Zoom Video Communications (Zoom) acquires Five9, a fast-growing provider of intelligent cloud contact center tools to improve customer experience in a more ‘hybrid world.’ A look at the ‘what’ and ‘why.’

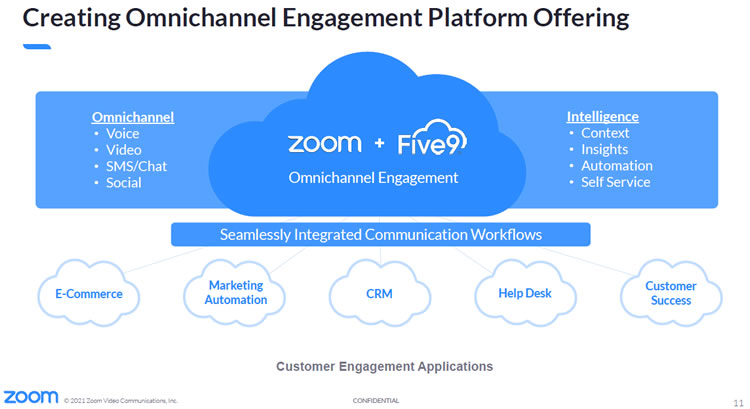

Ongoing automation, digitization, and digital transformation initiatives across business, society, and work call for digital customer engagement possibilities that integrate multiple functions across channels. It’s why the call center or contact center has been evolving to a customer engagement center for the omnichannel customer.

Businesses spend significant resources annually on their contact centers, but still struggle to deliver a seamless experience for their customers (Rowan Trollope, CEO of Five9)

With the accelerated usage of digital tools for ample purposes during the COVID-19 pandemic, the need for intelligent contact center solutions inevitably grew. It is poised to continue to do so, especially since offering a seamless experience to customers is still challenging for many.

At the same time, the evolution towards a more ‘managed’ hybrid work reality strongly accelerated due to the ‘remote everything’ impact of the COVID-19 pandemic. And, last but not least, larger organizations prefer integrated customer engagement tools with frictionless experiences, customer service efficiency and customer-centricity in mind.

Zoom and Five9: focus on the omnichannel enterprise customer engagement market

Now that most organizations want their employees back in the office or other – evolving – physical workplace, this inevitably impacts future of work technologies, including the video conferencing applications we massively embraced when working remotely.

Zoom (Zoom Video Communications), undoubtedly the fastest videoconferencing grower and most mentioned company during the ongoing health crisis when maximal remote work was a must or recommended (where feasible), started to diversify its strategy.

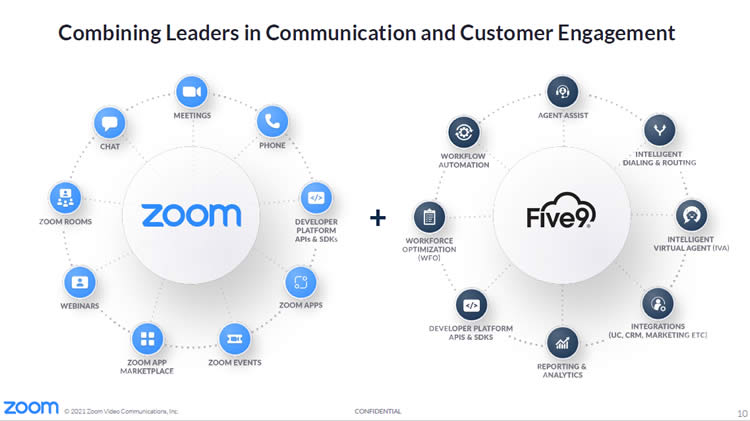

The company knew that the impact of the pandemic wouldn’t last forever and looked for long-term opportunities on top of the solutions it added (Zoom Meetings, Zoom Rooms, Zoom Phone, Zoom Apps). Moreover, competitors upped their offerings and followed Zoom’s strategy of fast-growing adoption everywhere for its core products (mainly video and increasingly voice).

At the same time, the company wanted to do more with existing enterprise clients and acquire new ones. Zoom looked for a more significant stake with a more comprehensive offering, including various customer engagement applications enabling it to go for an omnichannel engagement offering. It’s against this background that the acquisition of Five9 by Zoom can be seen. Five9 is a well-known intelligent cloud contact center player, offering pretty much all functions required for customer engagement. Moreover, Five9 also jumped on the hybrid work and remote work opportunity, providing organizations with the tech, tips, and tools for a ‘work-from-home

The trend towards a hybrid workforce has accelerated over the last year, advancing contact centers’ shift to the cloud and increasing demand by customers for customized and personalized experiences. Today, enterprises not only need to enable customers to engage via their preferred channel, they need to empower their teams to accomplish more, and do so with empathy, purpose, and connection. We truly believe that together, we will enable customers to reimagine the way they do business and deliver exceptional results (Eric S. Yuan)

The acquisition of Five9 by Zoom, officially announced in July 2021, is Zoom’s most significant so far. End of June 2021, Zoom acquired Karlsruhe Information Technology Solutions – kites, GmbH (‘Kites’), a German start-up developing real-time Machine Translation solutions. With the acquisition, in an all-stock transaction valued at approximately $14.7 billion, Zoom CEO Eric S. Yuan accelerates his company’s long-term growth vision to become a key player in the hybrid workforce platform market and customer engagement market.

What Zoom and Five9 want to achieve

With Five9, Zoom acquires an organization with the enterprise customers it seeks and sales force to find new ones. Moreover, by integrating several solutions, it can do so faster with immediate cross-selling opportunities.

The acquisition of Five9 by Zoom makes complete sense in this context, and both Zoom and Five9 are cloud-native players with enterprise clients that want integrated solutions.

The growth and success of Zoom during the pandemic are well-documented. For many who were new to it, Zoom almost became a synonym of teleconferencing. That’s also because of the company’s initiatives whereby it didn’t just get embraced by business but also by schools, consumers; you name it. A risky but smart move: enterprise customers are people, and people work, have families, are members of whatever hobby club, teach, anything you can imagine.

Now that competition in the video conferencing core market increased and things slowly change again, only offering video conferencing, webinar functions, chat tools, and voice communication (Cloud Phone) doesn’t suffice for a long-term growth strategy.

Per Zoom and Five9, the cloud phone system ‘Zoom Phone’ is important for the future, however. Quote: “Zoom’s acquisition of Five9 is complementary to the growing popularity of its Zoom Phone offering”.

As part of the agreement, Five9 stockholders will receive 0.5533 shares of Class A common stock of Zoom Video Communications, Inc. for each share of Five9, Inc. Based on the closing share price of Zoom Class A common stock as of July 16, 2021, this represents a per share price for Five9 common stock of $200.28 and an implied transaction value of approximately $14.7 billion.

Five9 CEO Rowan Trollope (like Eric S. Yuan formerly at Cisco): “Joining forces with Zoom will provide Five9’s business customers access to best-of-breed solutions, particularly Zoom Phone, that will enable them to realize more value and deliver real results for their business”. Trollope becomes President of Zoom and remains CEO of Five9, which becomes an operating unit of Zoom.

For Zoom, it was time to focus on its enterprise customers and the longer term (again), focusing on corporate clients and integrated solutions, moving beyond communications. Betting on the importance of customer engagement, the customer experience, the contact center market where older technologies are still omnipresent and digital transformation is relatively slow, and the accelerating change of the workforce indeed seems like a good idea. And a comprehensive cloud-based customer engagement platform is what organizations want, even if Zoom and Five9 are not alone – but can move fast.

Zoom isn’t the only partner in the acquisition that did well in recent years. In April 2021, Five9 reported a revenue increase of 45% to a record $137.9 million, compared to $95.1 million for the first quarter of 2020.

In a blog post, Zoom CEO Eric S. Yuan states that Combining Five9’s Contact Center as a Service (CCaaS) solution with Zoom’s broad communications platform will transform how businesses connect with their customers, building that customer engagement platform of the future.

In recent years there has been an accelerating evolution towards new technologies and more integration in the contact center.

The transition to cloud solutions is speeding up, and artificial intelligence plays a more important role. This isn’t just the case in somewhat older areas driven by the growth of customer interaction channels and unstructured data sources. AI also enables the transition from simple chatbots to (intelligent) virtual agents. Moreover, we see more channels (even IoT plays a role), and workflow automation has become essential. Integration with other tools and departments is critical here. Think classics such as CRM and marketing automation but also robotic process automation as some tools and technologies.

These evolutions can pose a challenge for several ‘older’ contact center players, given their technology legacy. In the end, it’s as Five9’s Rowan Trollope says: businesses spend significant resources annually on their contact centers but still struggle to deliver a seamless experience for their customers. And that – satisfied customers and, of course, staff, is still what matters.

For Yuan, the acquisition is another important step to realize his goals but certainly not the last, well on the contrary.

The acquisition is anticipated to close in H1 2022.

All images belong to their respective mentioned owners and serve illustration purposes. Source Zoom pictures.

Link to the investor relations video call on the acquisition.