The digital transformation of healthcare goes hand in hand with shifting care models, bringing care closer to the patient where feasible and valuable, among others enabled by the Internet of Things.

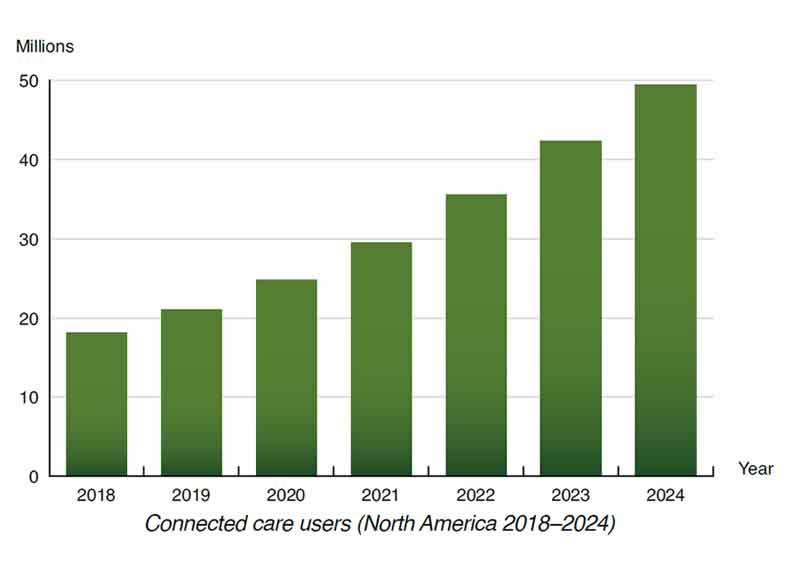

The number of connected care users in the US and Canada is expected to grow from 18 million at the end of 2018 to 49.4 million by 2024. The segment of connected medication management solutions will see the highest growth rates during the forecast period.

Remote patient monitoring (solutions), however, are and remain the largest – and most mature- connected care market segment in North America.

As the focus on digital health and – within that scope – on solutions and technologies enabling new healthcare models which, among others, bring care closer to the personal environment of patient continues to grow, the connected care market is predicted to grow by a CAGR of 18.3 percent during the next six years in North America (in terms of users, revenue forecasts below).

The number of remote patient monitoring solution users is expected to reach a total of 47.4 million users in 2024 (16.1 million at the end of 2018). In terms of revenues, medication management solutions are about to overtake a third connected care segment, the medical alert system market, soon – probably this year. These are some takeaways from a report by IoT and M2M analyst firm Berg Insight, announced in July 2019. An overview.

Note: when comparing the total number of forecasted RPM solution users with the number of connected care solutions overall do keep into account that there is obviously an overlap between various connected care categories since a patient with one or various (often chronic) conditions can use various solutions at the same time.

Sleep therapy compliance monitoring main use case in the RPM connected care segment in North America

The leading RPM application thus far has been sleep therapy compliance monitoring Berg Insight states.

Usually, an airflow generator is prescribed to patients that suffer from sleep disorders such as obstructive sleep apnea. Yet, as Berg Insight points out, many patients find the device unpleasant to use and poor compliance is common. Healthcare payers increasingly require that patients comply with their treatment plans to be reimbursed for the device which has driven equipment vendors to connect the devices, Berg Insight adds.

According to the firm, Philips is the largest provider of connected airflow generators and ResMed follows closely thanks to the company’s decision to include cellular IoT connectivity as standard in its Air Solutions product family.

Medical alert systems: 4.3 million users by 2024

On top of remote patient monitoring solutions, Berg Insight’s definition of connected care solutions (for North America) includes medical alert systems and connected medication management solutions.

Medical alert systems or personal emergency response systems (PERS) consist of solutions that trigger an alarm when a specific condition is met. Most traditional medical alert or personal emergency response systems today require the patient to trigger the alarm, for instance by pushing a button. It’s clear that with IoT, passive sensors and ever more smart sensors, health patches and monitoring technologies overall, there is a gradual shift in this market towards ‘smarter’ solutions.

End 2018, the market for medical alert systems had an estimated total of 3.1 million users in North America. In 2024 Berg Insight expects that number to be 4.3 million users. In North America medical alert systems typically already include more advanced solutions than in many other regions. Obviously, there are also various regulatory frameworks regarding the leverage of healthcare-related data and there are other healthcare (payment) systems and organizations of care overall (delivery, payment, etc.) between various regions and countries.

Connected medication management: the main growth segment in the connected care market

Connected medication management solutions account for the smallest connected care segment with 900,000 users at the end of 2018 and an expected 3.2 million in 2024.

There are several therapy adherence solutions on the market whereby patients need to manually enter data about whether they took their medication or not which takes effort from the patient who then stop using them as Valerie Storms pointed out in an interview on mHealth.

With connected medication management we’re in the space of solutions which are connected to a monitoring platform to improve medication adherence and therapy adherence with connected solutions comprising, among others medication dispensers, pillboxes, pill bottles, vials caps, blister packages, injection devices, insulin pumps and inhalers.

While being the smallest of the three types of connected care solutions mentioned by Berg Insight, revenues from medication management solutions are expected to grow the fastest at a CAGR of 24.2 percent during the forecast period and overtaking the medical alert system market in North America already this year, 2019.

The connected care market in North America: revenues, connections, drivers and trends

Remote patient monitoring, however, for all the obvious reasons mentioned, accounts for the largest share of the connected care market which, in total is expected to grow from US$ 12.5 billion in 2018 to US$ 30.0 billion in 2024, a CAGR of 15.7 percent.

On top of connected medical devices and monitoring services for patients with obstructive sleep apnea, other disease areas in RPM include arrhythmia, asthma, chronic kidney disease, chronic obstructive pulmonary disease, congestive heart failure, coronary artery disease, diabetes and hypertension.

Connected care finally also means connectivity (and technology). Among the changes in that regard there is the sunset of the landline telephone networks and cellular 3G networks, which forces equipment providers to upgrade products, an ongoing change since quite some time.

Berg Insight forecasts that the number of cellular connections in the connected care market in North America will increase from 12.5 million in 2018 to more than 25.8 million in 2024. In Europe, that is slower in adopting new connected care solutions (see below), the number of cellular connections in the connected care market is expected to increase from 2.4 million in 2018 to more than 8.1 million in 2024.

Other drivers of the North American connected care market are more universal and include the impact of changing demographics, new technologies and regulatory changes.

Within healthcare as such there is the increased attention for patient-centricity as one of those pillars of the triple aim of healthcare (or quadruple aim as depicted in this interview with Philips’s Frank Dendas). And that de facto means more integrated systems and a higher operability of connected care solutions although we can call that an ongoing challenge in the digital transformation of healthcare overall as the Future Health Index 2019 again showed and hospital CEO Wouter De Ploey expressed when stating that ‘the dream is obviously one of a fully integrated process around the patient’.

Finally, there is the advent of new companies in the connected care market in North America with, as mentioned, connected medication management solutions today being in the center of attention for start-ups.

The reason is obviously that the market for these solutions is seen as an opportunity whereas the remote patient monitoring is more mature, as is the market for medical alert systems in North America per Berg Insight.

Connected care in America ahead of Europe

Earlier in 2019 Berg Insight also looked at the European connected care market that is picking up slowly in comparison with the US and Canada.

Analyst Sebastian Hellström commented: “Connected care actors want to innovate and provide better solutions for people, but they are held back by the slow adoption in public care systems in Europe”.

European countries where positive signs could be seen according to Hellström included Denmark, Norway, the Netherlands and the United Kingdom where “insurers, legislators and national health systems have taken steps to implement next-generation telecare and telehealth solutions at a larger scale”.

In Europe, or more precisely the EU28+2 countries traditional telecare is the largest and most mature market with the highest growth rates expected for next-generation telecare and telehealth solutions. Yet, the next-generation segment will only overtake traditional telecare by or in 2024.

More information about the report in the news section of Berg Insight or in this PDF. You can buy the report itself here.