A leaky bucket is not just a computer algorithm or a bucket with holes in it. The concept of leaky buckets is also known in customer experience management, business process optimization and conversion optimization.

Leaky – or leaking – buckets in the latter sense are simply about where we lose – potential – customers during various processes. Efficient, customer-centric, user-friendly and connected processes, flows and activities enable organizations to reduce the leakage rates as the number of lost – potential – customers.

However, before we can do that, we need to know where the main leaks are, the costs (including hidden ones), missed potential revenues, and, most importantly, what causes the various leaks. Such leaks are normal in the customer life cycle and all more or less consecutive stages in the overall customer journey. They’re also normal in micro-processes, for instance in the conversion/outcomes of specific marketing or customer service efforts.

The cost and complexity of leaks in an omnichannel world

Reducing leakage rates is complex in an omnichannel world and when multiple stages occur in the overall journey. In other words: it’s always hard. It needs to be looked upon from a holistic optimization perspective and from the perspective of micro-processes and causality at the same time. When on top of that multiple partners are involved in a complex go-to-market situation or various typical steps are even split up in different sub-processes all the way until transactional processes – and beyond – it becomes even more complex.

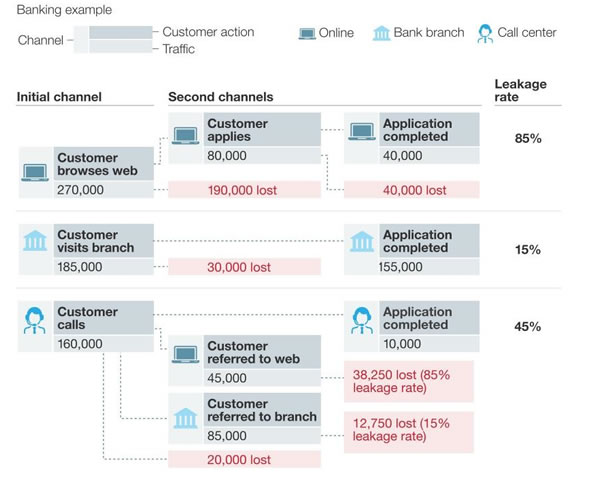

However, let’s take a relatively simply example from retail banking and look at the image from McKinsey below with a leakage rate “model” in this financial services context. As you can see below, the image is a typical example of steps in the customer decision-making process in a (retail) banking context, mapping various touchpoints such as interactions on the Web, branch visits, calls and then the next channels used in those processes.

The most straightforward scenario in the image is in the middle: customers visit branches (with an intent) and the application gets completed, in this case at a leakage rate (lost customers or transactions) of 15%.

However, as we know, the customer reality has changed a lot (and continues to do so) and, depending on the context, people jump from channel to channel (and device to device) and/or there can be more steps within one channel. And the more channels and steps come into play, the more potential leaks.

Even if retail bank customers still often use more traditional channels such as the contact center and the physical branch, it’s a well-known fact that digital and direct banking, mobile, and omnichannel, become increasingly important in retail banking.

Reducing leakage rates for profit now and tomorrow

These digital/mobile evolutions certainly go for existing customers but also become far more important for new customers.

In 2013, Bain released a report (PDF opens), stating that ‘roughly’ three-quarters of new account openings happen in retail banking branches. However, things change and there are clear differences, depending on the geography, customer, type of transaction, etc.

Opening a new account as a new customer of a bank, for instance, is something else than applying for various financial products as an existing customer of a bank. Even if we assume that, still today, on average three-quarters of new accounts are opened in branches, that means one quarter is not. That’s 25% of your potential business, just for new accounts.

The McKinsey image, that to some extent looks a bit like the journeys used in so-called customer journey mapping clearly shows what’s at stake in an omnichannel reality where multiple channels and touchpoints are used: losing potential customers and thus hard cash in several stages of the customer journey, including the depicted buying stage.

However, it’s about more than the channels and there are many factors influencing the leakage rate. And of course we can also apply a similar model/exercise to other industries such as insurance, retail and even non-profit transactions, for instance in e-government.

Reducing leakage – considerations and differentiators

If we look at all the different steps in the retail banking image and the leakage rates from a broader perspective the improvement opportunities and some key differentiators quickly become clear.

Processes – digitized and optimized

Channels are just channels. It’s only when they get connected to follow the path of the customer and be at the service of both the business goal and the customer intent that they become meaningful. But channels also are about people and, at least as important, processes.

If a customer applies online and all steps, processes and details affecting the customer experience and decision in-between the online application and effective completed application are not connected and optimized, the leakage rate in-between those steps will be higher.

To reduce that leakage rate, several factors come into play. Below are a few of them in the form of questions to ask.

- Are the processes optimized and fast enough (digitized, automated, reactive) between various steps in order to make the whole end-to-end process as smooth as possible?

- Are the customer-facing front-end and necessary backoffice systems needed in various steps connected, aligned and efficient with a focus on customer intent, results and the digital customer experience?

- Are all the elements present that the customer needs in each step and in-between various steps, ranging from information to help functions, contact possibilities, follow-up, consistent customer experiences, etc.?

- Is the whole process easy enough and does it focus on the core goal of the prospective customer? Offering the needed information and contact opportunities is one thing but offering too much so that it distracts the customer is a genuine risk. Or in other words: is the information and interaction present/possible at the right time on the right place for the right people etc.? This is also where fast data and real-time possibilities come into play.

People – customer experiences and interactions

While the connection of digital channels and of online and offline channels, is about consistency, enablement, customer experiences, process optimization and the integration of the front end and backoffice, it’s key to keep the human element in mind, also in a customer experience context.

As mentioned, many transactions and interactions still happen in the branch and, as the image shows customer calls play a crucial role as well. Aside from the fact that the role of the contact center (and of customer service) is evolving, the human interaction and optimized processes in the multi-channel contact center are essential for the end-to-end customer experience and the efficiency of customer-oriented functions.

There is a shift away from quantity and quantitative metrics (number of calls responded, for instance), to quality and enabling a holistic end-to-end follow-up of the customer’s next steps to reduce leakage. By automating traditional paper-based interactions and adding intelligence to the multi-channel contact center process, agents can focus on customer service exceptions but also play a role in application processes and so on, making them clearer profit centers than is often the case today, where contact centers still are seen too often as cost centers, also in service. In order to do so, they need the education, recognition, tools, platforms and resources to fulfil these tasks fast and in an end-to-end chain, in close relationship with other divisions. Removing hurdles and frictions in the customer experience and the customer’s task at hand, is key.

Holistic optimization across silos

And this brings us to the third point I would like to mention: silos. Not so long ago – and often still today – optimization happened in silos, just as departments work in silos, information sits in silos and the data needed to help the customer fulfil his task in real-time (and the business to fulfil its goals) sits in silos or is not available, let alone actionable at all.

When looking at the different interactions, channels and scenarios in the McKinsey retail banking scenario, you can see the various siloed optimization possibilities as they often happen in real life.

The Web team is responsible to optimize the website for the customer and his intent. The contact center has the task to optimize the interactions with customers.

In fact, regularly each individual channel used across interactions (online tools, emails, chat, etc.) is optimized by a team that is responsible for these specific channels. If we also take the multi-device reality into account (mobile, Web,..) we see the same silos. And then there is of course the branch where quite a bit can be optimized as well.

Digital transformation and customer-centric optimization: closing the gaps in-between stages

In order to reduce the leaks, we need end-to-end overviews and responsibilities and gather, store and use the information, processes and data across the silos. However, we also need to have a mindset, processes and mechanisms that is holistic, end-to-end. Just as the customer experience is end-to-end and at the same time is about individual experiences.

So, while it’s good to specialize in optimization for specific touchpoints, channels, customer experiences and stages of the customer journey, one sees immediately why it’s also necessary to have this holistic optimization approach: most leakage is in the connection of the steps (and with it systems, processes, goals, etc.). It’s exactly these areas that are covered least when we look too much at various stages and channels as islands and forget to optimize in a consistent way around the customer journey instead of our organizational realities, disconnected systems and other silos the customer doesn’t care about – as you will notice in your leakage rates. It’s also one of many areas where process automation and customer experience optimization meet.

Digital transformation can be needed here on multiple levels. Look at outcomes across silos, from the perspective of the consecutive customer stages and everything in-between. This holistic optimization, through digitization and digital transformation projects is not just needed because of changing and increasingly digital behavior but also by the need to connect the dots beyond the silos. The retail banking scenario is one example showing it.

Images purchased under license from Shutterstock