The insurance industry: key challenges and evolutions in a hyper-connected age

The insurance business is one of the most competitive industries and faces multiple challenges. These challenges are not just caused by changing customer expectations and behavior or by the advent of ‘disruptive‘ organizations from outside the industry, although that is a growing concern for quite some time now as well.

Examples of such ‘disruptive’ firms include InsurTech players (InsurTech is the FinTech of the insurance industry) and, since many years, the initiatives taken by some of those technology giants which we tend to refer to as GAFAA (Google, Apple, Facebook, Amazon and Alibaba).

While we see that the landscape is changing due to, among others, these forces there is more, much more. An overview of the digital transformation challenges and overall evolutions in the insurance landscape.

The many challenges of insurance companies

On top of the changing and increasingly digital, mobile, channel-agnostic and demanding customer, InsurTech and certainly the moves of those GAFAA giants, other challenges for the insurance industry include:

- Ongoing commoditization.

- Easy to replicate innovations.

- Regulatory changes.

- Macro-economic uncertainties.

- Decreasing loyalty.

- The need to find a different narrative in approaching today’s customer.

- Challenges regarding digitization of business processes (e.g. insurance claims processing).

- Innovations in the area of new models whereby policy terms are linked with data from emerging technologies such as the Internet of Things.

Insurance firms are disrupted, disrupting and going through important digital transformation projects, which de factor often revolve around the need to optimize the end-to-end customer experience.

The customer experience challenge in the insurance industry

In its 2016 worldwide insurance survey, in collaboration with Efma, Capgemini uncovered that 47 percent of all insurance customers report a positive customer experience. However, also according to the 2016 report, only 34 percent of Gen Y customers stated the same as we’ll cover below.

Capgemini has been emphasizing how hard it is for insurance companies to differentiate their products in any sustained way (competitive pricing, the mentioned commoditization of products and easy replication of innovations, etc.).

Striving for superior customer experience is a must but alone it is not enough anymore. However, there is a significant gap and while policy holders expect quick and comprehensive service, many insurance carriers fail to meet their expectations. With exception of some countries, the percentage of customers reporting positive experiences, is also less in insurance than in banking, the report found.

Customer experience and insurance: the ways consumers engage

The customer experience challenge starts with the way policy holders communicate. They are used to communicate via email, text and a whole range of new channels and formats.

Furthermore, if they’re not satisfied they use social media to tell the world. This challenge affects many industries, also in other financial services industry areas. However, in the insurance industry, dissatisfaction is easily voiced, as customers expect almost immediate accuracy and responsiveness. This is a huge challenge, especially as 84% of customers trust other consumer’s experiences.

On top of that, there is the very nature of the insurance business whereby incidents can cause a sudden rise in claims with even more customer expectations. When such incidents happen on a larger scale, they can also be closely monitored by the media and regulators, adding more pressure to the equation.

Changing customer behavior in an omni-channel, digital age

Customer experience expectations, customer service demands and customer behavior have of course changed in virtually industries as consumers expect the same levels of quality and speed as they are used to in various markets.

Research, however, shows that among younger insurance consumers, the frequency of interaction is higher, the likeliness to go to non-insurance firms for insurance and the information needs are different.

This behavior is traditionally attributed to Generation Y but is showing across segments of more digital-savvy consumers.

Still, not everything is as ‘digital’ as we might expect. It all depends on various contextual factors and this goes for Gen Y too. Among these contextual factors are the nature of what needs to be protected with an insurance policy, the family context, regional differences, specific attitudes regarding risk, trust and insurance as such, the employment status, the local digital ecosystem and much more.

Changing customer expectations regarding insurance: the Gen Y effectThe information management, workflows and staff challenges

Many insurance carriers struggle to efficiently handle a request that includes inputs from different communication channels and provide this instant response their customers expect.

Instead, they have automated processes for some communication channels like paper documents and emails, but communications like text and especially social media are largely manual or remain siloed.

The increasing expectations also present a challenge for the insurance staff. Aging experts and enormous training requirements – it takes as long as 15 years for a claims expert to reach the level of senior expertise – make it very difficult to meet policy holder expectations. It is therefore not a viable strategy to hire claims agents in volume, train them, and then retain only the top performers. A more graceful way of transitioning employee knowledge, streamlining workflow, and retaining and growing knowledge bases is needed.

In the highly competitive insurance environment there is an enormous pressure to increase efficiency and streamline operations. Most carriers struggle with manual process steps – including many repetitive tasks, such as checking a claim input for completeness and requesting missing information like an auto accident police report.

The handling of an underwriting request or claim requires matching the request with customer information that in most cases resides in legacy systems. Finding this data, such as customer status and associated entitlement to reimbursement, is often a bottle neck for the end-to-end automation of the claims process.

The cost of fraudulent claims

Fraud is another huge challenge for insurance carriers. In 2012, fraudulent claims cost the insurance industry $30 billion annually.

With a 10% overall increase in fraudulent claims since 2010, insurers are seeking smarter, more effective security and fraud prevention technologies. But in most cases today, fraud analysis is being done after the fact, as opposed to while fraud is occurring and thus is easier to stop or prevent. Some insurers employ hundreds of specialists using innovative technologies and network analysis tools to help prevent fraud.

Several technologies can be leveraged to improve insurance claims fraud detection. These include more traditional information management approaches but also more advanced claims fraud detection systems as depicted in the 2013 graphic from Celent, announcing a report on the market dynamics of claims fraud detection.

Achieving these goals is easier said than done. But it can be done, with the proper smart strategy. In fact, the intersection of policy holders, insurance staff and technology offers significant opportunities in the challenging claims processing business.

- Engaging and effectively communicating with policy holders in the communication channel they chose is imperative.

- Balance workforce expertise levels and keep experts as well as less experienced staff motivated.

- Improve the efficiency of processes ensuring the tight integration of all communication flows connecting the mailroom, back office operations, and your service center

- Invest in fraud prevention through focused data mining to detect and prevent fraud.

The result is an optimized cost structure, higher customer satisfaction and loyalty and a motivated employee base who have more time to focus on upselling, thus creating addition revenue.

Commoditization in the insurance industry

Consumers generally don’t want a relationship with their insurance company. Many insurance offerings in the P&C (Property and Casualty) area are seen as commodities, something consumers need to pay for – and would even prefer to avoid. Cost is the differentiating factor in this regard for many consumers but it’s also a dangerous one for insurance companies.

The narrative and messaging regarding such insurance products regularly revolves around the pricing aspect. When typing in the term “car insurance” in Google at the time of writing this, the first organic (not paid for) result I get is a web page that allows me to compare cheap car insurance quotes.

The paid results (the ads by insurance providers whereby those that pay most for the search term appear first) use terms such as “cheap”, “pay less”, “cheapest rates” and “40% less”. Imagine what happens when I look for “cheap car insurances” instead of just “car insurance”. Knowing that such insurance products are increasingly purchased online and that people who buy them “offline”, compare rates online before doing so, the impact is clear. The cost aspect is not just key in the messaging of usual suspects such as insurance comparison websites, of which many effectively allow to also “buy” the insurance as they team up with various insurance providers.

Some insurance companies have responded by launching online platforms – often as separate brands – themselves. Others have taken over the same narrative of price. In my search, for instance, a leading insurer and financial services firm showed up in the first search results with a web page titled “Car insurance at a truly incredible price”. What’s rather remarkable is that this hasn’t changed since two decades, ever since we started using the Internet for commercial reasons. Just look at the screenshot from MSN from…1996. The image saying “Overpaying for Auto Insurance?” is very prominent.

Depending on which version of Google or any other search engine you use and where you live, the results will differ but almost everywhere across the globe we see the same phenomenon happen.

The arrival of the behemots of the online world

To make things worse, the previously mentioned tech giants – and others – are increasingly entering the space as well. Whereas a few years ago, for instance, online comparison sites with a license to sell insurances started working with insurers by launching a Web-first platform and brand, the online behemoths are joining the game.

As said, the phenomenon is not new (think about Geico, for instance, in the US), nor is the use of the Internet to get quotes. As early as 2005, The Wall Street Journal reported that 68% of consumers obtained auto insurance quotes online, beating the phone which was used by only 55% of consumers.

What is relatively new though, is this arrival of ever more and ever more ‘powerful’ players who have a huge online presence and foothold such as, indeed, Google. To make things even more challenging, there is the entry of non-traditional players who have no background in financial services but are champions in “cheap”. In The Netherlands, for instance, HEMA, a retail brand known for cheap products in many categories, also offers insurances in most P&C categories and with a dedicated website. On the general website of the companies, insurances are just another offering, appearing amid other products such as food, drinks, baby clothes and mobile phones.

20 years of commoditization challenges: the road ahead

The price erosion and commoditization in established and crowded markets isn’t new either. Since the advent of e-commerce at the end of the nineties, organizations already started to feel the impact of the Web and the MSN screenshot is just one of many examples.

In 2000, Wallstreet & Technology published a piece on the need for financial services institutions to look for new operating models and digital technologies and IT projects, back then in e-commerce and CRM, were mentioned as ways to look for ways to cope with the challenge of commoditization. In the next 15 years, virtually every single piece of research published on the risks and challenges facing financial services providers – and also insurance companies – has been mentioning commoditization as a key issue. And it is still the case today. Since then, insurance companies adapted to numerous regulatory changes, more complex ways of distribution, financial crises and much more. Yet, while doing so, the challenges brought upon them as a consequence of new technologies, social media, an increasingly demanding and empowered consumer, ongoing digitization, ever more competition and more regulatory changes and crises, kept growing. At the same time, consumers massively flocked to mobile devices and a mixed and even simultaneous use of channels and devices, an ongoing evolution with quite some repercussions as well that will continue to challenge the actual situation in the next years.

On top of the commoditization challenge in many P&C insurance areas, there is also the easy replication of offerings and even innovations.

While the advent of online players certainly has been a challenge it also has proven to be a benefit for insurance companies as they seized the opportunity to use more direct and digital channels, both for marketing and actual underwriting purposes. The fact that consumers increasingly use digital and mobile in this regard helped lower acquisition costs to some extent and in certain regions. In countries and regions with high competition and a high maturity level regarding such digital offerings and services, the impact of on the acquisition costs has been less significant and, in general, acquisition costs have continued to be a key challenge.

Tackling the challenges: focus on the end-to-end customer experience

Gradually, there has been a shift to look at the overall customer life cycle and be more customer-centric in order to reduce costs and increase revenue.

Customer retention and satisfaction became more important, especially as the choice for an insurance provider is not just determined by pricing but also by “tradition” (choosing the same providers as family members, for instance) and by peer recommendations and word-of-mouth, both offline and online (via review sites and other platforms but also personal interactions). Reducing churn has become an imperative, making insurance companies looking at the customer experience and especially customer satisfaction as a proven way to increase customer acquisition.

Consumers don’t want relationships with insurance companies for commoditized products but they do want to protect what is dear to them and when push comes to shovel the claim in case of an incident is an important moment of truth. It’s then that consumers think about their insurance provider: when the unforeseen happens.

Unfortunately, customer satisfaction, service, assistance and smooth claim processes alone don’t cut it, even if smart claims strategies are essential to make the difference. Acquisition through other channels remains important too and, as everyone is using direct and digital channels, competitive advantages in this area are not easy to accomplish, keeping pressure on costs and pricing.

This has led many insurance companies to optimize their processes and costs structures through automation and digitization, an ongoing challenge. But it also makes them look more at the core value proposition. And that value proposition becomes visible in the intersection of the underwriter’s priorities and goals on one hand and the brand on the other. It’s one of the reasons brand management has become more important again in many industries and content has become crucial in a marketing context.

Content, in the sense of information, also has become key in the actual processes, cost reductions and efficiencies insurance companies look for. And in that regard, digital technology and many recent evolutions are closely examined by insurance providers.

While price continues to be core in the messaging of many insurance firms, there is also an evolution in the narrative whereby some providers try to focus on their role as advisors and partners across the customer life cycle (in this case also literally the customer’s life as such). In some cases this can work well, certainly when this approach is not just a matter of messaging but also shows in acts at those mentioned moments when it truly matters.

In other cases, especially for products that are deemed less essential by consumers, the approach seems less effective. It might make more sense in corporate insurance, when the insurance provider offers more than insurances, for agents that are close to local consumers who seek a more personal approach and for specific types of customers.

Claims, emotions and the moment of truth

However, as mentioned earlier, consumers do not really want relationships with their insurance providers. Once an insurance is underwritten, there are very little interactions between the provider and consumer.

The relational dimension often indeed becomes clear in case of an incident and consequent claim. That moment is probably far more important from a relational perspective than the underwriting, even if the latter happens in a personal way instead of via direct and digital interactions and distribution channels. This is not just in insurance, by the way. Consumers in general don’t want relationships with brands. What they do want is getting…what they want so it becomes increasingly important to really know and validate what that is. Again that focus on the customer and customer experience optimization.

People don’t look for insurances. Sure, they look for them online and via other ways but it’s not their end goal, it’s not what they really look for. As mentioned, what they want to do is protect something that is dear to them. They buy a guarantee, a sense of security and comfort, a promise. In that sense, an insurance is almost part of what they want to protect. That’s one of the reasons people buy insurances when they book a travel or when they buy a new car. It’s why they want a warranty with that new computer. They also buy a protection for less tangible things they care about: their lives, their income, their family members, etc. They buy a guarantee in case something unforeseen happens. We can even take this a step further: when people buy a house, they don’t buy bricks and mortar, they buy something they can call “home” and so much more. It’s in understanding these emotional and practical aspects that lies an opportunity for insurance providers who go beyond the insurance product (and attributes of it such as price) and align their brand, service, content etc. with those end goals of the underwriter.

These personal goals, emotions and values of the consumer can’t be commoditized nor can be the way an insurance company delivers upon them in practice. Acting in a customer-centric manner, while optimizing processes and managing risks and cost structures, is one way to reduce the impact of commoditization. It requires focus and, admittedly, acknowledging that the perception of commoditization won’t go away as more players, including the Google’s of this world, focus on price.

The rise of InsurTech

FinTech has been present in various areas of retail banking, payments, (peer-to-peer) lending and wealth management as we reported on our FinTech overview page.

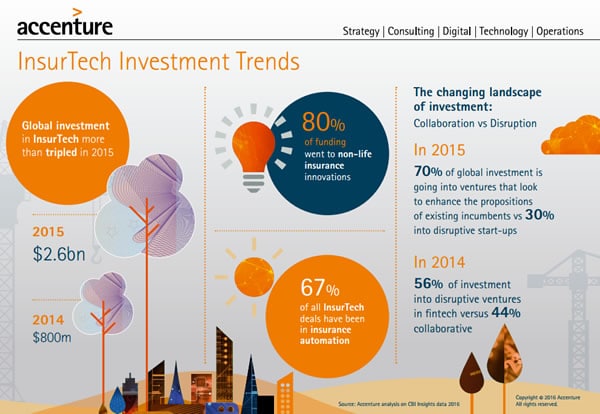

One area of the financial industry where FinTech has been lagging behind is insurance. According to 2016 research by Accenture, however, InsurTech is clearly on the rise.

InsurTech companies have been attracting far more funding in 2015 than in 2014, Accenture states (more than three times as much in just one year). And while insurance firms are facing several challenges they also have been experimenting with new models themselves, based upon third platform technologies.

Big data, analytics (in a context of insurance where risk is key, mainly predictive analytics), the usage of telematics in relationship with pricing models, mobile, cloud: they all have been high on the list of insurance companies in recent years.

With InsurTech providers working in some of these areas, there seems to be a more collaborative approach between InsurTech firms and insurance companies, something we see happening in FinTech now as well. Maybe the initiatives of insurers have added to this and InsurTech firms have been working more from a collaborative rather than a competitive perspective.

In an infographic, released at the occasion of the report we see that 80 percent of InsurTech investing went to non-life insurance innovations and 67 percent of all InsurTech deals have been in insurance automation.

Check out the full infographic here and read Accenture’s analysis (which covers the state of FinTech investment with a special focus on InsurTech) here.

Top image: Shutterstock – Copyright: Jirsak – All other images are the property of their respective mentioned owners.