An overview of LPWA (low-power, wide-area) network solutions and evolutions: the various LPWAN approaches, the main players and standards (cellular and non-cellular), facts, resources and considerations for your IoT deployments.

There are ample IoT use cases, also in an Industrial IoT (IIoT) context, where applications/deployments and the used, often battery-powered ‘things’ they leverage, need cheap, mobile, low-power and long-range connectivity, whereby low bandwidth (low bit rate) is more than enough.

That’s essentially what LPWA and LPWA networks (LPWAN) are about. LPWAN stands for low-power-wide-area networks and LPWA communication standards are designed for IoT use cases in the mentioned scope of wireless IoT connectivity with limited needs.

Although LPWA technologies and LPWAN exist since ages (measured in ‘technological evolution time’ that is), it is estimated that for now only roundabout a fifth of the globe has LPWAN coverage but things change fast as we’ll cover. This LPWAN ‘reach’ includes both non-cellular proprietary LPWAN and the – more recent – cellular LPWA technologies.

It will still take a few years before the landscape is less confusing with its many players, approaches, operator and ecosystem strategies, standards (a term we strictly can only use for cellular LPWA) and noise and before reach has expanded. Moreover, IoT is, we like to repeat it, an umbrella term and covers many use cases, industries and goals in many countries where many businesses operate in many different situations, so one needs to take all that into account.

LPWA: between the present and future

Won’t there be 5G by the time LPWA technologies have broader coverage? Not for IoT. Moreover, 5G is not a replacement of LPWAN.

Another popular question concerning the future of LPWA: who will win? No idea, it depends upon whom you ask and in the end, it doesn’t matter for your business as we’ll see. Moreover, it’s even not the question to ask as all mobile operators have their strategies and roadmaps which can include any combination of cellular and non-cellular LPWA technologies whatsoever. Crystal ball? Forgotten at home as per usual.

Do note though that LPWA is already used for many IoT projects, albeit mainly in the scope of what Ericsson likes to call massive IoT (although that’s only cellular; it’s the areas of applications we mean: from smart offices, smart metering and smart cities to smart agriculture, smart manufacturing and smart ‘x’, with ‘x’ being ‘where low cost devices, long range and low power have their place’, a bit opposed to large critical applications).

De facto most IoT solutions and deployments really need lower-power wide-area networks. In mature and large IoT projects this is often in combination with several other network technologies such as other mobile technologies and fixed lines (all depending on the context and IoT use cases). In other words: a mix (often also in the usage of various wireless and even LPWA technologies).

In typical Industrial Internet of Things and Industry 4.0 IoT deployments the majority of connections is fixed line (DSL, modem, Ethernet, PTSN), some industrial IoT cases need satellite connectivity but until 2021 the fastest growing category in industrial IoT manufacturing deployments is LPWA.

As said there are several offerings to choose from (and even to come) in the highly competitive and for many very confusing LPWA landscape. Below are some aspects to take into account for your projects and some players, ecosystems, considerations, evolutions and more.

Making choices in the confusing LPWA landscape

When looking for the best LPWA approach for your projects start from your needs, the context of the project (not just in the scope of the type of needed mobile ability but in the broad ecosystem perspective, including the various players and providers of IoT hardware, software, solutions and services, and the local situation within which your project is realized) and your future roadmap.

Look at the pros and cons of the offerings/approaches and certainly at the solutions in the overall IoT stack, which you plan to deploy. For example: if you plan to use an IoT platform to develop your applications, make sure it supports the LPWA network technologies you want. Other areas where the support of your LPWA choices matter, on top of IoT and Industrial IoT platforms, include IoT devices and modules, IoT gateways, network servers and, in this all, increasingly edge servers and infrastructure in several circumstances where edge computing is leveraged.

Often telecommunication operators support various LPWA approaches (both evolving cellular standards and existing unlicensed band – more about these terms below – offerings, since the leaders in the latter space strike partnerships with operators to build out their networks and expand global coverage). So, you might want to know about the future plans of your operators(s) and/or the unlicensed band actors in the country or countries where you are active as well.

Let’s take a closer look at LPWA standards, approaches and players in a nutshell before covering the main LPWAN players and providing more resources and links that might help you in seeing clearer and/or making choices.

There are LPWA standards outside of the licensed spectrum (non-cellular, unlicensed band, essentially meaning not running on the networks of mobile network operators; yet as said offered by several mobile carriers on top of cellular options) of which Sigfox and LoRa(WAN) are the best known and in a race to deploy their networks as fast as possible (more below).

Next, there are cellular LPWAN solutions and standards. Cellular LPWA networks are inside the licensed spectrum and are offered by mobile network operators. They were developed with the 3rd Generation Partnership Project (3GPP) and GSMA (the GSM Association, launched in 1982 as the Groupe Speciale Mobile and also known as the organizers of the annual Mobile World Congress).

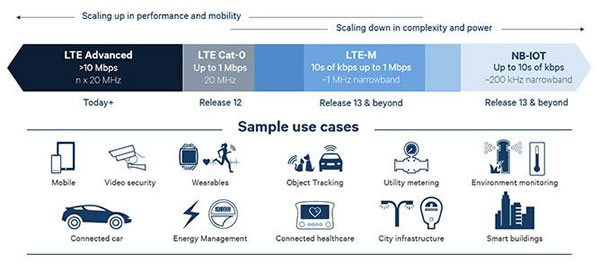

In other words: cellular telecommunications network technologies and mobile operators in the licensed band. The most often mentioned cellular LPWA technologies and leaders of the pack are LTE-M and NB-IoT.

LPWAN outside of the licensed spectrum

As cellular technologies (not cellular LPWAN, which didn’t exist in the early days) were too expensive for IoT applications, which typically need LPWA functionality (and there are really a lot of those), various providers started developing their own networks in the unlicensed mobile spectrum.

In other words: these companies moved first and the various cellular technologies have moved into the LPWA space of IoT connectivity later with the mentioned technologies and others which we cover further below in this LPWA overview.

Let’s tak a look at the main pioneers who have and still are working in the unlicensed, non-cellular LPWAN market that has increasingly gained adoption for many IoT use cases, among many players in the IoT ecosystem and in ample IoT deployments.

They all have their own ecosystem of partners and supporters, including major telecommunication firms, and industrial giants. While, again, their approaches are very different, we mention four players below.

LoRA and LoRaWAN

The LoRa Alliance was founded by Semtech, a company which patented a CSS modulation technology that gave birth to LoRa wide area networks (LoRAWAN).

LoRaWAN is available in many countries across the globe, sometimes even nationwide. With the LoRa Alliance; Semtech and its partners went for a more open approach and the possibility for public and private LPWA networks.

Sigfox

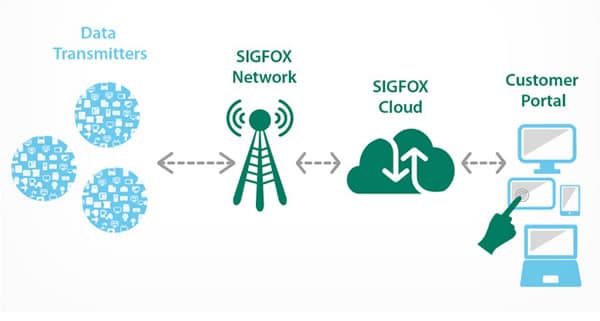

Sigfox has a completely different model. It doesn’t just use another technology (ultra-narrowband) for its Sigfox networks (Sigfox is both the name of the company and the solution) but also has an entirely different business model.

Sigfox in principle works with one partner, a so-called Sigfox network operator, per country, and has a focus on deploying as much Sigfox LPWAN coverage as possible across the globe.

To achieve this, it works with (and is also funded by) several companies who dispose of towers and other high places where they can put there antennas. Sigfox has a big ecosystem but a different and more closed approach.

Weightless (SIG)

Another player in the non-cellular LPWAN market is Weightless. Weightless is the name of a group of companies, the Weightless Special Interest Group or SIG and the name of the technology which it developed for LPWAN IoT.

Weightless SIG, again, has another approach. It is a non-profit organization whose aim is to find ‘the best’ IoT connectivity technology.

In fact, Weightless SIG already developed a set of standards: Weightless-N (uni-directional, lowest cost), Weightless-P (communication in two directions for a somewhat shorter range and low cost) and Weightless-W (also bi-directional, for ranges over 5 kilometers and a bit more expensive but still cheaper than cellular). Weightless-P also supports licensed spectrum.

Ingenu

A last (but not least) player we’ll mention (there are more) and who typically belongs to those who are active in the unlicensed spectrum, is Ingenu (formerly known as On-Ramp Wireless).

Just like Sigfox, Ingenu has a proprietary model. Ingenu designed the so-called RPMA technology. RPMA, short for Random Phase Multiple Access, is an LPWA channel access method for M2M communication. Machine-to-machine is the DNA of Ingenu, which was initially mainly active in oil and gas but is now building one of biggest LPWA networks in the US (‘the Machine Network’) and is also deploying across the globe (as all the others do of course).

Which LPWAN approach? Use case and context first

Sigfox, LoRaWAN and Ingenu are the main players of the four, again, all with their specific focus and different technologies and partnership ecosystems (proprietary doesn’t mean there are no partners of course and it doesn’t mean the same thing for Sigfox and Ingenu either).

As said, for companies who want to launch Internet of Things applications it can all be a bit confusing, especially as some of the mentioned players of course are in a race to become the norm and defend their solutions.

What the best connectivity solution is for your projects depends on numerous factors:

- What is the scope of the project, what’s the use case for IoT?

- How much data is being sent, at which range and at which speed and intervals?

- What is the local context? Is there coverage for any of the mentioned players? Is there other coverage that suits your needs better? Do you build something from scratch as your application will need to work in remote areas?

- Do you need a hybrid approach with several connectivity solutions, including cellular, WiFi and more (vendors such as Cisco have hybrid offerings)?

- What about costs? Data range? Outdoor? Indoor? Both?

- Is there a partnership ecosystem in your area upon which you can rely?

- How important is the autonomy (and battery life) of your devices?

- Etc…

In the end it’s the application and its desired outcome within a broader context which matters more.

In some regions you will also have the luxury of several LPWAN technologies, in others there will be none as the providers race to build out their networks.

Cellular LPWAN: NB-IoT, LTE-M and EC-GSM-IoT

There are essentially three cellular LPWA technologies of which LTE-M and NB-IoT are the most often mentioned and tackled in this overview. Yet, the third one, in our view at least, might just get its place if operators want: EC-GSM-IoT. We tackle it first as it needs attention.

EC-GSM-IoT: extended GSM for the Internet of Things

EC-GSM-IoT (previously known as EC-EGPRS) is short for Extended Coverage GSM IoT which already indicates what it is and why it has been ‘developed’.

EC-GSM-IoT is based upon EGPRS (a.k.a. EDGE, Enhanced GPRS, eGPRS or Enhanced Data rates for GSM Evolution), which was developed in the still very early days of mobile Internet before Facebook and YouTube existed. EGPRS (hence the original name of EC-GSM-IoT, EC-EGPRS) was an extension of GSM with backward-compatibility. And EC-GSM-IoT is an enhancement of GSM for IoT based upon EGPRS.

Just as EGPRS enabled GSM operators to easily upgrade their networks before 3G existed (although it was part of the definition of 3G of the ITU), EC-GSM-IoT requires a software upgrade to the networks of GSM operators. There are a lot of GSM networks, older versions of GSM do still exist and EC-GSM-IoT can make sense in many regions and probably specific contexts.

Extended Coverage GSM IoT isn’t just designed for 2G (eGPRS is tied to 2.5G). It also works with 3G and 4G and is supported by several hardware vendors. 2G of course won’t be around forever and in the meantime, we have UMTS (Universal Mobile Telecommunications System) and LTE (Long-Term Evolution), although EC-GSM-IoT also can play a role in LTE-M evolutions.

EC-GSM-IoT is standard-based (3GPP), designed for low power and wide area (or it wouldn’t be LPWA) and positioned as high capacity and low complexity and fit for several use cases, also in Industrial IoT, and in environments where LTE deployments are not common.

As an LPWA technology, EC-GSM-IoT offers the same battery life for devices as NB-IoT and LTE-M: 10 years. “Extended Coverage – GSM – Internet of Things” is not an ‘old technology’, well on the contrary. However, for now it’s highly unclear what will happen with it as real commercial trials, let alone roll-outs aren’t a fact yet.

Cellular LPWA: NB-IoT and LTE-M

And now the two better known ones: LTE-M and NB-IoT.

Some operators argue that cellular offerings, such as NB-IoT (NarrowBand IoT, also known as CAT-NB1) are about to destroy the earlier mentioned non-cellular providers. However, we feel that is as exaggerated as saying that cellular LPWA technologies (see 3GPP) such as NB-IoT or LTE-M (CAT-M1), which has a higher bandwidth than NB-IoT, are worse than non-cellular LPWA networks.

It all depends and there are differences but in the end, even if there might be a change in the landscape with maybe someone dropping out, the various LPWAN approaches will still live along each other for quite some time.

The debates are for the various stakeholders in each category but the reality is that the use case and application makes all the difference.

LPWAN for buyers

In a 2016 article that covered LPWAN IoT forecasts for 2017 we mentioned August 2016 data from Machina Research saying that by 2025 about 11 percent of IoT connections would use LPWA type connections such as Sigfox, LoRA, LTE-NB1 (LTE Cat NB1, more broadly known as NB-IoT) and LTE Cat M1 (LTE-M).

In that same article we also mentioned how IDC didn’t see a lot of potential in unlicensed spectrum LPWAN approaches such as LoRa and Sigfox, among others citing the unlicensed spectrum and lack of QoS as a reason for organizations to only focus on it in non-critical applications.

IDC back then (November 2016) only expected 3 percent of organizations to deploy unlicensed spectrum LPWAN (Sigfox, LoRa,…) by 2018 so that’s outdated. For cellular LPWA the predictions were much better as you can read in that LPWAN 2017 forecast article, pointing out that predictions in this space are very hard, pointing out some clear signs that made us think otherwise than many analysts on the potential and emphasizing that, among others, regional differences needed to be taken into account (there are also links to research from Forrester, IHS, MarketsandMarkets and more in the article).

It needs to be said that the 3GPP standards weren’t finalized yet at that time (some still aren’t). So, time for an update, even if end 2016 isn’t really THAT long ago but when looking at all that happened since it clearly shows how fast things can change.

There is still a lot of hype: smart vendors, partners and customers see through it

A prediction we forgot to make/emphasize about LPWAN, LTE-M, NB-IoT, Sigfox, LoRa and so forth end 2016 is that the the number of announcements, reports, partnerships etc. have dramatically increased which really does say a lot as the volume was already staggering.

That of course doesn’t help you much, on the contrary: it’s a hectic space with many different views and forecasts, depending on the source.

What is clear, however, is that:

- Analysts have become far more careful and look much more at the regional context (with IDC, for instance, focusing on countries such as New Zealand where there are…seven LPWAN networks with nationwide coverage and, as said, local context is key);

- There is much more attention for the IoT use cases and verticals where LPWAN makes a good fit in any particular context or form (finally; once again reminding the words of Professor Maarten Weyn from the LPWAN World Forum 2016: “Multimodality is key if LPWAN wants to be a success, there is not one technology which is able to cover all use cases”)

- Related with the first two: the ‘wars’ are anything but over; however, it’s become far less a story of this or that with even companies such as Vodafone that are strong proponents of NB-IoT and 5G recognizing the role of non-cellular LPWAN players as mentioned in our overview of the Vodafone IoT Barometer report 2017/2018.

- Smart vendors, and not the smallest ones, keep all options open and focus on interoperability and support of multiple approaches as 1) they know customers want choice, 2) they realize no business and use case is the same, 3) they understand regional differences, 4) they see the hype coming from all sides, 5) they put outcomes, ecosystems, developers, partners and end clients/projects first, 6) they see IoT for what it is, an umbrella term that loses all meaning when you get real and work with organizations to achieve something and/or 7) they know very well what works best in specific applications and, these do include critical ones as well.

- Analyst still close to all agree that in the end the LPWA market will be mainly for the cellular options. We’ll see. Chance is of course high but still we do see regional differences and interesting evolutions in some verticals in some of those regions for what it’s worth.

A quick reminder of the mentioned Vodafone IoT Barometer and a few words on it from the LPWAN perspective (again, keep in mind it’s a Vodafone report which means that some things are less emphasized than others in messaging to put it mildly but in the report there really is certainly mention of non-cellular technologies and it is a great piece of work) as it does show a few things.

While 40 percent of respondents is said to investigate 5G in IoT (even in cases where this really isn’t needed as LPWAN covers the needs of ample use cases), the report also stressed LPWAN isn’t just recognized as leading to IoT adoption growth but is also looked at by 28 percent of those considering IoT adoption. And although Vodafone won’t emphasize it in public communications too much it isn’t just about NB-IoT and so on. If you download the report, you’ll see how LoRa and Sigfox are pretty close to LTE/Cat-1/Cat-M1 in terms of consideration and not that far behind NB-IoT/Cat-M2.

Yet, even this is quite meaningless as such for your projects and business. The argument that 5G will conquer all as GSM technology is well-known and in the end will be used more is one. Yet, 5G is not here yet and it rarely is looked at from an IoT scope (own data clearly tell us).

Predictions about the adoption of NB-IoT, LTE-M, Sigfox, LoRa and the likes are pretty meaningless if not tied to the most granular level, taking into account region, use case, coverage and so forth. Moreover, it isn’t exactly as if Sigfox, to name one, despite lots of stories, has become less agressive in pursuing its goal and dream of one global IoT network. And the LoRa Alliance, although having a different approach, isn’t exactly sitting still either. In fact, reports put both Sigfox and LoRa at more or less the same level regarding consideration.

Amid these wars it’s important to see 5G as most probably part of a FUTURE heterogenous environment with LPWA technologies as the GSMA put it and as mentioned in our article on 5G and IoT. Obviously, for the GSM Association, LPWA in this case means the cellular standards.

Yet, what the practice will hold is another thing. Analysts such as IDC in the longer run and, with the mentioned specific situations in countries with high LPWA competition and nationwide coverage of non-cellular LPWAN deployment such as New Zealand, also still bet on cellular in wireless and in LPWA in general.

Look at vendors that clearly understand you and the developer community: LPWAN in motion

If you’re planning an IoT project you’ll keep being confronted with a very fragmented market for now but in the end this doesn’t even matter as much either. Just make sure that the IoT platforms, software, hardware and whatnot support all the standards and solutions, beginning with the existing ones and looking at how future-proof critical ones are when being in a more mature context.

Also keep thinking location. We mentioned New Zealand but non-cellular players are also strong in Australia, Europe, several parts of Asia, several parts of South America and increasingly in the US. You’ll notice that some of the best IoT business platforms in areas such as smart buildings or smart industry applications (e.g. manufacturing platforms) work very intensively with the likes of Sigfox as do many Europe-based leaders in other areas. Yet, just as much as IoT should be all about the IoT of integration, value and action, in other words business, use cases, integrated technologies, platforms and solutions etc. before the term IoT even dissapears, so are LPWAN, its various flavors and all other existing connectivity solutions pieces your solution providers, developers, system integrators or other partners have to deal with so you can focus on successful IoT projects.

The market clearly wants to offer solutions that work for the use cases organizations have on their roadmap by supporting and sometimes even de facto pushing some LPWAN technologies.

There is a reason why major Europe-based but internationally active IoT products and solutions vendor Libelium, with a community of over 10,000 developers in 120 countries, supports 3G, 4G, LoRa and Sigfox with its sensor nodes, gateways, platforms and so forth which account for lots of projects in areas such as agriculture, environmental monitoring, smart cities, disaster prevention and so on.

Yet, there is also a reason why in April 2018 the company announced that after having supported Sigfox and LoRaWAN since 2015 in the European version of its Libelium IoT sensor platform and having added support for both in the American version for its environment, pollution, water quality and smart parking projects, due to, quote, “strong demand for low-energy, long-range and cost efficient IoT connectivity” it now also added support for Australia, APAC and LATAM with countries having nationwide deployments (Libelium offers a dual radio LoRaWAN/Sigfox solution of several of its Waspmote Plug & Sense! sensor devices).

Sure, these use cases don’t cover all, they are part of that ‘massive IoT’ Ericsson speaks about.

But there is more. Look at the industrial software powerhouse that has emerged with the combination of the industrial software business of Schneider Electric with AVEVA. It isn’t a coiincidence that Libelium on April 25 2018 announced interoperability with AVEVA’s Insight, powered by the Wonderware Online cloud platform (which comes from the Schneider Electric side of the merger so to speak), in its Meshlium IoT gateway.

And these are just some examples of one company, working with major others, in supporting the choices of customers across quite some use cases if you start adding up. Look at all the other vendors, regardless of what they do.

There is a reason why in the Summer of 2017 Cisco invested in French LoRaWAN player Actility, why its Jasper platform supports all LPWA technologies, why many of the best IoT platforms (aim to) do the same, why STMicroelectronics includes Sigfox networking in its embedded software suite and why ample IoT companies either support more specific LPWA network technologies for particular use cases, either broaden support of LPWA network technologies overall. The list is really endless and gets updated by the day.

What all these companies have in common is that they want to leave things open, be ready and in the know, build solutions where they see it makes sense to leverage technology x, y and z, and offer customers want they want: choices to get value from their IoT projects, regardless of what the 3GPPP, Sigfox, the LoRa Alliance and so forth want. All the rest in the end is noise and companies fighting to be leaders with really many opinions, debates and all too often public fights. Not exactly the most customer-centric approach but inevitable so it seems.

The names of those who could tune it down a bit now and then and those being not really that factual are well-known in the industry but that doesn’t help you either and it doesn’t help us too.