organizations obviously need to start somewhere. Knowing the market challenges and the lowest hanging fruit in many industrial markets it’s normal that in initial stages connectivity in the IIoT space is focusing on a restricted set of goals and benefits. Yet, it’s important to have a roadmap or plan for the longer term. It is not a coiincidence that the holistic challenge we see in the evolution of IIoT is exactly the same as the one we see in the digital transformation of manufacturing, the main IIoT market.

Last, but not least, optimization and automation are not the enemy of customer-centricity in the larger industrial context where speed and enhanced processes are what customers expect.

Industrial IoT across major industries

The Industrial Internet of Things can be defined as ‘machines, computers and people enabling intelligent industrial operations using advanced data analytics for transformational business outcomes” (see infographic at the bottom).

In this Industry 4.0 or ‘Industrial Internet’ context, where we essentally find the IIoT as part of an integrated approach where it takes center stage, data is a key asset and analytics a necessity in the connected sphere of products (across their full life cycle), production assets and more.

The Industrial Internet of Things is the biggest and most important part of the Internet of Things now but consumer applications will catch up from a spending perspective, mainly starting 2018. Still, the Industrial Internet of Things is far more important and advanced in the overall IoT picture.

Manufacturing: the largest Industrial Internet of Things market

The first one is manufacturing. It is also the largest industry from an IoT spending (software, hardware, connectivity and services) perspective.

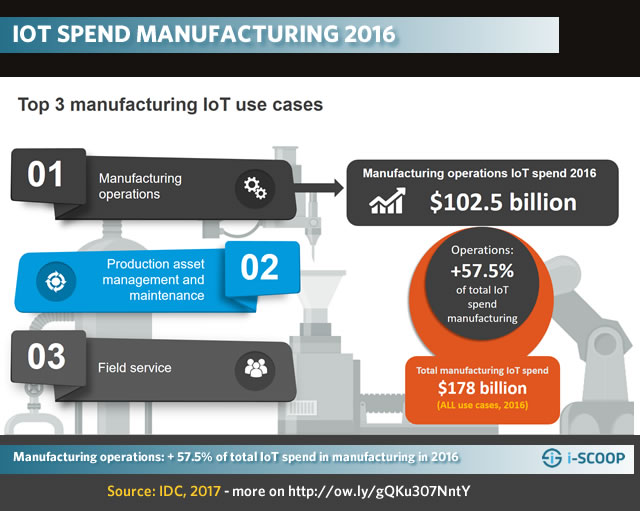

In 2016, manufacturing operations alone accounted for an IoT spend of $102.5 billion on a total of $178 billion, all IoT use cases in manufacturing combined. With a total spend of $178, manufacturing overall is by far the largest industry in the Internet of Things AND of the Industrial IoT and the segment of manufactoring operations outweighs all other IoT use case investments across all industries, consumer included.

Two other IoT use cases which are important in manufacturing from a spending perspective, on top of operations, are production asset management and maintenance and field service, according to the mentioned research by IDC, released early 2017.

A more detailed overview of the evolutions in the manufacturing IIoT market, including more data, benefits and IIoT cases on our Internet of Things manufacturing page.

Industrial IoT in connected logistics and transportation

Transportation represent the second largest market from an Internet of Things spending perspective. Transportation and logistics (T&L) firms are looking to move up the value chain with advanced communication and monitoring systems, enabled by IoT.

The global connected logistics market is poised to grow at a CAGR of approximately 30% until 2020.

The transportation market reached an IoT spend of $78 billion and is poised to continue to grow rapidly, just as is the case for the IoT manufacturing market. The main use case in transportation is freight monitoring, good for a large majority of overall transportation IoT spend with a total of $55.9 billion and remaining a key driver in the market until 2020.

If we look at the overall IIoT evolutions in transportation and logistics, we see the growing emergence of a digital supply chain and connected logistics reality, which is at the same time one of the challenges for the manufacturing industry and the T&L market as such as many players don’t have a digital strategy in place and are urged to speed up their digital transformation efforts. As you can read here, about 20 percent of digital transformation costs in T&L will be allocated to supply chain transformation. It’s clear that the Internet of Things plays an important role here.

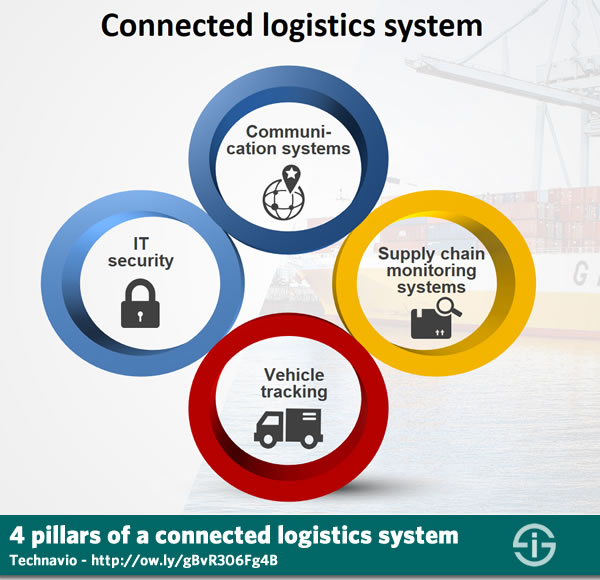

This is also the case for the four pillars of a connected logistics system as Technavio defined them: IT security, communication systems, supply chain monitoring systems and vehicle/transport tracking. Along with the cloud and analytics, the Industrial Internet of Things is a driver in the connected logistics landscape and freight monitoring leads the pack.

Smart supply chain management (Logistics 4.0) is also a data-intensive and IoT-intensive given with a focus on (semi-)autonomous decisions.

Industrial IoT in energy and utilities

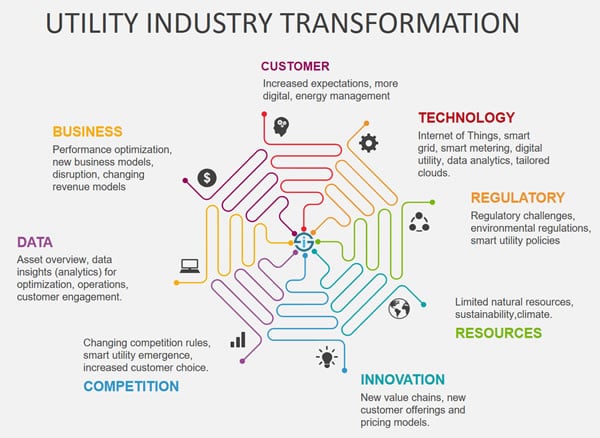

Oil and gas, smart grid and plenty of other evolutions and use cases in the energy and utilities market overall are also a main part of the Industrial Internet of Things market.

According to the earlier mentioned data from IDC, utilities alone is the third industry from the IoT spending context, having reached a total of $69 billion in 2016. Here as well there is one area of investment that clearly sticks out: smart grid for electricity and gas, which accounted for a whopping $57.8 billion in 2016.

The Industrial Internet of Things plays a key role in the overall digital transformation towards a digital supply chain in many parts and value chain components of the large ecosystem, which obviously also touches retail/consumer-facing aspects.

However, from the sheer Industrial Internet perspective, smart grids are key in supply and network transmission/distribution. Others include plant effectiveness, maintenance and data-driven opportunities as a result of smart grids and IoT-enabled operations and services.

The Industrial Internet of Things in other industries

Maintenance and services, enabled by the IIoT are two key areas in virtually all Industrial Internet industries.

Predictive maintenance, data-enabled services and remote possibilities in several areas, from service to control and optimization of operations, also come back in many other IIoT use cases across industries such as healthcare (remote health monitoring, equipment maintenance, etc.), aviation, robotics and cobots, oil and gas, mining, metals and more.

As mentioned, depending on the industry body, the broader context of IIoT is also often used for use cases in areas such as agriculture, smart cities and so on.

The Industrial Internet of Things in context

We saw how the initial purpose of IIoT projects typically is to automate, save costs and optimize in often rather siloed and ad hoc ways and how it’s important to have a more holistic view and strategy, whereby there is a shift towards goals of inovation, better customer-centric service offerings, leveraging new sources of data-driven revenues, building ecosystems of value and ecosystem-wide digital transformation goals.

As mentioned, the Industrial Internet of Things enables industries to rethink business models. Generating actionable information and knowledge from IIoT devices, for instance, enables the creation of a data sharing ecosystem with new revenue streams and partnerships.

The other way around, aggregated and real-time data from sensors and from information sources which can be ‘consulted’ via built-in capabilities also lead to the development of robots which can take specific actions because of these built-in capabilities whereby IIoT becomes a driver of ‘decision-making’ devices. This already happens in some warehouses and is called the Internet of Robotic Things (IoRT). It is used in an IIoT context but also a consumer IoT context.

The usage of the Industrial Internet of Things, within a broader context, ultimately leads from specific projects and ‘smart’ IIoT use cases to connected ecosystems.

Supply chains become connected supply chains, factories become connected factories and so forth. In this sense, the connectedness stretches far beyond the simple connectedness – and data-driven results – of devices and industrial assets to a more connected ecosystem, whereby the extended enterprise gains a new meaning.

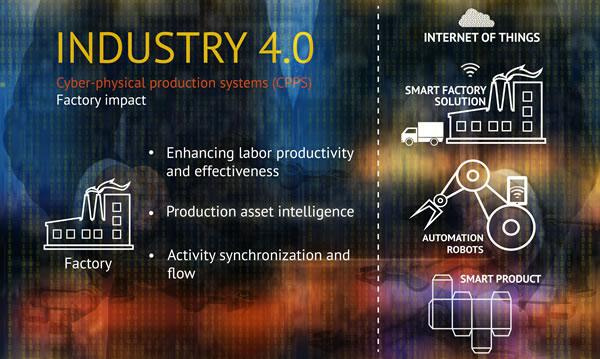

This is why the Industrial Internet of Things is mainly used in the context of Industry 4.0, the Industrial Internet and related initiatives across the globe, which all have their own names, from smart production to smart factory or intelligent industry as we tackled in the introduction (definition section). Industry 4.0 (which we tackle more in depth in an IIoT context below) describes a new industrial revolution with a focus on automation, innovation, data, cyber-physical systems, processes and people. On top of IIoT, Industry 4.0 also is about other technologies; which are related with it.

Examples include robotics, cloud computing and the evolutions in operational technology (OT). In the Industrial Internet of Things, IT and OT need and meet each other. Industry 4.0 further refers to cyber-physical production systems (CPPS) and typical embeds the so-called third platform technologies and accelerators of what is known as the digital transformation or DX economy.

Industrial Internet of Things use cases

Despite the link with factories, manufacturing and heavy industries like mining, , aviation, oil and gas, defense, power and electricity and energy overall, as mentioned the IIoT is often also used to describe several Internet of Things applications outside of the Consumer Internet of Things.

So, de facto it is also used for industries such as agriculture, connected logistics, finance, the government sector (including smart cities), healthcare (hospitals and healthcare facilities) and cross-industry IoT use cases such as smart buildings in a context of facility management. Depending on the view and industries that are understood in an Industrial Internet of Things context, this leads to less or more IIoT use cases.

Below are a few typical IIoT use cases and business contexts – if we broaden IIoT beyond only manufacturing and the likes

- Smart factory applications and smart warehousing.

- Predictive and remote maintenance.

- Freight, goods and transportation monitoring.

- Connected logistics.

- Smart metering and smart grid.

- Smart environment solutions.

- Smart city applications.

- Smart farming and livestock monitoring.

- Industrial security systems

- Energy consumption optimization

- Industrial heating, ventilation, and air conditioning

- Manufacturing equipment monitoring.

- Asset tracking and smart logistics.

- Ozone, gas and temperature monitoring in industrial environments.

- Safety and health (conditions) monitoring of workers.

- Asset performance management

- Remote service, field service, remote maintenance and control use cases.

The Industrial Internet of Things market: size, growth and impact on economy

The market opportunity of the IIoT is huge. According to IndustryARC research (June 2016), the industrial IoT market is estimated to reach $123.89 Billion by 2021 at a high CAGR.

In the graphic below you can also see some forecasts by Morgan Stanley, data on the impact of IIoT on the global economy by Accenture and another forecast from Research and Markets. Leaders in the IIoT space, such as GE, also have impressive forecasts but, again, it all depends on what you exactly measure and how you define IIoT.

Industrial Internet of Things adoption barriers: the major challenges

Although the Industrial Internet of Things is poised to grow significantly, challenges remain.

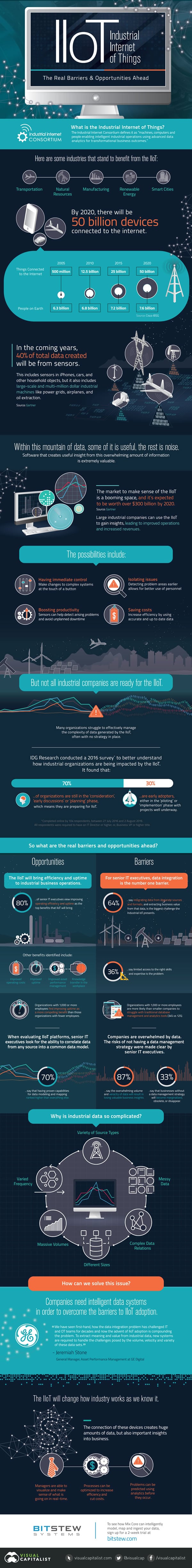

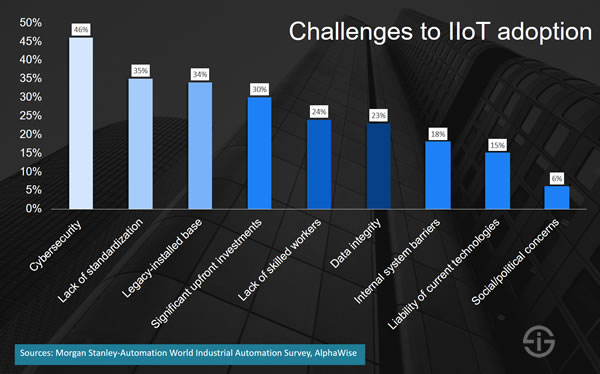

The infographic by Visual Capitalist at the bottom of this article shows a few, as does research by Morgan Stanley and others. An overview of IIoT challenges as perceived by executives.

Data integration challenges (and data is key in IIoT).

Industrial data is complicated for the reasons mentioned in the infographic (based upon IDC 2016 data), of which most also are among the (big) data challenges of our times.

Think about the variety of data source types, big data volumes (certainly in ‘heavy’ industrial applications), varied date frequency and complex data relations. The answer, just like in the big data ‘chaos’ picture overall: intelligent data systems.

Data integration is the number one barrier according to the research with 64 percent of respondents. It’s the eternal challenge of moving from data to business value, which becomes clear in the IIoT context. However, data and more specifically insights and knowledge in ecosystems of sharing are where the future revenue opportunities reside.

Lack of skills (and access to skills)

Another major reason why companies are not ready for the Industrial Internet of Things according to the survey is a lack of skills.

Limited access to the right skills and expertise is a problem for 36 percent of respondents. This issue of lacking skills is not just one of data integration but also one of other skills, which are needed for the IIoT.

A lack of skilled workers also was mentioned in the Morgan Stanley-Automation World Industrial Automation Survey, where 24 percent of respondents cited a lack of skilled workers. There is a lack of highly specific skills in general but at the same time it might also deem necessary to look more ‘outside’ to get access to the right skills. If there is one thing that is clear in this age of digital transformation and of the Industrial Internet of Things, it’s that no organization can do it all alone and networks, ecosystems and platforms of partners are extremely crucial to succeed.

Cybersecurity and data security

By far the major challenge for executives in the survey by Morgan Stanley and Automation World magazine, was cybersecurity and data security.

In fact, when Morgan Stanley posted some of its findings in April 2016, it said that data security was even more of a growing concern for organizations which rely on universal connectivity and that’s of course typical for the Internet of Things which in industrial applications often needs a mix of IoT connectivity solutions, depending on the use case.

It’s why companies who are active in the Industrial Internet of Things as service providers offer hybrid IoT connectivity solutions for industrial applications, ranging from cellular IoT and low power wide area networks (LPWAN) to industrial connectivity solutions, fixed and beyond.

Important to note: cybersecurity and data security came out as the first IIoT adoption challenge in the Morgan Stanley research, before the end 2016 major IoT security issues and cyberattacks, even if those were not all using the types of devices and connectivity one thinks of in an IIoT context. We’ve tackled these Internet of Things security priorities previously.

However, with the Industrial Internet of Things come specific security challenges, among others in the integration of IT and OT and a need to redesign security architectures.

Other IIoT adoption barriers

According to the mentioned survey by Morgan Stanley a lack of standardization is also a concern and there is more.

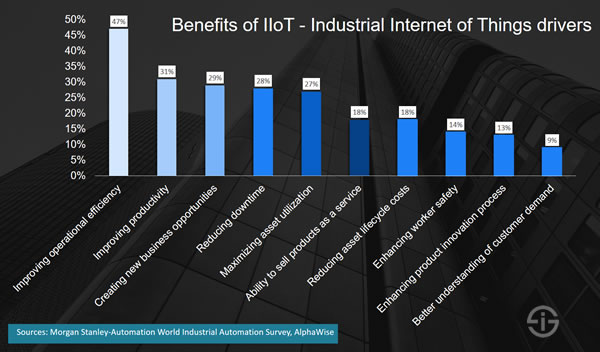

The top 5 of challenges to IIoT adoption, according to the survey, are, respectively, 1) cybersecurity (46 percent), 2) lack of standardization (35 percent), 3) the legacy-installed base (34 percent), 4) significant upfront investments (30 percent) and 5) the mentioned lack of skilled workers (24 percent).

Data integrity ended sixth (23 percent) as the illustration below indicates. Several of these challenges are reported by others too and seem universal.

IIoT adoption: the driving benefits of the Industrial Internet of Things

The main drivers of Industrial Internet of Things adoption, according to research by Morgan Stanley are:

- Improving operational efficiency.

- Improving productivity.

- Creating new business opportunities.

- Reducing downtime.

- Maximizing asset utilization.

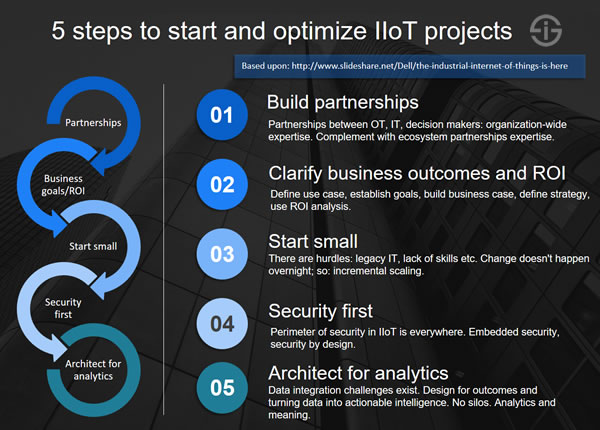

Build partnerships

As already mentioned, partnerships between OT and IT are crucial.

But of course also the business decision makers need to be involved. Go even further and forge partnerships and join forces with parties (internal and external) that might seem less obvious – as is recommended by IDC for any digital transformation project.

Clarify business outcomes and ROI

This sounds so obvious but as virtually all IoT experts will tell you all too often the business benefits are not clear enough.

Unclear business benefits are simply deadly for IIoT projects, as they are for others. An IIoT project starts with an idea, a need or an opportunity that is detected. But the business case needs to be clear.

Start small

This is very often the de facto approach in Internet of Things and Industrial Internet of Things projects.

Pilots, incremental growth, start small, fail, iterate, go bigger, scale, you know the approach and the benefits with which it comes (unless of course there is a reason to deploy fast if you have the right ecosystem in place).

Security first

While the business outcomes and partnerships with key stakeholders and others are obviously essential, security is at least as much.

Watch the IoT vendors you work with, look at security from an end-to-end perspective as there are so many components involved: from connectivity to devices and connected applications. Security by design and embedded security is a must. And as in all transformational projects, involve security early on.

Architect for analytics

It’s all about big data – and what you do with it: the intelligence, the action, the automation.

It’s about the data which you turn into insights, action and automation in your Industrial Internet of Things project and the need to use analytics in order to turn data into these insights, also for data you already might have.

The Industrial Internet (of Things) in practice: real-life examples/cases

As mentioned there are several IoT use cases of which some are specific to an industry and some are cross-industry.

From the optimization of manufacturing operations to predictive and remote maintenance: there are also ample existing Internet of Things deployment examples that show the real-life benefits. Cases are great to help you see the benefits without too much theory.

Manufacturing: a connected services offering at ABB Robotics with IIoT

The Industrial Internet of Things enabled ABB Robotics to achieve higher efficiency, enhance customer support and introduce a new connected services approach.

ABB Robotics, a division of automation multinational ABB, manufactures industrial robots for its customers. In this technology-intensive environment, the Internet of Things enabled the company to move from solving issues with robots after the facts to remote maintenance and the possibility to completely transform the company’s services offering.

By building a connected ecosystem of the industrial robots which the company had installed for customers, sometimes in hard to reach places, engineers can analyze issues without having to go to the customer. For customers this leads to tangible benefits in an environment where uptime is of crucial importance. For ABB Robotics the deployment of the Internet of Things – and the platforms to leverage the data and insights derived from it – opened new doors to develop additional services and a web applications that enables monitoring, asset optimization and more.

Industry 4.0 and IIoT in the mining industry: the Dundee Precious Metals case

Although 77 percent of mining companies still are at the beginning of their digital transformation journeys, according to IDC (end 2016), several mines already have taken important initiatives in the Industrial Internet of Things.

An example is the Chelopech mine in Bulgaria. It’s an underground gold and copper mine, operated by Canadian firm Dundee Precious Metals. Building upon a modernization, digitization and the implementation of a mobile IP network (with companies such as Sandvik, Dassault Systèmes GEOVIA and Cisco for the communications and network part) an Industry 4.0 project helped achieving several benefits.

Among them: an increase of production, real-time maintenance, better and cheaper communication possibilities, fast productivity data (no more paper), better collaboration, fast resolving of issues that have a negative impact on production and thanks to tags which are added to miner’s helmets and to vehicles an overview of who and what is where and when. This doesn’t just lead to insights but also adds to miner’s safety.

Looking for more industrial – and less industrial – examples of the Internet of Things in practice?

Check out the list on our examples page (with, on top of the above cases, additional examples from companies such as Rolls Royce in aviation, Great Lakes NeuroTechnologies in healthcare, Daimler Trucks, ELM Energy and more).

The Industrial Internet of Things and connectivity: IIoT connections and connectivity solutions and evolutions

Although there are some overlaps, the connectivity and communication solutions which power the Industrial Internet of Things (IIoT) are different from those in consumer-oriented applications.

This doesn’t mean that for communication between specific elements of an IIoT solution, there can’t be any technologies that are mainly used for consumer applications. Examples include communications between sensor nodes and sensor hubs over a very short distance.

It also doesn’t mean that some approaches (e.g. LPWA or Wi-Fi) can’t be used in Industrial IoT and in non-industrial applications. That’s the overlap.

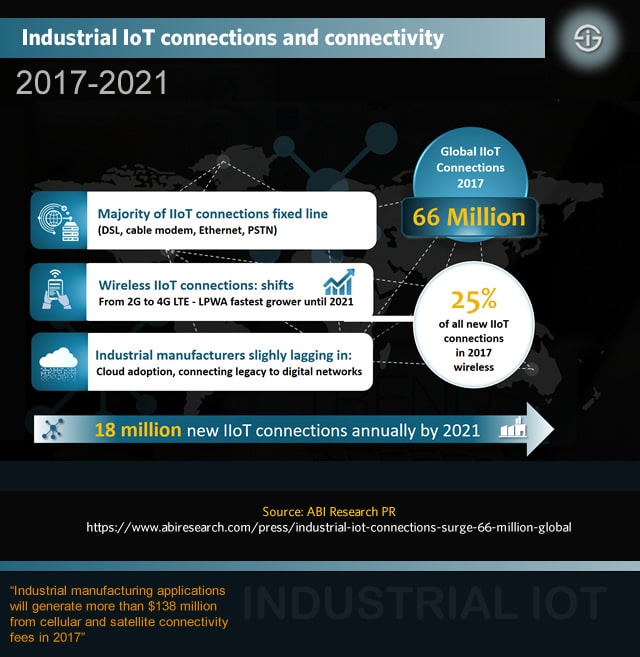

What we do see though is that in the Industrial Internet of Things the types of connections and connectivity approaches are different in general. This is certainly also the case in manufacturing (Industry 4.0). The image below shows the main evolutions with regards to the number and type of IIoT connections and the evolutions with regards to the IIoT connectivity technologies.

The majority of IIoT connections runs across fixed line technologies, ranging from DSL and cable modem to Ethernet and PSTN. In the period until 2021, wireless IIoT conncetions become more important with, among others a shift towards 4G LTE technologies and LPWA as the fastest grower.

In 2017, 25 percent of the 13 million new connections in Industrial IoT goes to wireless IIoT connections.

The Industrial Internet of Things across the globe: standardization, industry bodies and initiatives

The Industrial Internet of Things takes a central place in the industrial transformation projects which are initiated, developed and implemented in nations and industry bodies across the globe. We already mentioned some previously and as promised take a deeper dive.

Why you need to know the global initiatives regarding IIoT: architectures and standards

It’s important to know the industry bodies, understand what industries they cover and how the Industrial Internet of Things fits in.

It’s especially important to see how these different initiatives, the reference architectures they develop and the publications they put out in regards with security and the Industrial IoT, IIoT standards and so forth evolve and how they collaborate and try to align with eachother.

Why is this important? First, because standardization and the promotion of the usage of the Industrial Internet of Things is key in their efforts, standards are essential in IIoT and at one point or the other there will be some kind of certification to see if Industrial IoT ‘products’ and solutions are compatible with the requirements which are agreed within the bodies that laid out the rules.

Global companies require global IIoT know-how and operational flexibility

Next, there is the fact that industries such as manufacturing, logistics, oil and gas and so forth are typically international.

Companies such as GE, Siemens and Bosch operate across the globe and are often members of several industry bodies at the same time. Manufacturers and logistics firms (also think shipping, aviation etc.), even smaller ones, operate in a gobal context as well, and, last but not least all the providers of Industrial Internet of Things solutions, on top of the three mentioned ones (think Cisco, IBM, SAP etc.) also work globally (and are active members of these consortia).

Finally the several initiatives and industry bodies are key sources for in-depth material regarding the Industrial Internet of Things. They (and their members) come with a wealth of information, best practices and recommendations about, among others, IIoT. In other words: they also help you succeed if you have an Industrial Internet of Things project or broader project in which IIoT fits.

The main global initiatives promoting and standardizing the Industrial Internet of Things

The several national, regional and global industry bodies and initiatives, which de facto put the Industrial Internet of Things at the center of their efforts, have different names, frameworks/models and approaches, depending on their background. An overview of the main ones.

The Industrial Internet of Things in the Industry 4.0 Platform view

Originating in the German manufacturing industry and government, Industry 4.0 is gaining more attention across Europe and the globe.

Its main focus is manufacturing and logistics with an important role for cyber-physical systems.

IIoT and cyber-physical systems in Industry 4.0

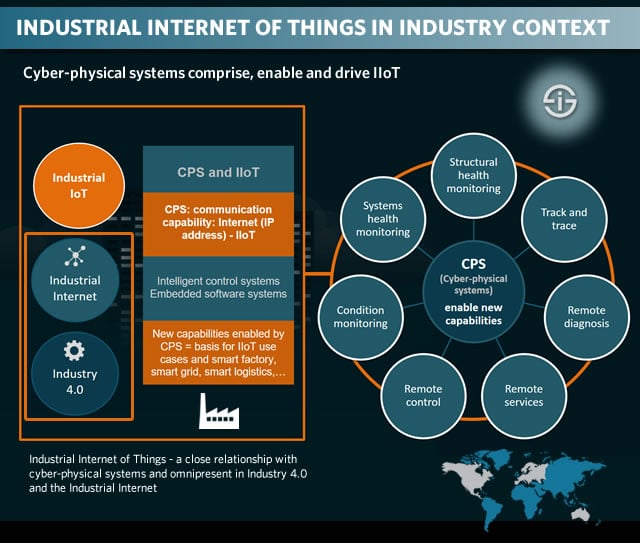

Although strictly speaking cyber-physical systems are not the same as the Industrial Internet of Things, IIoT is essential in the overall Industry 4.0 vision.

Its building blocks, cyber-physical systems, are based on the newest control systems, embedded software systems and the ability of connection using an IP (Internet Protocol) address.

This means that cyber-physical systems share numerous characteristics with the Internet of Things and certainly the Industrial Internet of Things: the bridging of a physical and cyber reality (what else is the IoT about?) and the ability to connect to ‘the Internet’.

Cyber-physical systems, in the view of Industry 4.0 are a next stage in engineering and mechanics and essentially that next stage IS the Industrial Internet of Things (the connectedness of manufacturing assets, products and production processes, with a strong focus on data). Cyber-physical systems in the Industry 4.0 view are the building blocks of Industry 4.0 but they also enable new capabilities for manufacturing and more.

The new capabilities in Industry 4.0 are IIoT use cases, enabling smart industry

These capabilities are essentially what we also call IoT or IIoT use cases, within the industrial focus of Industry 4.0: track and trace, structural health monitoring, remote diagnosis and control: they are all typical use cases.

The new capabilities (or IoT use cases), again in the view of Industry 4.0 in turn enable anything ‘smart’: the smart plant, smart factory, smart logistics, smart home, smart building, you name it. The link is pretty clear.

As you can read on our Industry 4.0 page, the Boston Consulting Group sees Industry 4.0 as the convergence of nine digital industrial technologies: advanced robotics, additive manufacturing, augmented reality, simulation, horizontal/vertical integration, cloud, cybersecurity, Big Data and Analytics, and the Industrial Internet.

The Industrial Internet of Things comes back in virtually all of the mentioned converging technologies. Advanced robots and cobots need IoT, simulation (think digital twins) needs IoT, Big Data de facto is (also) about IIoT data, the list goes on.

What else you need to know about Industry 4.0 and IIoT

Funny enough, the Industrial Internet, which we’ll tackle next and is mentioned as a technology by BCG (which it really isn’t though) is all about IIoT and another industry group: the Industrial Internet Consortium. Its main tasks? Promote and standardize…the Industrial Internet of Things.

While Industry 4.0 as said originates from Germany and has a background in engineering, manufacturing, German government efforts in industrial transformation and academia, it is spreading.

This is, among others due to efforts of German ‘Plattform Industrie 4.0’ to put Industry 4.0 as a European standardization platform. This is done within EU institutions, by bilateral agreements with countries such a France and Italy, which just as other European countries have their own industrial transformation projects with the IIoT taking center stage such as smart factory (e.g. The Netherlands), Industry of the Future (France) and more.

On top of pushing the Industry 4.0 view and architectural reference model (see next point), ‘Plattform Industrie 4.0’ and the powerful German industrial market (we mentioned some companies) is also taking Industry 4.0 globally.

This is among others done via similar international partnerships such as a collaboration with the Japanese Robot Revolution initiative and the Industrial Internet Consortium, which we mentioned and further explain next. It’s pretty clear that such collaborations matter, even if it’s just because the big industrial players in practice are members of various industry bodies and they care less about names such as Industry 4.0 or Industrial Internet than they do about their business.

Finally, note that ‘Plattform Industrie 4.0’ has an architecture reference model.

It covers the several aspects of Industry 4.0 where in practice processes, protocols, data, cyber-physical systems and de facto the Industrial Internet of Things are all tackled. This reference architecture model for Industry 4.0 is called RAMI 4.0.

Time for the next industrial body where IIoT is essential (and where another architecture model has been developed, again a reason for collaboration): the Industrial Internet Consortium.

The Industrial Internet of Things in the Industrial Internet Consortium view

We’ve mentioned the Industrial Internet several times before. Although the term and concept Industrial Internet originally was not the same as the Industrial Internet of Things, today de facto it is used as a synonym.

It’s here that our second industry body comes in where the Industrial Internet of Things is even more prominents and where, in comparison with Industry 4.0, more industries are covered.

IIoT and the Industrial Internet Consortium: background

The Industrial Internet Consortium (IIC) was co-founded by US industrial giant GE, who also coined the term Industrial Internet and is one of the major players in the Industrial IoT.

The Industral Internet Consortium today mainly is busy with the promotion of the usage of IIoT, which has to be seen in the scope of using data in order to improve operations, enhance service and detect new opportunities. The image below shows the definition of the Industrial Internet.

Since the beginning, the IIC, which was founded by GE and other big players in industrial (technology) markets such as Cisco, IBM, Intel and AT&T had the mission to create standards to “connect objects, sensors and large computing systems”.

In other words: the Industrial Internet of Things with a focus on several aspects whereby intelligent machines, advanced analytics and people at work were three key elements.

The IIC collaborates with the Industry 4.0 Platform and in November 2016, the organization also signed a ‘memorandum of understanding’ with a consortium with similar goals: the IoT Acceleration Consortium or ITAC.

IIoT architectures and frameworks from the Industrial Internet of Things Consortium: from BSIF and IIRA to IICF

Just like the Industry 4.0 Platform, the Internet of Things Consortium, as mentioned, developed a framework. It’s called IIRA, short for Industrial Internet Reference Architecture.

The first version was released in 2015 and version 1.8 of the IIRA was published in January 2017. It aims to help all sorts of experts who are involved in Industrial Internet of Things projects to consistently design IIoT solution architectures and deploy INTEROPERABLE Industrial Internet of Things systems.

Remember that, as previously mentioned, the Industrial Internet Consortium covers more industries and thus also IIoT use cases and deployments than just manufacturing. On top of manufacturing they are energy, healthcare, smart cities and transportation.

With the IIRA v1.8, however, the IIC really wants to cover applications in virtually all industries. Some are related to the main industries mentioned above (mining, public infrastructure), others aren’t really or partially (agriculture).

On top of the IIRA model, the Industrial Internet Consortium also published the so-called IICF, short for Industrial Internet Connectivity Framework, in February 2017.

Last but not least, the IIC also has a Business Strategy and Innovation Framework (BSIF) which was published end 2016, as we mentioned in our article on the Industrial Internet.

Quite a lot of things to go through, yet worth the effort obviously.

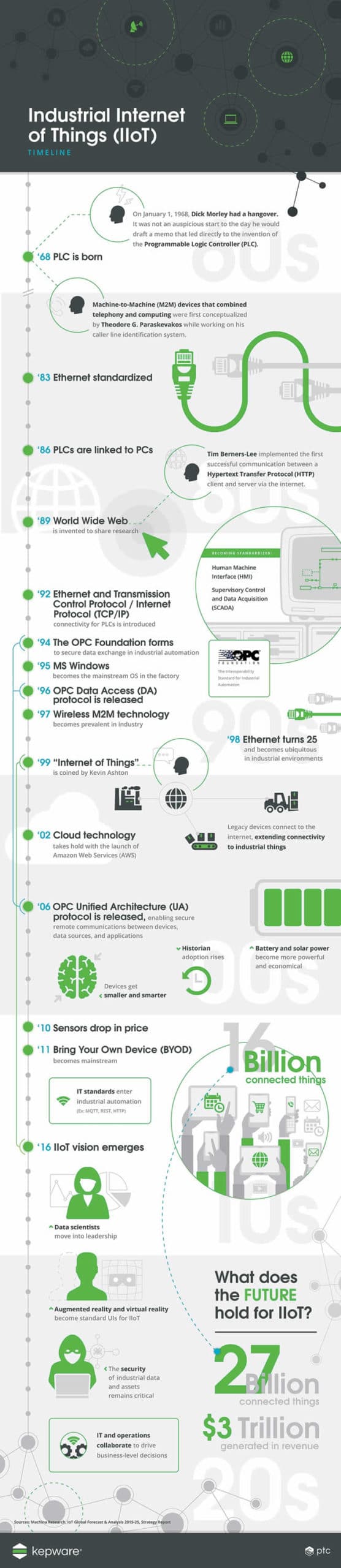

An Industrial IoT and smart manufacturing timeline

Keeping the different possible definitions of the Industrial Internet of Things or IIoT in mind (so, as a synonym of the Industrial Internet or as, essentially, the usage of IoT in industrial markets and use cases which tend to be very different in nature, scope and technologies used, among others) below is a timeline of, well, some essential developments which have brought us where we are in smart manufacturing and Industrial IoT from the people of Kepware (read a guest blog from Sam Elsner of Kepware on using Industrial Protocols to connect IoT with industry at the edge with some of the protocols mentioned in the infographic).

It’s a mix of various selected events really, ranging from the invention of the PLC (Programmable Logic Controller), the first M2M devices, the standardization of Ethernet (which still plays a crucial role in IIoT applications, especially with new Power over Ethernet or PoE standards around the corner which are fit for many of today’s…controllers and M2M devices in applications ranging from industrial control systems to connected lighting and room control), the invention of the Web and http, TCP/IP, OPC Data Access, the IoT as coined by Kevin Ashton and cloud to OPC Unified Architecture, the drops in sensor prices (which definitely led to the growing usage of IoT) and far more.

One could add much more to it of course, ranging from EDI and RFID to several breakthroughs in chip technologies such as MEMS and smart transducers and so much more but one needs to stop a timeline somewhere of course. And in the future? Well, that convergence of IT and OT might still take some time but moves fast at different speeds. In the meantime add digital twins and smart products, artificial intelligence, machine learning and blockchain (beyond just blockchain and IoT) to that timeline in your mind too, trust us.

Too bad there isn’t a universal interoperability standard yet.

IIoT infographic

The Industral Internet of Things infographic by Visual Capitalist with some of the research data we mentioned in this article.