In a quite amazing short period of time, the customer data platform (CDP) moved to the top of enterprise marketing technology (martech) topics. The customer data platform is a solution to long-standing customer data integration/unification issues that made a unified customer view almost impossible. So, it’s not surprising that the CDP market is booming in times of digital marketing. Yet confusion still reigns about what a customer data platform is and what it’s not.

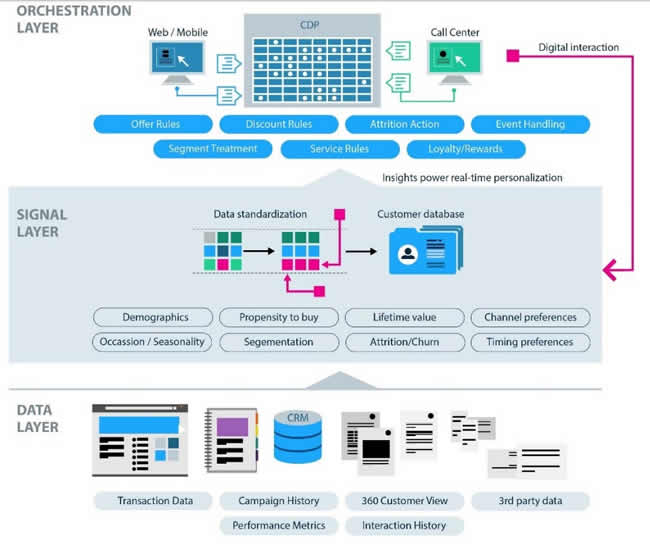

A Customer Data Platform (CDP) ingests customer data from many source systems and combines it into a unified customer database that is open for use and connects to other systems

How do you get the most out of your customer data to make marketing, customer experience and customer service as efficient as possible while avoiding as much waste and frustrations because of poorly coordinated activities as you can?

The customer data platform is seen by many enterprise marketers as the solution. Thanks to big data technologies this ‘new’ category of solutions offers possibilities to have a far more integrated/unified/consistent/persistent/actionable customer data approach. Make no mistake though: while customer data platforms rank high on the wish list of many enterprise marketers – and quite some have one or more – it’s not as if you buy a simple new solution that doesn’t need too much attention.

- Customer data platforms in perspective

- The goals of customer data platforms

- CDPs in the digital marketing hype cycle

- Types of customer data platforms

- The quest for the real CDP

- RealCDP certification and the 5 CDP capabilities

- Selecting a customer data platform: use cases first

- The customer data platform market

You know the challenges marketers have been facing. Customers want convenience and frictionless experiences. They expect you to know them well enough to engage in a consistent way and meet their expectations across numerous touchpoints and ample channels, devices and applications. They don’t want you to mess up and, for example, see ads or get mails about products which they just bought in one of your stores but looked for on your website first.

You have more customer data than ever before. So, in theory meeting those expectations and having all this information at your fingertips shouldn’t be that hard. Yet, you know the reality.

Customer data platforms in perspective

Ever more customer data sources and formats, including semi-structured and structured data, vendors of different types of systems begging to be your master database and a martech stack that isn’t – to say the least – always that integrated with all these others systems and dozens or even hundreds of various data sources and sales and service applications that can’t talk to each other properly yet.

The challenge isn’t new. The stakes are just higher. The customer experience is your so-called battlefield. The customer wants everything here and now. And the data you’ve got is, well, big, requiring analysis and usage at different speeds in a smart way.

The rising attention for data customer platforms can be seen from the perspective of these and other concerns calling to overcome customer data unification challenges and the good old silos standing in the way of enabling a better customer experience and realizing digital transformation gains in customer-facing situations – with context and ‘the moment’ shifting to the center of the attention in marketing.

Add the new technologies and systems being embraced (it’s all about data and how you leverage it – or not), overall big data challenges in marketing and the ongoing quest to make marketing more contextual and effective to meet changing customer demands (speed, convenience, you name it) and you have the backdrop of customer data platforms.

The main driver is obviously the desire of marketers to have a unified customer view which is also perceived as the main benefit as research (see below) confirms.

The goals of customer data platforms

The purpose of a customer data platform (CPD) is to enable marketers to manage one single and persistent database for all customer data that can be used for various (marketing) systems. You can look at marketing in a broad sense here.

Marketing technology (martech) consultant David Raab, who has been offering advice regarding marketing software and service vendor selection, marketing analytics and marketing technology assessment since 1987 came up with the concept and term in 2013, defining a CDP as follows: “a customer data platform is a marketer-managed system that creates a persistent, unified customer database that is accessible to other systems.” Lately, the CDP Institute Customer Data Platforms as “packaged software that maintains a unified, persistent customer database which is accessible to external systems.” That packaged software part is key.

In 2016 Raab launched the Customer Data Platform Institute (CDP Institute) to advocate the concept and provide vendor-neutral information about issues, methods, and technology related to customer data management and customer data platforms.

41% of companies selling to consumers are in the process of deploying a customer data platform, compared with 19% of companies selling to business but 34% of the B2B companies plan to start deployment within the next twelve months, compared to only 19% of consumer brands (CDP Institute, May 2019)

Since end 2017 attention for customer data platforms has been accelerating. Today we’re at a point we can call the customer data platform one of the marketing technology categories that has grown into a major topic for marketers with an increasingly crowded but confusing market of vendors having or claiming to have a customer data platform.

So, simply put, the customer data platform was born out of fact that, with all the data, systems etc. we now have, thus far no other customer-facing system was able to offer that persistent database and unified customer data view. This latter aspect also explains why in Europe the General Data Protection Regulation was an important market driver. Personal data protection in the context of customer data does require to know where the data sits, no matter the systems.

For people who’ve witnessed the rise of CRM, marketing automation and all those applications that popped up with each new ‘form’ of marketing (content marketing, social media marketing, the increasing usage of AI and so forth in contextual marketing) that data silo challenge is well-known as is the eternal promise of a more unified and single environment enabling to enhance marketing efficiency and customer experience.

With the advent of big data and more recent technology categories such as the Internet of Things (IoT), volumes of customer-related data continue to increase, as do the number of touchpoints and sources, types and formats all this data comes from/in. Is a customer data platform a solution to integrate it all to move to customer-based or people-based marketing as some like to call what in the end is still data-driven marketing? Is it a solution to be more relevant and contextual?

Half of enterprise marketers surveyed by Gartner who have deployed a Customer Data Platform say it’s their CRM system, which indicates a misperception of its purpose and unique differentiators (Gartner, July 2019)

It’s clear that by removing silos customers can be served in a better way. Ask contact center agents who still don’t have the information they need related to a specific customer and their urgent request. It’s also clear that customer data platforms make sense for marketers as it might be an end to custom integrations and the need to have databases developed enabling a more holistic customer (data) view.

Yet, it’s equally clear that a CDP is not for everyone, that in this stage as per usual there is quite some hype and that, regardless of the system, a better tool doesn’t mean better marketing. Moreover, not all customer data platforms are the same and it’s not as if they solve the tasks you have as a marketer regarding, for instance, personal data protection, watching over data quality and so forth. David Raab also regularly points out challenges regarding CDPs as well as you will read below with an overview of essential capabilities that customer data platforms should have.

CDPs in the digital marketing hype cycle

End August 2019, Gartner listed four emerging trends that will transform how marketers run their technology ecosystems as the research firm announced its Gartner Hype Cycle for Digital Marketing and Advertising 2019 report that contains 28 technologies.

Gartner added the customer data platform to its Hype Cycle in 2016, the year the CDP Institute was founded. The four ‘trends’ that will change how marketers run their MarTech systems according to the 2019 edition, are customer data platforms, artificial intelligence for marketing, blockchain for advertising and real-time marketing. Three of them, including customer data platforms indeed, are at the famous Peak of Inflated Expectations with CDPs having started their descent to the through of disillusionment. Always a good moment to start looking deeper at something unless you like to be an early adopter with all the benefits and risks.

The expectations of marketers for customer data platforms remain at an all-time high Gartner says. However, the reported use of the technology is different from the advertised capabilities.

If you have a déjà-vu feeling that’s quite OK. Marketing automation platforms still face similar challenges. Perhaps not that much in the advertised capabilities but most certainly in the way they are used and the extent to which they are used. Let’s also not forget that both marketing automation vendors and CRM vendors still want to be the providers of the central database often as well.

A unified customer view is the most important CDP benefit, listed by 86% of respondents. Many fewer cited applications such as predictive modeling (59%), message selection (49%) or cross-channel orchestration (49%) – Customer Data Platform Institute data, May 2019

Yet, the challenge with the adoption of customer data platforms and how they’re effectively used as per Gartner is more worrying. According to the firm half of the surveyed enterprise marketers who have deployed a CDP say it’s their CRM system. Ouch. While it is perfectly understandable why one would use a platform where all customer data from numerous sources that are pulled into a database could enable an integrated customer data view as a CRM, this isn’t precisely why customer data platforms exist nor what they are about. At best this finding shows that CRM vendors who want their platforms to be the master database might have quite some work ahead.

The fact that so many enterprise marketers say their customer data platform is their CRM indicates a misperception of its purpose and unique differentiators according to Gartner so there seems to be room to educate marketers on what a customer data platform is and what is that purpose.

Types of customer data platforms

Yet, as per usual, things aren’t exactly made easier by vendors in a market that gets all the attention and a big ecosystem of companies having or claiming to have a CDP wants to win in that ‘new’ market.

As has been the case with other marketing and customer-facing technologies we know that’s just a matter of time. But for now confusion does reign, especially as, per Gartner, those CDP vendors fighting for a spot in your martech stack are trying to differentiate themselves. While that’s common business sense de facto the consequence is an overlap with other, more mature marketing technologies as Gartner states.

Among the auxiliary features that CDP vendors add in order to differentiate themselves are features such as customer journey design and optimization, rule-based attribution, final-mile campaign execution and website personalization.

The feature overlap with related technologies is one aspect of a mounting confusion that has led to the slowing of customer data platforms through the Hype Cycle for Digital Marketing and Advertising according to Gartner. That confusion is further strengthened by the saturation of vendors (on top of the variety of CDP vendors). Moreover, it shouldn’t be forgotten that customer data platform vendors come from different backgrounds, for instance tag management.

The quest for the real CDP

Gartner’s take corresponds with that of several others who have been watching the customer data platform space and interviewing both industry insiders and marketers.

In March 2019 Winterberry Group Research, for instance, also detected the need to clarify what a customer data platform is – and isn’t – and, more importantly, how a CDP can offer value to marketers (who hopefully use them to create value for customers). Winterberry pointed out that, although over 100 companies describe themselves as a customer data platform – or are defined as such by others – in reality fewer than 20 really are a CDP.

Confusing for marketers who are looking for a CDP indeed. Instead of using David Raab’s definition and thus that of the CDP Institute, Winterberry has its own definition that resembles what David Raab has described over the years. Winterberry defines customer data platforms as platforms that can ingest and integrate customer data from multiple sources; offer customer profile management; support “real-time” customer segmentation; and make customer data accessible to other systems.

On that definition note: Gartner defines a customer data platform as “a marketing system that unifies a company’s customer data from marketing and other channels to enable customer modeling and optimize the timing and targeting of messages and offers”.

The colleagues at Forrester Research define a CDP as follows: “a CDP centralizes customer data from multiple sources and makes it available to systems of insight and (systems of) engagement”.

Per Forrester for many B2C marketers, customer data platforms are a Band-Aid solution on a much larger challenge even if marketers “face the convoluted task of wrangling myriad customer data to deliver customer-centric, contextually relevant engagement”.

Immediate changes companies can expect from a Customer Data Platform are less time spent on data preparation, followed by deeper analysis as analysts’ time is freed and as unified data becomes available. By the twelve month mark, you should start to run marketing programs that use CDP data and be getting measurable business results. By 24 months, you should be ready to manage cross-channel programs with the CDP as the connector between different delivery systems (David Raab)

Yet, this has a lot to do with priorities such as the fact that quite some organizations still aren’t that good at, for instance, data hygiene and cross-channel orchestration and – to a large extent – also with that confusing landscape and the overlaps with various features and even systems possible being duplicate. Still, Forrester clearly shows that there is quite some room for CDPs to evolve on many levels and looking back at those ‘all-time high expectations’ customers have regarding customer data platforms per Gartner, essentially Forrester says those expectations are far from met today with not just the quite diverse and confusing market but also lacking capabilities, immature capabilities and CDPs expecting too much from users, more reason to know the place of the CDP, its role, the consequences of bringing a customer data platform in, and of course to talk with experts and peers, rather than just relying on the promises of vendors.

On a sidenote: customer data platforms were originally mainly deployed in B2C marketing environments but B2B companies are catching up as you can read here. 41% of companies selling to consumers are in the process of deploying a CDP, compared with just 19% of companies selling to business. But 34% of the B2B companies plan to start deployment within the next twelve months, compared to only 19% of consumer brands.

There are also differences between Europe and North America in the reasons why the customer data platform took off and the types of buyers, the usage etc. Since CDPs have all customer data, they were seen as interesting solutions for regulation purposes in Europe with the GDPR indeed. Now that other regions also focus more on privacy and personal data protection, compliance is one of the benefits vendor will often mention.

RealCDP certification and the 5 CDP capabilities

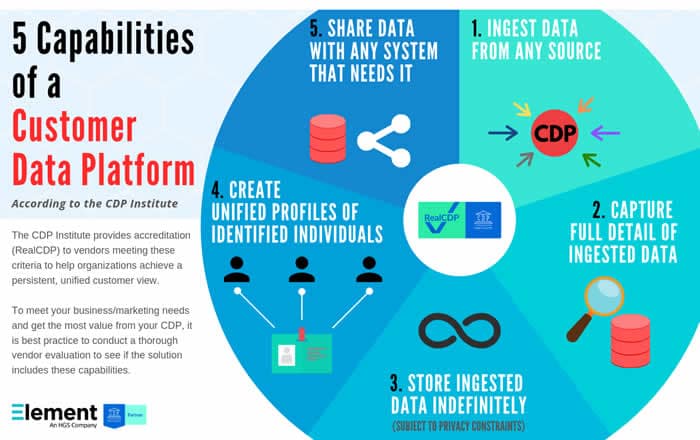

To reduce the confusion regarding customer data platforms, the Customer Data Platform Institute decided to launch a RealCDP program in April 2019.

There are two parts to this program. First, in order to be RealCDP-certified and have their systems listed in a “True CDP” database, customer data platform vendors must make sure their CDPs respond to the following five capabilities:

- Ingest data from any source (yes, that includes all those fancy new touchpoints and technologies but also data from audio calls etc.);

- Capture full detail of ingested data (there is an identifier);

- Store ingested data indefinitely (subject to privacy constraints);

- Create unified profiles of identified individuals;

- Share data with any system that needs it (do note any; marketing is not an island and the exaggerated focus on the difference between a CDP and DMP is short-sighted and even weird).

Secondly, CDPFinder templates and vendor information are launched to help buyers find the right CDP for their needs.

In announcing the program David Raab pointed out two challenges the CDP industry is facing. First, many companies that offer a customer data platform or CDP fail to build the complete, shareable customer database that is the heart§! of the CDP concept he says. Secondly, and this is indeed what Gartner and others said as well, with the additional features they offer ‘legitimate’ CDPS leave buyers confused with the many options out there. It’s here that these efforts come in.

Access to the CDP Institute is free and it seems like a good idea to start your journey there if you’re looking for a customer data platform.

More recently, the Institute released some new data on the customer data platform industry with data on the first half of 2019. You can check them out here and some are in the quotes in this article.

Selecting a customer data platform: use cases first

The selection of the right customer data platform for your needs depends on several factors that go beyond features as per usual when in the market for information systems.

Instead of looking at the CDP market, marketers are recommended to start from their use cases. All in all, it’s quite amazing that the latter isn’t already common practice and sense.

Knowing that all CDPs are different and that several offer additional features while some are more about the data unification and so-called single view aspect (that as such is just the beginning), it’s most of all important to look at the use cases and there are quite some use cases for CDPs. These include cases such as avoiding to show retargeting ads regarding a specific product someone looked at online and just bought somewhere in one of your stores (separate customer data repositories indeed) – and thus avoiding waste and irritation – to several other cases in a context of creating matching identities with customer data from physical/offline and digital/online touchpoints and interactions.

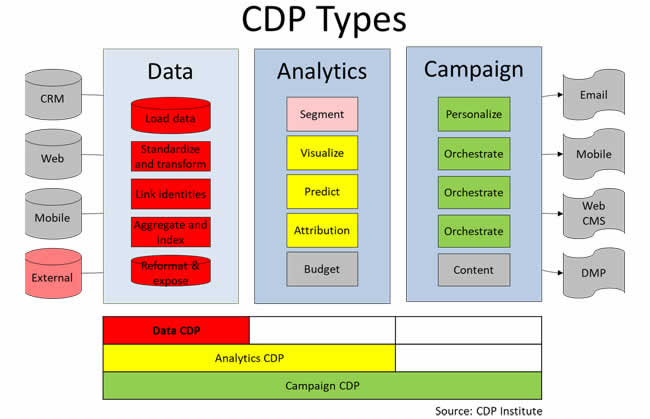

In the mentioned blog on emailvendorselection.com, David distinguished between three types of customer data platforms as you can also see in the image above.

- Data Access type CDPs

- Analytics type CDPs

- Campaign type CDPs

In a more recent blog, Jordie and several Customer Data Platform experts, including David, look at what companies can expect as a result of having a CDP in the short and somewhat longer run, what types of use cases for CDPs excite them most (with some examples) which gives you some more ideas on what might make sense for you and why to invest or not to invest in a CDP.

The customer data platform market

Since 2016 the customer data platform market has been rapidly growing. As David Raab explains in a soon-to-be-published interview, Europe lagged a bit behind since DMPs were sold as the solutions for the challenges which customer data platforms solve by DMP vendors.

Now the market keeps growing pretty much everywhere (the US market was fastest and first). And as tends to be the case in a booming market, consolidation has started. According to the latest semi-annual Industry Update at the time of updating this overview (January 2020), established customer data platforms are prepared for industry consolidation but at the same time end, 2019 again saw the entrance of new players in the market.

Customer Data Platforms are defined as “packaged software that maintains a unified, persistent customer database which is accessible to external systems

The update from the CDP Institute found that during the second half of 2019, the industry added fourteen new CDP vendors and $236 million in new capital. Moreover, employment in the CDP industry was up 64 percent over the year before.

Looking at 2020, one of the key growth drivers will be expansion outside of the US. The CDP Institute forecasts that customer data platform industry revenue will reach at least $1.3 billion in 2020 after having reached $1 billion in 2019.

A second driver of the market is the entry of the big enterprise marketing vendors. Adobe, Microsoft, and Oracle already released RealCDP-compliant products in the second half of last year and Salesforce is expected to release one in mid-2020. Earlier in 2020, Salesforce also acquired customer data platform Evergage.

The battle for domination in a crowded marketplace has started with more consolidation expected. End 2019 and early 2020 were already busy in that regard. On top of Salesforce’s acquisition of Evergage, there was the acquisition of SessionM by Mastercard, of Lattice Engines by Dun & Bradstreet and of Agilone by Acquia. On top of these four acquisitions (three in 2019, one so far in 2020), there were also seven major funding events and the exits of nine firms through asset sales or repositioning (during the second half of 2019).

Stay tuned for more on customer data platforms, selection criteria and some of the common myths and challenges marketers should be aware of.