As mentioned in our blockchain and distributed ledger technology overview for business, end September 2017 Juniper Research announced that according to a survey IBM by far was ranked first as a blockchain technology leader by executives who are actively considering or deploying blockchain initiatives.

IBM’s strong credentials already make it the leader in blockchain and IoT and in blockchain use cases and sectors where it has a large customer base. On October 16th, 2017 IBM officially announced a major initiative in one of these major areas it is active in: banking, with IBM’s new universal blockchain payment solution.

Keeping in mind that one of the reasons why IBM is a blockchain technology leader are its R&D investments in Hyperledger, the company stuck to its open source commitment and runs the universal blockchain payment solution from the IBM Blockchain Platform on Hyperledger Fabric.

As the name indicates, the blockchain banking solution in question is a cross-border payments solution that will reduce transaction costs while increasing transaction speeds. It will be further developed in collaboration with Stellar and KlickEx but is already in action in 12 currency corridors.

Reducing settlement time and costs of global payments

Confirming its credible position as a blockchain technology leader IBM brought together a group of banks taking part in the process of development and deployment of its universal blockchain payment solution.

With an initial focus on the processing of live transactions in 12 currency corridors across the Pacific Islands and Australia, New Zealand and the United Kingdom as the press release of Stellar puts it, the list of participating banks includes Banco Bilbao Vizcaya Argentaria, Bank Danamon Indonesia, Bank Mandiri, Bank Negara Indonesia, Bank Permata, Bank Rakyat Indonesia, Kasikornbank Thailand, Mizuho Financial Group, National Australia Bank, Rizal Commercial Banking Corp. (RCBC) Philippines, Sumitomo Mitsui Financial Group, TD Bank, Wizdraw (HK) of WorldCom Finance, and other financial institutions and others.

Stellar’s network is the backbone of the solution and can securely process over 1,000 transactions per second with a billion unique user accounts. Stellar states that the new solution will “help financial institutions and consumers eliminate inefficiencies and frustrations in current cross-border payment systems, including high fees, slow processing, error-prone transactions, and inefficient capital utilization”.

KlickEx, the second technological partner, was founded to meet critical remittance and foreign exchange needs in Oceania by Robert Bell.

IBM also emphasizes how the universal blockchain payment solution helps banks process of universal cross-border payments with the aim to reduce settlement time and reduction of costs of global payments for both businesses and consumers. Quoting from IBM’s press release ‘ the solution is intended to improve the speed in which banks both clear and settle payment transactions on a single network in near real time’.

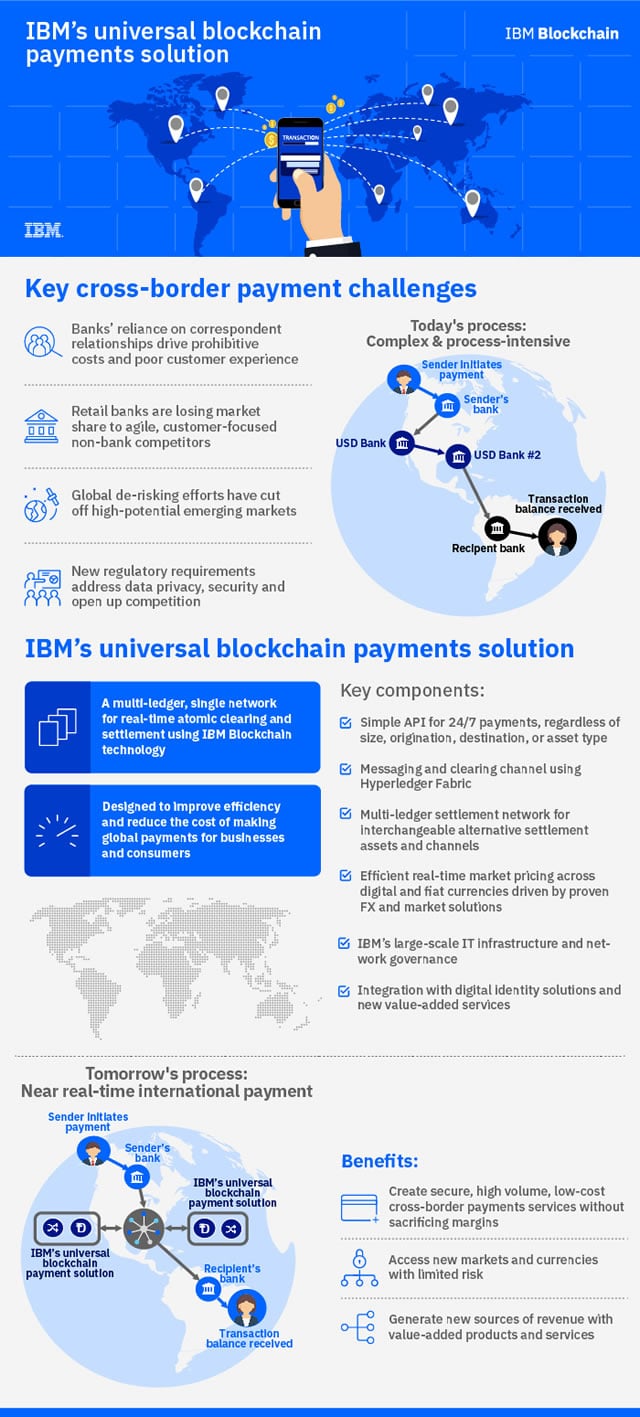

The infographic below tells the whole story:

Major cross-border payment challenges today include:

- Reliance of banks on correspondent relationships lead to prohibitive costs and – indeed – very poor customer experience.

- Retail banks are confronted with the challenge of newcomers, FinTech and (as Forrester Research would call it) customer-obsessed non-bank competitors.

How does IBM’s universal blockchain payments solution aims to help?

- With a multi-ledger, single network for real-time clearing and settlement with the previously mentioned benefits.

- With some of the mentioned components such as a messaging and clearing channel using Hyperledger Fabric and more as the infographic shows.

Among the other benefits of the near-real time international payment process using IBM’s universal blockchain payments solution aims to achieve note, among others, the possibility to generate new revenue sources and the attention for margins and risk, all things that banks like to hear more than ever.

More details, quotes and info in the IBM News Room

The potential market impact of IBM’s universal blockchain payment solution

The announcement of the universal blockchain payment solution as IBM seems to have called the cross-border blockchain-based payments solution might strike insiders as being relatively similar to many other IBM blockchain initiatives.

It might also have struck you that developed markets are mentioned (in which KlickEx’s founder has a lot of experience according to the press release). Despite all the benefits there could also be potential business risks for some companies and on a longer term even banks as IBM is, as mentioned, the clear leader in blockchain and with leadership comes power.

Charles Brett wrote a very good piece on, among others, scenarios in which the universal blockchain payment solution can be imagined and the interesting potential impact on SWIFT, knowing that, as he writes, the official announcement was done at the occasion of SWIFT’s Sibos 2017 event. Charles also looks at the future and the potential of what IBM’s power could mean for banks, pointing to, among others, SWIFT itself and Visa.

Definitely an interesting read and viewpoint. In the meantime let’s close with Charles and his reference to the goals of the World Bank: “conducting global trade with transparency and relative ease”. That’s what this solution should do.

All pictures are courtesy of IBM and can be found in the dedicated Flickr album, the infographic can also be downloaded here.