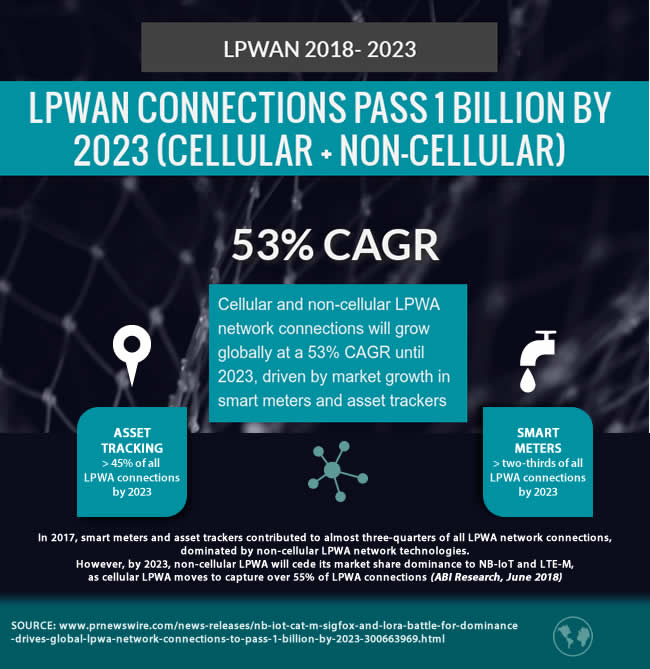

The number of LPWAN connections is expected to grow at a 53% CAGR (Compound Annual Growth Rate) globally, resulting in over 1 Billion LPWAN connections by 2023.

Smart meters and asset trackers are the two main Internet of Things applications driving this growth of LPWAN connections according to a June 2018 report from ABI Research. A deep dive into the market, the evolutions and the caveats with findings and analyst quotes from ABI Research.

LPWANs (LPWA networks or lower power wide area networks) are networks enabled by a range of various protocols by different players in the wireless IoT wide area network range for applications with devices needing little power and connectivity over a longer range with limited data transmission and bandwidth needs. Asset trackers and asset tracking applications already are main drivers of LPWAN connections and will have the largest share of LPWAN connections in 2023 (over 45 percent worldwide).

The LPWAN market consists of non-cellular LPWA (network) protocols, players and ecosystems with LoRa and Sigfox being the main ones and of, more recently standardized 3GPP licensed spectrum or cellular solutions with CAT-M or LTE-M (both refer to the same: LTE Cat-M1 whereby LTE stands for Long Term Evolution) and NB-IoT being the main ones of the three 3GPP LPWAN standards.

Update: in June 2019, ABI Research released an update of the report, looking at LPWAN trends and finding a delayed deployment of NB-IoT and LTE-M.

While LoRa (and LoRaWAN, with WAN meaning Wide Area Network and LoRa and LoRaWAN simply sitting on different levels of the OSI model) and Sigfox have been around for many years, LTE-M or CAT-M is deployed and getting deployed right now with ever more operators offering it.

In many cases both LTE-M and LoRa are offered at the same time by operators while others chose a pure cellular LPWAN connections technology approach with LTE-M and NB-IoT although the latter is less available for now (depending on country and so forth). However, this as well is about to change according to ABI Research. An overview and comments.

Asset tracking applications and LPWAN connections

From an asset tracking (and asset management and monitoring) application perspective one of the main reasons why asset tracking is poised to keep having a major share of LPWAN connections relates to exactly the mentioned availability and roll-out of more LPWA network options and technologies for several types of applications.

Even within an application area such as asset tracking the precise LPWA network technology that makes most sense depends on various factors as also asset tracking really encompasses many possible IoT use cases, since not all assets are the same and the assets to track of course ‘travel’ differently.

By way of an example: assets such as mine vehicles operating in open pit mines can’t exactly be compared with containers being transported across the globe which in turn can’t be compared to any asset a consumer wants to track, whether it’s a pet or a skateboard. Moreover, LPWA networks aren’t fit for fast moving assets for all the obvious reasons.

So, this is really a very broad category that is hard to see on its own (except perhaps in some consumer IoT applications) and is related with applications in areas such as fleet management, asset monitoring, pro-active maintenance and so forth. It also touches different markets and activities, ranging from smart homes to IoT in healthcare (and certainly healthcare facilities where asset tracking and real-time location systems are anything but new) to smart manufacturing, retail and more.

Do note that according to IDC’s 2018 IoT spending forecasts cross-industry IoT use cases, what asset tracking definitely is, are among the top growers and already high in fact.

Still, asset tracking applications are the big LPWAN connections use case overall. Adarsh Krishnan, Principal Analyst at ABI Research explains: asset tracking applications traditionally relied on complex, expensive solutions to track high-value assets. LPWA network technologies are making it feasible to build simple, small, and low-cost footprint devices that can track and monitor everything from sea-freight containers to bicycles, patients to pets, supermarket trolleys to pallets, paving the way for new innovative solutions and business opportunities.

According to ABI Research asset tracking, which includes tracking stationary or slow-moving assets, as said will have the largest share of LPWAN connections in 2023, accounting for over 45% worldwide.

Smart meters and smart meter applications in the LPWAN connections context

No slow movements or movements at all in the second main driver of the global LPWAN connections market: smart meters and smart meter applications.

By now smart meters are well-known by most people. They are used in smart buildings, building management applications, building energy management systems, connected power solutions enabled by electrical contractors for smaller buildings, critical power facilities, home automation and of course in the scope of the digital transformation of the utilities industry where electricity, gas and water utilities deploy them.

While in the overall facility optimization sense of buildings and so forth smart meters are deployed in broader projects, in the utilities industry they typically are purely energy-related with electricity meters or devices measuring natural gas or water consumption and leveraged for monitoring, billing and commercial purposes of utilities (e.g. new pricing models, gaining insights for other reasons as essentially smart meters enable two-way communications, etc). In some regions and areas, they become mandatory for regulatory reasons (e.g. in large buildings, Industry 4.0 or in utilities overall, mainly in the scope of environmental regulations).

According to ABI Research those smart meters as they are deployed by energy and water utilities will be the second largest vertical IoT application in 2023 for LPWAN connections, accounting for more than a third of all LPWA device connections. Most IoT device management platforms and overall IoT platforms support them, just make sure (and in case of working with an operator look at operator IoT platform ecosystems).

Given the very nature of smart meters (in buildings, really little data in a utilities scope, no movement at all, etc.) smart meters are often candidates for non-cellular forms of LPWA connectivity. Yet, also the market plays a role in this. ABI Research: “Early adoption from meter vendors such as Sensus, Itron, Kamstrup, Arad, and Holley metering means that non-cellular LPWA technologies are well positioned to capture two-thirds of the LPWA connections in smart meters by 2023”.

With the smart home being the main driver that makes consumer IoT rank on the fourth place regarding IoT spending in 2018 and utilities being the second largest IoT market after good old manufacturing, it’s easy to see why smart meters are key drivers of LPWAN connections growth, certainly if you add some of those other key cross-industry IoT use cases such as anything in the scope of intelligent buildings.

The LPWAN connections landscape in flux

And that brings us to all those different players, ecosystems and protocols in the LPWAN space where a lot is going on at the same time, new partnerships are formed, technological capabilities evolve, roaming tests have been conducted (or roaming is in place) on several levels and both operators and cable companies are preparing their often very different IoT connectivity roadmaps with LPWAN connections playing an increasing role in it.

According to the June 2018 announcement of ABI Research’s Low-Power Wide Area Network Market Data report, in 2017 non-cellular LPWAN technologies (which on top of LoRa and Sigfox also include others such as Ingenu and Weightless) dominated in the number of LPWAN connections and smart meters and asset trackers contributed to nearly three-quarters of all LPWAN connections.

Yet, by 2023, ABI Research says, non-cellular LPWAN connections will have to cede their market share to LPWAN connections of the cellular type, namely NB-IoT and LTE-M which by then would have over 55 percent of LPWAN connections.

In other words: it remains a mixed picture and will continue to be for at least another 5 years. As we wrote many times previously non-cellular and cellular options will continue to exist for quite some time as, in fact, they are complementary and all depends on region, context and most of all the goals and use cases of not just the IoT project but also of the IoT project within the broader business goal and context where de facto often ample connectivity solutions need to be combined. Moreover, don’t tell anyone, but for most organizations it’s really still early days for IoT.

As organizations start leveraging IoT more and more and as on top of smart meters and asset trackers there are ample other use cases needing LPWAN connections (e.g. specific applications in a smart cities context, smart agriculture, smart environmental applications, the list is long) and as in the end the customer decides which LPWAN connectivity he chooses there is nothing more uncertain than forecasting the evolutions in LPWAN in a general way. The technologies change and evolve, some cellular options still must prove themselves, ecosystems and business models change and evolve, new providers of one or the other technology appear while others disappear, some utilities have invested in non-cellular players (and might invest when the time is right), it all depends with, again, serious regional differences.

Anyway, it is indeed very possible that cellular LPWAN connections by 2023 are higher than non-cellular ones overall by 2023 across the globe.

Regional differences and the differences between various LPWAN connections ecosystems

ABI Research also points to those differences and states that regionally, although Western Europe and North America witnessed early deployments of public LPWA networks, the Asia-pacific, especially China, has been a pivotal market for driving large-scale adoption of NB-IoT and LoRa.

Very true indeed. We also shouldn’t forget Australia (loads of non-cellular options and applications), the different approaches of operators who are challenged by cable players and of course need to offer what king customer wants and the impact partnerships between utility companies and non-cellular players certainly have in Europe.

ABI Research also looks at the players and says that in 2017, Sigfox had the largest share of public LPWAN connections across the globe as it benefited from its first mover advantage in European countries. ABI Research: “Sigfox has continued to stay a step ahead in public LPWA networks with the roll-out of the Monarch cognitive network service in early 2018”.

That Monarch service enables Sigfox IoT devices to automatically adapt to radio frequency changes which enables seamless roaming across Sigfox networks, Adarsh Krishnan reminds, referring to the first commercial (asset tracking indeed) application of the Monarch service: the Luis Vuitton’s Echo travel bag tracker as the first commercial Sigfox device and leveraged in the asset tracking application it comes with and is available in over 100 airports across 26 countries.

Whereas Sigfox is a player in the space of public LPWAN connections and has a model that looks a bit like that of a cellular operator whereby it wants to build its network with global LPWA coverage (why Monarch is so important), the players in the LoRa Alliance are active in both public and private LPWAN connectivity. And it’s precisely in the latter area that, according to ABI Research, LoRa gained significant market share: as a popular connectivity technology for private networks, witnessing over 54% year-on-year growth in 2017.

Private LPWANs, ABI explains, are typically used for a single vertical application or an individual enterprise. They have been a popular choice for over a decade and accounted for 93% of LPWAN connections in 2017 ABI Research continues. LoRa and other non-cellular LPWA technologies have also benefited from the decreasing cost of IC’s, low implementation costs and flexibility of private networks that can be tailored to meet specific enterprise IoT applications the research firms further elaborates.

According to the company LoRa has witnessed exponential growth in APAC, especially in China where ZTE has deployed China LoRa Application Alliance (CLAA) LoRa networks in 40 Chinese cities and is starting to ramp-up deployment of smart meters, parking sensors, air-quality monitoring sensors and other smart city solutions.

The expected higher number of cellular LPWAN connections and uncertainties to consider

Still, public networks (both cellular and non-cellular) are the main area of LPWAN connections. ABI Research: “as the geographic footprint of public networks rapidly expands, cellular and non-cellular public networks will capture over 70% of LPWA connections by 2023”.

Could we conclude that this public LPWAN connections space will be dominated by non-cellular providers and by Sigfox then? Well, no really. LoRa has some inherent benefits for ample use cases (which would bring us to far), as said cable operators and even some mobile operators (for instance, Proximus in Belgium) are investing more in LoRa which they have been offering for years, there have been successful LoRa roaming tests and pretty important new partners are rolling out LoRa right now as cable company Comcast is doing in the US with its machineQ.

Moreover, as said some technologies really still have to prove themselves and, last but not least, the business model of Sigfox is a not the easiest one as it requires quite some cash and continuous investments. The LPWAN connections game in other words is far from over and by 2023 things can look very different, certainly with other standards on the horizon and many organizations de facto only just starting or considering starting with IoT.

More in the announcement of the ABI Research report and in ABI Research’s Low-Power Wide Area Network Market Data report.