Among the industries facing big challenges and having tremendous opportunities in digital innovation and digital transformation is the utilities industry.

For utility firms the challenge is not just to review, optimize and transform existing processes and business models. It is to find completely new ways to conduct their business.

There are many players in the utility chain so the challenges, evolutions, technologies and transformations are not the same for all components of that chain. However, new revenue models and sources, as well as opportunities of process improvement from various possible angles are universal across the utility chain.

The utility industry traditionally was a rather slow mover in technology adoption but is challenged to be a fast mover when it boils down to digital transformation and the adoption of specific technologies to enable the smart infrastructure, processes and data it needs to be future-proof as competition increases, customer demands change and the industry is in full flux.

In this overall technology picture IoT (the Internet of Things, more specifically Industrial IoT), artificial intelligence and edge computing play an important role as do other technologies typically encountered in the scope of Industry 4.0.

Given the importance of the utility industry (critical), cybersecurity is at least as essential. We added an graphic below with an overview of the six major and most pressing industrial control systems risks for the utility industry as ABI Research identified them.

More about security in the utility industry in the article on the utility industrial control systems security report.

The challenges of utility industry firms

The challenges utility firms face are diverse. Along with the complexity of the utility value chain and fast-evolving evolutions thinking ahead and grasping the benefits of “new technologies” is key in this extremely competitive and sensitive market with many fluctuations in the broader ecosystems.

Among the (really many) challenges facing the utilities industry overall (and making abstraction of regional differences):

- Regulatory challenges. Both in the short and long term the utilities industry has several regulatory challenges but also opportunities. While some regulatory initiatives are about catching up with changed realities and enabling innovation others include more stringent rules, for example on the environmental front. This is of course a broad area with differences across the value chain, regions, countries, states and areas of application.

- Typical utility industry challenges such as the fact that natural resources are not endless and the increased attention for renewable energy and storage, resilience, sustainability, distributed energy resources (DERs) and more – whereby some of these impact or are impacted by the regulations.

- Heightened competition. Also, among others, as a result of some regulatory changes in several regions (but not just that), competition has increased. Furthermore, with so-called disruptive players entering (parts of) the utility industry, business models as such are under pressure, mainly from a digital customer experience perspective.

- Macro-economic and geopolitical. In recent years it has become clear that energy has become more than a weapon and is not just used as one but also the cause of many conflicts. Some of these recent conflicts are reshaping the way countries are sourcing their energy and reviewing existing dependencies while others forge partnerships challenging balances that have existed for a long time.

- Technological challenges. As is often the case, digital technologies and evolutions are both a challenge (e.g. demands of the digital customer, need to be cyber resilient, need for an integrated risk management approach) and an opportunity. In the utility industry we tend to look at technology far more as an opportunity and enabler. We’ll tackle some of the technologies but it’s clear that big data, the Internet of Things, analytics (adding insight and action to the avalanche of unstructured data), and artificial intelligence are among them.

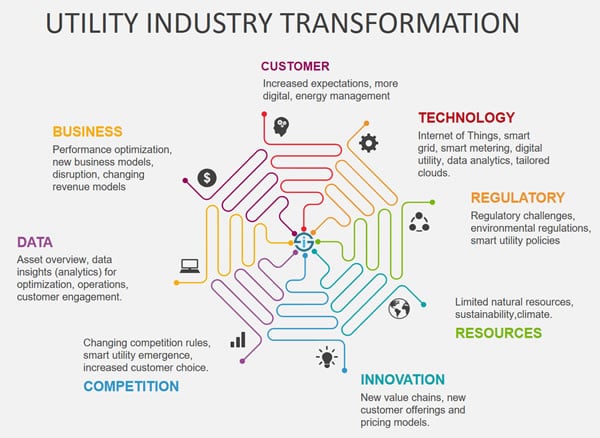

The graphic below summarizes just a few of the mentioned challenges.

The technology picture

So, let’s look at some of the technological evolutions playing a crucial part in the utilities industry.

- The Internet of Things. It’s obvious that IoT (smart grid, energy efficiency management, smart meters etc.) is big in the utilities industry. According to Gartner’s Jim Tully back in 2015 there were already 299 million IoT units installed in the utilities market, making it rank second after manufacturing. In its worldwide IoT forecasts 2019, IDC found that utilities will spend $61 billion on IoT solutions in 2019 (on a total of $745 billion for all industries and market segments including consumer IoT). Smart grids for electricity, gas, and water represent the main use case. However, the impact of ‘electrification’ and different energy approaches shows in a use case that will grow fastest through 2022: electric vehicle charging.

- Big Data (advanced and predictive analytics but also data at the edge). Along with the rise of “smart devices” but also because of many other reasons, including the crucial role of data in an industry where data matters a lot from all perspectives, dealing with the amount of data generated and especially turning all this data into competitive benefits, gained efficiencies and customer-facing advantages is a key priority in utilities.

- Edge computing. Analytics are increasingly done at the edge in the utility industry. According to IDC’s top 10 worldwide utilities predictions 2019, by 2020, 65% of power, gas, and water companies will have invested in edge analytics/computing as they strive for operational excellence and the best optimization of their assets.

There are of course more technologies and digital evolutions in the utility industry whereby we find more ‘traditional’ technologies (cloud, for example) and more advanced ones (e.g. digital twins enabling to build replica of assets in the cloud for optimization of design, engineering planning, maintenance and so forth, de facto needing a range of other technologies, including mentioned ones such as IoT and artificial intelligence) – the graphic below shows some forecasts in that regard (and on how these technologies will be used from the mentioned IDC top 10 worldwide utilities predictions 2019.

Digital transformation across the utilities value chain

When looking at the broader utility industry ecosystem, it’s important to break up the “chain” and see the various challenges and opportunities per element of the value chain as energy, water etc. are such complex ecosystems.

Accenture did a tremendous effort in this regard and summarized it all in a great infographic on the “digital utility”. The company sums up the business imperatives, challenges and solutions in three segments:

- Supply. Where the ‘resources’ get generated and trading occurs. Let’s say the source.

- Network: where all the transmission and distribution happens.

- Retail: what you and I meet the utility in our capacity as consumers, business owners and/or managers.

The infographic and where digital technologies, the digital landscape and transformational initiatives fit in, speaks for itself so check it out.

Customer experience and commercial models

Changing customer demands rule all. At the occasion of Oracle Open World 2013, Jonathan D. Loretto and Michel van Zupthen, both from Capgemini, made a presentation of the emergence and transformation of digital utilities in the “smart” era.

Smart is indeed the word we stumble upon in all aspects of digital within a utility industry context and overall service economy context: from smart meters to smart cities (where utilities come into play as well, smart grids) and smart parkings.

The presentation focuses a lot on the customer experience, as often mentioned today de facto a key driver in the bigger digital transformation picture. However, the dimensions of operating models, technology architecture and – last but not least – commercial models are mentioned as well as you can check out below (with some cases too).

The commercial model is also one example of how utility companies need to and can go beyond optimizing “what is” but truly review business models, for instance with alternative pricing models.

All images belong to their respective mentioned owners.