There isn’t a single day that goes by without an article, paper, webinar, or even event on edge computing. It’s clear that edge computing has become a technology/computing topic one can’t ignore anymore.

By 2023, more than 50% of new infrastructure deployed will be in increasingly critical edge locations rather than corporate datacenters, up from less than 10% today (IDC)

Edge computing isn’t new. We’ve been using it since before IoT (the Internet of Things) became an important phenomenon. The roots of edge computing can be traced back to content delivery networks (CDNs) at the end of the nineties. Since then, other topics have been added in combination with the computing paradigm that edge computing is.

- What is edge computing?

- Defining edge computing

- The deluge, opportunities, and innovation scenarios of ubiquitous data

- Why edge computing?

- Benefits of edge computing

- Where is the edge?

- The edge, endpoints and the core – cloud

- Edge computing and the data center market

- Edge and data center outlook

- Edge computing in large organizations

- Edge computing spending 2021-2024

- Edge spending – industries and technologies

Today and for several years to come, you’ll still mainly encounter edge computing in combination with IoT and Industrial IoT. Other related areas include edge computing and 5G, edge and Industry 4.0 (industrial edge), edge computing in autonomous vehicles, AR/VR, etc.

This overview explains what edge computing is, what it is not, how it evolves, what the benefits are, and how you will use it, if you don’t already, along with some market data and background.

Edge computing means many things

That’s a challenge for multiple reasons. Edge computing is one of those relatively broad computing terms (just as IoT and cloud computing are) that stands for various technological components/aspects, business use cases and benefits, more general applications, and industry-specific solutions.

Yet, although these all vary and evolve at different speeds, precisely like IoT and cloud computing, they have several things in common. As per usual, it’s all about data and leveraging it in the best possible and most efficient way. With edge computing, this means that computing happens at or close to the user’s location and/or data source.

A second challenge is that for many, it still is hard to understand the differences between edge computing, the Internet of Things, fog computing (a de facto related term), cloud, etc., and how these different technologies relate to each other. This guide to edge computing is gradually updated, so it becomes more evident and tangible, especially on a practical business level.

Data creation at the edge is growing almost as fast as that in the cloud (IDC, March 2021)

What is edge computing?

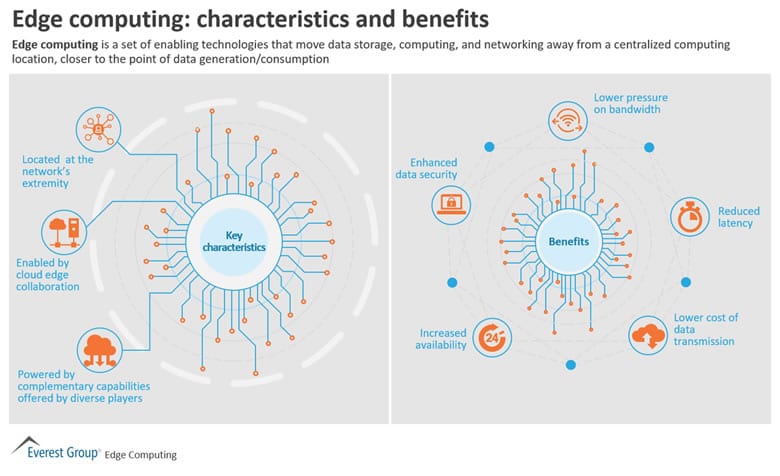

So, what is edge computing? Edge computing is a distributed computing paradigm bringing compute, storage, and applications closer to where users, facilities, and connected things generate, consume, and/or leverage data.

Edge computing is already used in ample applications. In recent years, mainly various types of IoT applications that require low latency, rapid analysis and/or fast action (intelligence shifting to the edge, including real-time decisions) and can’t (wait to) be processed elsewhere (e.g., cloud) have been driving the attention for edge computing.

Edge computing addresses the limitations of centralized computing (such as latency, bandwidth, data privacy, and autonomy) by moving the processing closer to the source of data generation, “things” and users, Gartner says as mentioned in our article on edge and IoT. You immediately see some of the main benefits of edge computing for ample types of IoT applications and use cases.

Edge computing addresses the limitations of centralized computing (such as latency, bandwidth, data privacy, and autonomy) by moving the processing closer to the source of data generation, “things” and users (Gartner)

Edge computing concerns distributed computing deployment in a connected and data-intensive world in general, among others for mission-critical applications and customer-facing situations where speed and uptime are crucial. The edge IT deployment model is complementary to cloud, overcomes some of the challenges encountered with cloud computing and includes data centers, physical infrastructure, and software.

Edge computing is more ‘deployed in particular markets and segments because the use cases to leverage it with a proven ROI, benefit, and/or need already exist. Many of the future use cases that will need edge computing and are most often mentioned, on the other hand, don’t exist at scale or at all. An ideal example: autonomous vehicles.

Edge computing complements cloud computing in a hybrid IT environment. While cloud computing leverages centralized data centers, edge computing leverages distributed micro data centers at the edge of the network where data is used closer to where it is generated. (Schneider Electric)

The usage of edge computing in specific markets and use cases goes hand in hand with vendor strategies whereby edge solutions and services are sold for applications that can directly benefit from it, not a bad strategy in times of short-terminism.

Today, these market segments and use cases are often divided into three categories, depending on the types of locations and applications.

In the context of applications and use cases for the edge, some vendors distinguish between:

- commercial applications (e.g., supermarkets and retail facilities),

- industrial applications (oil & gas, smart manufacturing, also called the industrial edge, in the sphere of Industrial IoT) and

- the telco market, which is perhaps the most promising but also still in full development (whereby 5G is an important factor).

Others distinguish between telco, the industrial/enterprise edge with a focus on IoT, and remote facilities/offices/locations (comparable to commercial).

Defining edge computing

The precise definition of edge computing and where ‘the edge’ actually is (it is a much-debated topic) depends on whom you talk to.

Ample vendors, organized in consortia with leading research institutions and working on standardization and reference architectures, come with different views and definitions.

Edge refers to enterprise-hardened servers and appliances that are not in core data centers. This includes server rooms, servers in the field, cell towers, and smaller data centers located regionally and remotely for faster response times (IDC)

The reason for the current confusion that arises as a result: edge computing is seen as a big business given its many components, and its full potential lies in the future. Vendors are thoroughly preparing to get a major share of the edge computing market as it develops. One could say that the market of solutions for the edge is ahead of the actual state of edge computing in the field. However, things evolve fast.

According to International Data Corporation (IDC), for instance, worldwide spending on edge computing will reach $250 Billion in 2024 (forecast September 2020), a compound annual growth rate (CAGR) of 12.5 percent over the 2019–2024 forecast period.

The three industries where edge computing spending will be highest until then are, respectively:

- discrete manufacturing,

- professional services (fastest grower),

- process manufacturing (that, however, will be surpassed by retail by the end of the forecast period).

There are ample definitions of edge computing, but they’re not always clear. The same goes for the edge, whereby some go as far as to say that edge (computing) is everything that is not in the cloud. In an older article on edge computing and IoT, we mentioned the definition of edge computing according to Gartner: “Edge computing is part of a distributed computing topology where information processing is located close to the edge, where things and people produce or consume that information.”

IDC states that edge products and services are powering the next wave of digital transformation whereby “the concept” of edge computing most often refers to intermediating infrastructure and critical services between core datacenters and intelligent endpoints.

More importantly, per IDC, “however edge is defined, the compute, storage, and networking cornerstones gird data creation, analysis, and management outside of the core.”

Edge and core are two essential elements here, as you’ll see below when we tackle data centers, cloud computing, and edge computing in the scope of the rapidly expanding datasphere with data and the reasons we (want to) use them for being the crux of the matter.

After all, where IDC states that “a future is unfolding where extraordinary value and opportunity for essential products and services from a myriad of technology ecosystem stakeholders is being created” with edge computing, it’s clear this is about our connected big data and analytics world – and the various ways to innovate/optimize across different scenarios using all this and other technology.

In this context, also note that edge computing won’t be the same across the world. As we’ve learned from the pandemic and differing attitudes regarding some applications (e.g., facial recognition), some use cases will be more accepted in some regions.

Most edge computing overviews also point to a 2018 Gartner prediction which we mentioned in the same article that by 2025, 75 percent of enterprise-generated data would be created and processed outside a traditional centralized data center or cloud. And that brings us to data and the mentioned core, cloud, and edge story.

Gartner defines edge computing as part of a distributed computing topology where information processing is located to the edge, with the edge being the physical location where things and people connect with the networked digital world.

The deluge, opportunities, and innovation scenarios of ubiquitous data

In ‘The Digitization of the World – From Edge to Core,’ a white paper (PDF opens) and series of research-based material which IDC presented end of 2018 (with Seagate) under the name ‘Data Age 2025‘, the interplay of edge computing and cloud computing is well explained.

Do note that as we update this edge computing article, early 2021, most workloads and compute aren’t happening at the edge at all. On the contrary, many IoT data are still not processed/stored in the cloud but a company’s data center.

However, things are predicted to change with the cloud becoming the core and the fastest growth for data creation happening at the core and the edge. At the center of it all: in these days of ongoing digitization and digital transformation across industries, we have more sources and volumes of data. More importantly, however, there is an increasing need to leverage (analyze) data faster in ample use cases and scenarios where such makes sense and/or where customers/consumers demand it, as mentioned previously.

And sometimes, this means processing the data closer to its source, especially in distributed types of applications and scenarios. So, it’s also simply a return to a decentralized model (edge), combined with a centralized one (cloud and data centers). The types of shifts we’ve seen many times before in IT: cycles.

Why edge computing?

With the increasing need for speed and low latency, ever more data and new use cases where edge computing makes sense we’re closer to the benefits of edge and examples of how edge computing is used. Let’s look at one.

Edge computing has implications in many traditional and innovative technology domains. The success and proliferation of edge computing use cases are directly linked to how vendors combine their capabilities and technologies to deliver the best solution for each use case (Gabriele Roberti, IDC EMEA)

There are many drivers for edge computing, other than sheer data-related and IoT-related ones. Moreover, most of the so-called next-generation applications that will really need extremely low latency and extremely high availability are not here yet. And it’s not certain if they will be here anytime soon, even if 5G is what many of them are waiting for. There simply isn’t any guarantee that things like autonomous vehicles or virtual and augmented reality at scale will indeed become a reality soon. In fact, even if 5G is really here there’s totally no guarantee that true self-driving cars will ever be a reality except in specific areas; there is far more to it than meets the eye. VR and AR might find their play here and there but in industrial applications slower than many like to believe as becomes clear in the part on edge computing and Industry 4.0.

Vendors of edge computing equipment of course aren’t waiting because of the earlier-mentioned use cases and scenarios in which edge already makes sense and since it’s not certain what use cases we’ll see. In fact, just as there are use cases we probably won’t see happening at all, others will pop up that we don’t think about today. Yet, that doesn’t change the case for edge computing overall. And there’s quite some low-hanging fruit already in customer-facing areas such as retail and commercial applications where edge computing vendors are focusing on.

While 10% of data is processed outside of the datacenter today, 75% of data will be processed outside of a traditional datacenter, or cloud, by 2025 (Michael Dell, 2021)

Let’s explain, including an example in the commercial sphere which was briefly mentioned in an interview on the evolutions in retail facilities: fast-food chains (with in-store retail being a big focus in edge computing now).

With fast-food chains we have one of many examples in retail and customer-facing, distributed, enterprise initiatives. As you know, many companies have started automating and digitalizing processes, including these customer-facing ones, thereby relying more on digital applications that become more mission-critical. However, in decentralized scenarios where the optimization of customer experience and cost savings, for instance, led to innovation, other issues arise, and the limits of cloud became visible. And here edge computing is positioned as the answer.

The example of the fast-food chain. Not that long ago, ordering something in a fast-food restaurant was a matter of standing in a queue until it was your time and checking you effectively received what you ordered. Today, you have kiosks close to everywhere. Less staff needed, an increased chance that you get what you ordered and so forth. For fast-food chains, this, however, means that these kiosks and the systems behind them have become more mission-critical. Vendors are positioning commercial edge computing solutions here, with, among others, so-called micro data centers and a potential centralized, cloud-based management service.

Benefits of edge computing

Let’s summarize some benefits of edge computing and where it can be applied: use cases where speed is essential (low latency), distance to a data center is an issue, there are applications that need to be a bit more secured and need to run constantly in customer-facing situations (regardless of a connection), the list goes on.

Many also tout lower costs and fast deployment time, for instance when deploying small micro data centers in those environments such as retail stores or fast-food restaurants where you also can save space and typically don’t have too many IT people around.

There’s scalability (e.g. across various dispersed locations, of course if you use compatible gear and can deploy and grow fast without compatibility issues), faster response times are especially important for some really critical applications, there’s the need to keep things – critical things – running in difficult and remote environments, typically what you’ll have with the industrial edge. And with customer-facing edge deployments we of course shouldn’t forget the customer experience. Finally, cost savings are also realized on a level of people, like it or not – remember the fast-food chain.

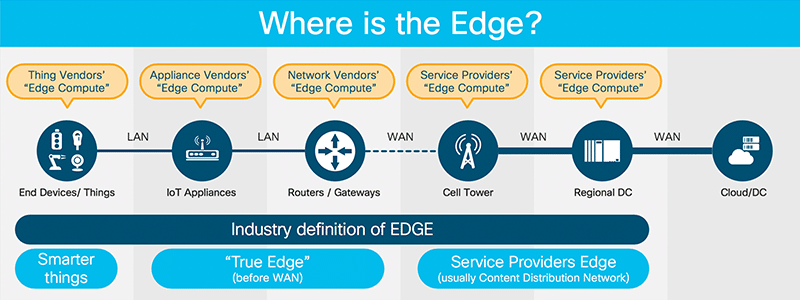

Where is the edge?

Now, where is the edge? Not that easy to tell and many definitions. And, again, it depends on whom you ask but also on the type of application and environment. You can imagine that the edge in the example of the fast-food restaurant that’s part of a chain, looks different than the industrial edge.

With the industrial edge, we’re often in remote areas, which are also further away from (regional) data centers with lots of devices in the field (think oil and gas, for example). Moreover, what do you precisely define as being part of the edge? In the fast-food restaurant, whereby a cloud application is used for remote monitoring of the various IT edge systems in all restaurants, you could say that everything is at the edge – close to the consumer.

An Edge location is a computing enclosure/ space/ facility geographically dispersed to be physically closer to the point of origin of data or a user base. In other words, for an Edge to exist there must be a hub or a core; therefore, dispersion of computing to the periphery would qualify as ‘Edge computing’ and the physical enclosure/ space/ facility can be defined as the ‘Edge facility’ (Smarak Bhuyan)

If you start digging deeper and go more in detail regarding the precise devices and so forth, in, for example, oil & gas, you can get lost in semantic details on what is precisely edge and not though. And the exact same thing goes for telco.

So, it’s time for standards and reference architectures. Here as well, a lot is going on, but again with multiple players and approaches. Did we say that the edge computing market is on the agenda of many vendors?

Sometimes you will also read that edge computing will replace cloud computing. That is simply nonsense since edge computing needs the cloud, among others, to have that visibility you need when things get distributed, for instance. And there simply isn’t a business case to use edge computing everywhere. Moreover, it’s not as if edge computing doesn’t have challenges. Some of the touted benefits, for instance, regarding cybersecurity, at the same time, are also still issues on other levels. And let’s not forget compatibility woes. Lastly, many organizations haven’t even started using cloud yet. So, the edge computing story certainly isn’t finished yet. In fact, it still really has to start.

The edge, endpoints and the core – cloud

A few more words on where the edge is. You could, for instance, follow IDC’s view.

In the before-mentioned paper, IDC distinguishes between:

- core (so, cloud, with colocation, hyperscale data centers, enterprise operational data centers and all forms of cloud computing),

- edge, being the enterprise-hardened servers and appliances that are not in core datacenters and

- endpoints which include the devices on the edge of the network such as sensors and wearables.

The overall trend is that data generation increases on the level of cloud which IDC sees as the core and of course at the edge with edge computing being that decentralized paradigm that drives digital transformation across ample use cases, especially in the coming years. And, as said, cloud, which is complementary, is still doing very fine for a long time to come too. According to IDC, in 2025 nearly 30 percent of data across the globe will need real-time processing with the role of edge continuing to grow.

Summarizing it all a bit, the graphic below from IDC shows the place and interplay of the endpoints, the edge and the core in the view of IDC. Note the presence of branch offices, cell towers and gateways in the edge part which again shows the three categories or clusters of applications we see.

Edge computing and the data center market

Within the edge layer, we find server rooms, servers in the field, cell towers, and smaller data centers located regionally and remotely for faster response times and this is also where you find micro data centers for the edge or edge data centers which are often, well, ‘micro’.

Some vendors distinguish between ‘regional edge’ as the large compute and storage in central or urban areas (closer to the user/consumer than large central data centers but still) and local edge as those smaller micro data centers where data is generated and consumed.

Edge computing obviously has an essential impact on the data center market. And that brings us back to those previously mentioned cycles or paradigm shifts in computing. Think about the shifts in computing paradigms from mainframes to the client-server model and then to the more centralized cloud model again with colocation and – since late 2019 – over 500 hyperscale data centers.

Edge computing is a foundational enabler for several emerging technologies such as 5G mobile communications, which will allow IoT and other edge devices to take advantage of faster connectivity to data and compute resources with single-digit-millisecond network latency (Equinix)

As Jeff Groat, from US-based building system integration company Wadsworth Solutions that is upping its activities in data centers and micro data centers with edge and 5G in mind put it: the pendulum had to swing one way with everyone going in the direction of mega data centers, and now edge or micro data centers becoming vital, certainly with 5G on the horizon, as the pendulum starts to swing in the other direction. One can also say that the pendulum swings in two directions at the same time, especially with hyperscale data centers continuing to increase. Again, it will be a mix: edge and cloud.

Now that we mention 5G again, it’s perhaps a good moment to emphasize that edge computing isn’t just an enabler of 5G, Industry 4.0 and IIoT use cases such as predictive maintenance, but also of IoT in other areas, of artificial intelligence and most certainly of digital twins, to name a few.

From a data storage perspective, the core (cloud) is expected to become the main repository with more than double the data stored in the core than in the endpoint by 2024. Moreover, edge storage is predicted to see significant growth as latency-sensitive services and applications proliferate per IDC.

Among the many edge computing definitions, here is one from Infrastructure Mason’s Smarak Bhuyan, Machine Learning Infrastructure PM at Google, that might appeal to the infrastructure and data center people: “An Edge location is a computing enclosure/ space/ facility geographically dispersed to be physically closer to the point of origin of data or a user base. In other words, for an Edge to exist there must be a hub or a core; therefore, dispersion of computing to the periphery would qualify as ‘Edge computing’ and the physical enclosure/ space/ facility can be defined as the ‘Edge facility’.” More here.

Edge and data center outlook

In its ‘FutureScape: Worldwide Datacenter 2020 Predictions’, IDC said that it expects that by 2023, more than half of new data center infrastructure deployed will be in increasingly critical edge locations rather than corporate data centers, up from less than 10 percent today.

Interconnection and data center company Equinix that cites the prediction for its ‘Top 5 Technology Trends to Impact the Digital Infrastructure Landscape in 2020’, adds that by 2024, the number of apps at the edge will increase 800 percent.

Distributed infrastructure and edge computing will accelerate hybrid multicloud adoption, Equinix says, expecting this to be the case across every business segment in 2020.

Referring back to IDC (you can listen to a replay of all FutureScape 2020 webinars from the research company here), Equinix points out that businesses must modernize IT to become virtualized, containerized and software-defined to support the edge and should consider new data center partners that can bolster edge build-out and prioritize infrastructure optimization and application communication costs.

Two more edge-related data center predictions from the same IDC FutureScape webinar: 1) by 2023, 75 percent of major edge IT sites will leverage ML and AI-enabled controls to transform maintenance and improve the efficient use of energy resources and 2) by 2024, over 75 percent of infrastructure in edge locations will be consumed/operated via an as a service model.

Edge computing in large organizations

Although there is a lot of activity in the edge computing market in the scope of industrial applications and Industry 4.0, also given the link with IIoT, it is likely that edge computing opportunities in the coming years are mainly limited to specific use cases.

IoT sensors will generate a ton of data that will be relevant for machine learning-based automation. Many of these technologies will be delivered and consumed in the cloud even as we see the emergence of edge computing (Ram Jambunathan, SAP)

In commercial applications, the rethinking of the IT architecture in several cases can lead to an immediate return and offer benefits that are related to business concerns that already exist and include challenges that aren’t even strictly related to a real need for the benefits of edge computing (e.g., a smaller footprint of IT infrastructure, the need to monitor and report performance across a broad number of shops in a centralized way, less interventions needed on the spot when these aren’t possible etc.), always an easier sell. The telco sector opportunity that remains to be seen is related to the fact that with 5G, a lot is about to happen in the next years anyway so the momentum might be there.

Industry 4.0 and the industrial edge are another matter. Most certainly, the benefits and opportunities are there as are the initiatives, especially in those types of industries where rapid actions can make important differences, and a lot of connected assets are geographically dispersed. Yet, analysts are divided and surveys show a mixed picture.

Workloads are increasingly moved to – and born in – the cloud. However, with edge computing, workloads, data, and processing capacity are shifted from the cloud to the edge. Cloud computing and edge computing will converge with the increasing need for artificial intelligence, where the right approach depends on the given application.

Edge computing not perceived as a top impactful technology yet

When we look at the technology priorities of large organizations in the scope of the so-called fourth industrial revolution, the big classic four still rank high on the list for 2020 and beyond: the Internet of Things, artificial intelligence, cloud infrastructure, and big data/analytics.

Moreover, the impact CXOs expect each of these ‘big four’ – related – technologies on their organization, all in all, is still limited. When asked about which technologies they expect to have the most impact on their organization, only 6 percent of over 2,000 CXOs of large organizations who were surveyed for the edition 2020 of Deloitte’s ‘The Fourth Industrial Revolution’ (PDF downloads) expected edge computing to have a significant impact on their organization.

By way of comparison: this is less than quantum computing (7% of respondents), augmented reality (9%), 3D printing (10%), and blockchain (17%). On the other side of the spectrum, 71 percent expect IoT to have a significant impact, followed by AI (68%), cloud infrastructure (64%) and big data/analytics (54%).

One can argue that the ‘big four’ technologies have been around for quite some time (how long are we talking about the cloud, how many IoT devices were once predicted to be connected right now?) but all in all it’s safe to say that edge computing indeed is still in its very early days as most vendors do realize and that a lot of education and cases will be needed.

An additional concern might be that, as confirmed by Deloitte’s survey again, strategic short-termism still is the norm. Short-term thinking and a lack of a coherent strategy is the organizational disease of our times as we also see in the marketing strategies of ample organizations. They are primary reasons why holistic visions such as Industry 4.0 and digital transformation often fail and remain stuck in ad hoc tactics and siloed projects, a business challenge that always existed but gets worse in these days of ‘fast anything.’

Moreover, strategy often lacks to begin with and strategic approaches with regards to Industry 4.0 aren’t exactly in the majority either. For edge computing vendors it will be key to make solutions as business-friendly as possible through an ecosystem approach and with a clear focus on benefits, also in the short term. That’s what some try to do. As per usual, the best approach is to steer away from the buzzword and technologies and focus on the business.

A quote by SAP.iO managing director Ram Jambunathan from the report is clear on his expectation with regards to edge computing in Industry 4.0 and Industrial IoT: “IoT sensors will generate a ton of data that will be relevant for machine learning-based automation. Many of these technologies will be delivered and consumed in the cloud even as we see the emergence of edge computing”.

Do note that many organizations, certainly in industrial markets, are still moving slowly to the cloud in ample areas and that Jambunathan speaks about a – for now unclear – future when talking about IoT sensors generating a ton of data that could be leveraged for ML-based automation. We’re certainly not there yet.

Obviously, this is just one survey and methodology matters. Other surveys seem far more positive on the development of edge computing in Industry 4.0, as do analysts. The survey respondents for Deloitte’s report, of course, weren’t from smaller organizations. They also came from all major industry sectors, and that also might have an impact. Only 30 percent of the 2,029 respondents came from the Americas and 29 percent from the Asia Pacific region. The large majority (41 percent) were from Europe / South Africa.

The link between IoT and edge computing is clear: large amounts of data must be collected, processed, analyzed, and actuated, increasingly in real time (Gabriele Roberti, IDC)

Edge computing moving in and beyond manufacturing and retail

When looking at analyst reports, we see a somewhat different picture. According to IDC, for instance, 60 percent of European companies are already leveraging edge computing solutions to an extent and the manufacturing sector isn’t just working with edge computing in Europe but also ready to move fast.

As IDC Research Manager Gabriele Roberti puts it in a blog, ‘From a vertical perspective, the manufacturing industry in Europe is in prime position to move forward with edge technologies, given the effort already put into Industry 4.0’. On the list of European industries that are most amenable to edge computing we notice manufacturing, retail, oil and gas, and the public sector.

And it’s not just IDC or Europe. ‘The empowered edge’ is one of Gartner’s Top 10 Strategic Technology Trends for 2020, with manufacturing still being the essence of Industry 4.0, along with retail, already most active.

Gartner research vice president Brian Burke: “Much of the current focus on edge computing comes from the need for IoT systems to deliver disconnected or distributed capabilities into the embedded IoT world for specific industries such as manufacturing or retail. However, edge computing will become a dominant factor across virtually all industries and use cases as the edge is empowered with increasingly more sophisticated and specialized compute resources and more data storage”.

Complex edge devices, including robots, drones, autonomous vehicles and operational systems will accelerate this shift, Burke adds. In the overview of the top 10 strategic technology trends, Gartner also has a somewhat longer description of edge computing:

“Edge computing is a computing topology in which information processing and content collection and delivery are placed closer to the sources, repositories and consumers of this information. It tries to keep the traffic and processing local to reduce latency, exploit the capabilities of the edge and enable greater autonomy at the edge.”

Edge computing spending 2021-2024

As we enter the so-called era of distributed intelligence, worldwide spending on edge computing is expected to reach a total of $250 Billion in 2024.

According to a Spending Guide by IDC (International Data Corporation), throughout the next few years, edge computing spending will be led by a future of ‘extraordinary value and opportunity.’ Spending will mainly be concentrated in the US and Western Europe with the Americas, the EMEA region, and Asia/Pacific today already accounting for around 99 percent of the total.

With a compound annual growth rate of 12.5 percent during the forecast period and a predicted worldwide edge spend of $250 Billion in 2024, edge computing is rising fast while cloud becomes the new core, as IDC predicted previously in its ‘Data Age’ report.

These shifts are in line with what has been happening in the market for several years and the evolution of the (impact of the ) global – continuously growing – datasphere whereby more use cases demand real-time processing for an increasing percentage of data.

They go hand in hand with the shift of intelligence to the edge in IoT, data center shifts, and newer technologies, including mobile networks (5G), and future applications, i.a. in automotive. Industry 4.0 is a crucial driver of edge spending, with manufacturing ranking high in the list of industries spending most on edge computing.

For Dave McCarthy, research director, Edge Strategies at IDC, edge products and services are powering the next wave of digital transformation. McCarthy: “With the ability to place infrastructure and applications close to where data is generated and consumed, organizations of all types are looking to edge technology as a method of improving business agility and creating new customer experiences.”

This shift to a more distributed environment with the endpoints playing a more important role isn’t new and goes hand in hand with endpoints (mobile devices, connected assets, vehicles, etc.) being the main locations for data creation.

Edge spending – industries and technologies

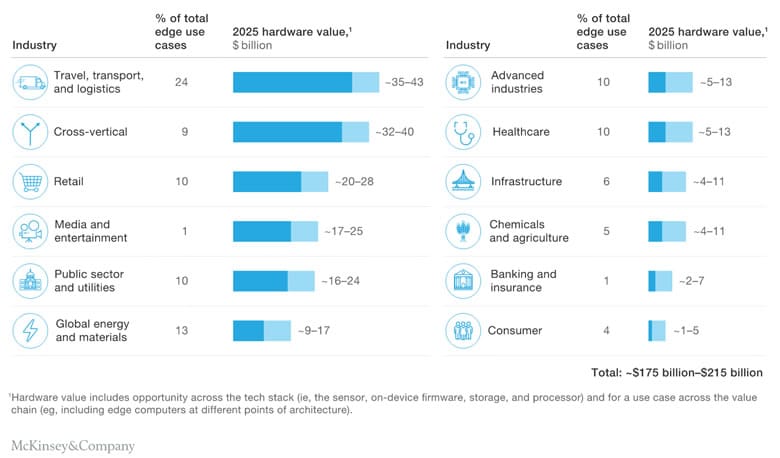

In its edge spending update, IDC also looks at the main growth areas for edge computing. From an industry perspective, manufacturing leads: the top three industries for edge spending throughout the forecast period are 1) discrete manufacturing, 2) professional services, and 3) process manufacturing.

“Edge products and services are powering the next wave of digital transformation. With the ability to place infrastructure and applications close to where data is generated and consumed, organizations of all types are looking to edge technology as a method of improving business agility and creating new customer experiences.” (Dave McCarthy, research director, Edge Strategies at IDC)

Retail is another vital industry. In fact, according to IDC, retail is expected to overtake process manufacturing and rank third from a spending perspective by the end of the forecast period (2024). However, the fastest growth over the forecast period is for professional services (edge spending increase with a five-year CAGR of 15.4 percent).

Looking at edge spending from the technology perspective, IDC expects that services (including professional and provisioned services) will account for almost half (46.2 percent) of all edge spending in 2024. Hardware ranks second with a 32.2 percent edge spending share, and software third with 21.6 percent poised to go to edge-related software.”