Retail banking: evolutions, disruptions and solutions in a hyper-connected digital age

The financial services industry is going through dramatic changes as a consequence of changing customer behavior, increasing expectations, channel proliferation, disruption, innovative use and adoption of new technologies and the digitization of business and society in general. Cost reductions, increasing top-line revenue and mitigating risk remain the key drivers, also in retail banking.

The digital transformations taking place in finance are driven by many common challenges and opportunities across the industry, whether it concerns insurance, (retail) banking or other financial services. At the same time, in each of those financial industry segments there are several specific challenges, depending on the digital transformation maturity level, the region, the overall ecosystem, the customer context (including the use of digital channels), the business scope and the degree in which digitization has taken place and processes have been connected.

90% of consumers prefer online banking services, regardless of age, income, place of residence or type of bank

In this article we take a look at the challenges and evolutions in consumer or retail banking.

Overall ecosystem challenges for retail banks

Although in some regions and countries, retail banks are leading in several digital areas, including marketing and customer-facing operations (with great examples of omni-channel banking and mobile banking, for instance), in general retail banking still has a lot of catching up to do.

Retail bank branch consolidation and branch shutdown will continue in many environments

How else could it be with the many ongoing digital customer shifts, market evolutions, disruptions and process change requirements?

Banks in general have additional challenges which we see in other segments of the financial industry as well:

- The need to integrate/connect distribution channels in order to optimize efficiencies, reduce costs and serve customers and prospects in a consistent way. This is the so-called omni-channel imperative, which we have seen in retail and other industries too and is typical for a channel-agnostic and increasingly digital/mobile consumer.

- Better identify opportunities by looking at the overall customer life cycle (and important changes in it), improve experiences and (thus) enable better customer service and experiences.

- Reducing churn and increasing loyalty. The loyalty of retail banking customers fluctuates. This has to do with several other challenges mentioned below and overall changes in consumer behavior. Sometimes we see increasing loyalty, while in other areas loyalty decreases. Furthermore, loyalty is not enough anymore. Think experiences.

- Decreased levels of trust: the impact of the 2008 financial crisis and uncertain economies today had a well-kown impact.

- Last but not least – there is the arrival of FinTechs and other competitors with disruptive models that are better adapted to the increasingly digital consumer. There are also significant changes in the competitive landscape, depending on the region and context (e.g. Islamic banks in the GCC region and several other countries).

Digital, disruptive and customer threats and opportunities for retail banks

Even if digital transformation is a priority for most retail banks, reality shows there is still quite some work in the area of digitization, a conditio sine qua non for digital transformation, and of underlying processes that are often overlooked.

In a 2012 report (PDF opens), called “Digital transformation in 10 building blocks to boost customer experience and ROE”, the Efma (a financial industry organization promoting innovation in retail banking) and McKinsey indeed stated retail banking was lagging behind in digitalization/digitization. The report, based on data and perspectives from across the European banking sector, for instance found that only 20-40% of processes are digitalized and 90% of banks invest less than 0.5% of their total spending in digital.

Efma and McKinsey, known for their annual World Retail Banking reports, have seen improvements in many areas since. However, as we’ll see challenges remain and are joined by other.

In an article in the Financial Times, McKinsey London’s Tunde Olanrewaju, wrote that “retail bank customers don’t experience the same level of digital choice, freedom and empowerment as in other industries” such as travel, to quote just one. And that is a challenge as the experiences, choice and digital expectations of consumers are shaped by those in all industries. We expect the same level of service and – even more importantly, empowerment – from retail banks as we do from other industries leading the digital evolutions.

As mentioned before, there are more risks: FinTech start-ups and newcomers with a clear and customer-centric digital approach and/or a disruptive approach enter the market and consumers won’t wait until banks have closed the digital gap neither. Furthermore, digital laggards will become more visible as their competitors do close the gap, Olanrewaju emphasizes.

12 retail banking priorities

Below we summarize 12 retail banking priorities, each with their own challenges and opportunities.

- Cost reduction (among others lowering cost per transaction) and increasing sales (cross-selling, up-selling, acquisition), which is a challenge for many.

- Customer focus: optimizing the customer experience and enhancing customer service in a consistent way: from cross-channel and multichannel to omnichannel.

- Single customer view: connecting systems and processes to achieve the above with an increasing role for digital channels and (connected) CRM.

- Developing new offerings, products and services that are adapted to the evolving customer reality, competitive landscape and area of activities. Noteworthy: after the bank crisis in 2008, in many regions, retail banks across the globe looked less at the Western banking system and more at their own markets and strengths/challenges/approaches. Innovation often comes from developing countries.

- Digital and direct banking with a clear role for mobile banking, especially in areas with less branches, high mobile penetration and cost reduction programs. More below in this article.

- Segmentation. Adaptive and agile business models, taking into account customer segments, based on various parameters (more below).

- Branch consolidation (and innovation), among others for cost reduction purposes, but also to introduce new – cost-effective and customer-adapted – ways to digitize specific processes and tasks (with experiments to see what works).

- Analytics and ways to combine all interactions, information and – predominantly unstructured data (also Big Data) to optimize customer service and touchpoints, while having dashboards, enabling cost control.

- Identifying silos that are omnipresent in virtually all business functions and processes. And finding ways to build cases that enable improved efficiency across silos.

- The use of digital marketing and customer service strategies to acquire, retain and service customers, adapting to the digital consumer but also promoting digital services to reduce costs, both in services and marketing spend.

- Turning customer experience and customer service improvements into changing customer behavior with real tangible profits and revenue-generating activities such as referrals. FinTech is very strong here.

- Stepping up the pace towards a digital banking ecosystem as a lack of speed regarding innovation and adapting to customer demands has certainly contributed to the rising success of FinTechs and is a reason for the de facto ongoing collaboration with these innovative and agile newcomers who are not withheld by the slowness of legacy IT systems and master the art of digitalization and of new technologies.

Reducing costs and managing risks remain key but digit(al)ization becomes crucial

Let there be no doubt: the de facto main priority of banks is keeping costs under control, managing risk and realizing cost reductions overall (which is again another reason why incumbents look at FinTech). Even if the implementation of digital strategies, customer experience optimization, reviewing the role of branches, replacing legacy systems and responding to regulatory changes are all important, costs and managing risk remain essential for all the obvious reasons. Still, things are changing. Digitization, digital disruption and digital transformation are increasingly recognized as priorities by the retail banking industry.

Technology and its cost, risk and transformation consequences

In a highly uncertain global economy, with challenges and urgent needs to transform, amidst digital and mobile first consumer demands and along with the pressure from politicians and regulators to digitize, controlling costs and managing risk is paramount. Current uncertainties in a geo-political context and urgent modernization and innovation requirements that need to be funded simply require retail banks to keep a close eye on costs and business risks. How else could it be? However, the perceived risks are changing.

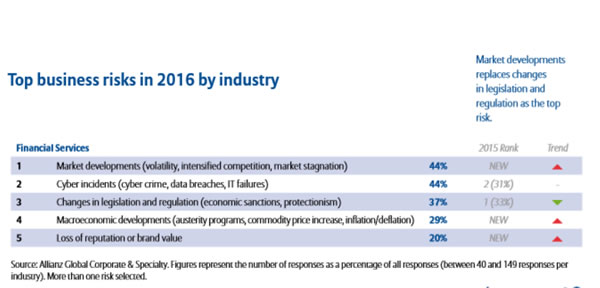

When looking at the perceived business risks for 2016 and beyond we mentioned how in the Allianz Risk Barometer 2016, for the first time ever technological innovation appeared in the top 5 long-term risks facing businesses. In financial services we see that cyber incidents are perceived as the second most important risk. The number one perceived risk in financial services concerns market developments. However, as we also mentioned this category of risk is increasingly about disruptive forces and business models.

Digital technologies are seen as challenges and enablers at the same time. Branch consolidation is a way to reduce costs, digitization and digital transformation another. Yet, many banks still don’t make the link between digitalization and cost savings. As you can read below, however, there is a clear link. Digitizing back office processes and automating back offices, for instance, leads to cost savings on levels such as core banking replacement, document management systems and Business process Management. Moreover, back office digitization removes the inevitable costs of manual labor and paper-based processes while creating efficiencies that lower customer service costs and reduce churn when done in the context of almighty customer experience.

Legacy systems deserve special attention as they are costing banks a lot of money and have led to expensive failures as you will read further. They are simply not adapted to current demands and can’t be replaced by other legacy systems even if that is what some CIOs keep hoping. In the words of Ovum’s Rik Turner in a 2013 article: “These [legacy] systems work, so bank IT leaders think, Why rock the boat?”.

It’s safe to say that the need to rock the boat is not just a matter of adapting to the changed realities of banks but also that a modernization of IT systems reduces costs when done well. It’s in that ‘done well’ that there is a risk with CIOs who are not willing to take those risks as they’ve been relying on the same technologies and systems in a market that was among the first to embrace numerous IT systems and solutions.

Retail banking, cost reduction and digital strategy in perspective

When asked about their top priorities in the years to 2020 at the occasion of research by financial software specialist Temenos and the Economist Intelligence Unit, as reported upon by David Bannister on Banking Technology, the majority of retail bank executives answered ‘implementing a digital strategy’. The implementation of a digital strategy thus overtook responding regulatory requirements in the 2015 edition of the research.

As improving customer segmentation by product, service levels or distribution channel ranked second, the more ‘direct cost-related answers rank lower’. On the third spot we find adapting to changes in the size structure and role of the branch network (where cost savings really play a big role). And on four we see cutting costs or improving margins on retail business lines. Responding to regulatory requirements, while still a crucial one, only ranked fifth which was somewhat unexpected.

If we look at the reasons behind the implementation of a digital strategy it’s probably not a big surprise that it’s not just a matter of adapting to changing customer requirements, regulatory pressure, “concerns over competition from new entrants” or creating the possibility to be more responsive, agile and innovative. The same goes for customer segmentation improvement and several other answers. More revenues, more competencies to survive amidst all those changes, managing risks (of, for instance those new entrants) and, most certainly, saving costs, also through the implementation of a digital strategy.

But again the signs are clear, especially as according to Monica Woodley of The Economist Group, (quoting from Banking Technology) “the surge in interest in digital channel strategies was driven by concerns over competition from new entrants – 35% of respondents cited it as having the biggest impact on the industry, up from 22% last year and tech and e-commerce companies are the competitors that banks fear most”.

Getting digitization right: beyond front-end functionality

A key question is why (retail) banks haven’t been moving more aggressively towards digital and still lag behind in digitization, for instance.

Banks must recognize that customer expectations are increasingly being set by nonbanks

Tunde Olanrewaju provides the answer in the previously mentioned article: bank executives have tended to view digital transformation too narrowly with a focus on front-end functionality delivered to customers.

This is indeed what we see happening. Many banks have come up with state-of-the-art apps, calculators, comparison charts, servicing tools, etc. While this focus on the customer is to be applauded, it cannot work if the underlying connected processes (internal…), resources and data and information flows and integrations aren’t in place. This often results in banks as being perceived as digital frontrunners in the public eye with nifty applications but that perception ends once the customer is beyond those – first – digital touches.

Digital transformation in banking requires integration of front office and back end

It’s in the integration of front end, back end and other areas that true digital transformation often still needs to happen.

From a pure digitization viewpoint, in retail banking we often still notice:

- Lots of information-related processes happen manually and leave room for errors.

- Disconnected systems, resources and – again processes – are time-consuming and costly.

- Organizational silos remain huge and different projects and goals live in isolation, thus standing in the way of cross-fuctional optimization.

If one of the underlying processes is slowed, this inevitably has an impact on other processes and of course on the overall customer experience, exactly an area where retail banks need to focus on. Olanrewaju rightfully states that, among others, there is a lot of value to gain in the automation of servicing and fulfilment process.

Cost reductions and channel optimization

From an information and data perspective following elements can lead to cost reductions, improved customer experiences, faster speed to business, lower risks and higher revenues and loyalty, among others on the process and channel levels.

- Reducing the manual labor that still happens in several back-office processes as mentioned earlier. This is not so much a matter of the cost of labor but especially of the mistakes that are inevitably made when capturing and processing any form of input or information (from loan applications to customer service questions) occurs. It’s part of the essence of digitizing information. Reducing manual labor, processes and workflows is a key step towards a higher goal, being automated processes that are connected or integrated with other systems to improve process efficiency and in the end customer and business goals. In today’s digital context, connecting processes, applications and digital information flows are inevitably connected. Siloed information is the enemy of digitization, optimization, transformation and even innovation.

- On top of traditional channels consumers still like to use such as paper and email, there is a range of new channels whereby it’s clear that today’s customer prefers fast interaction with unstructured data and content being the pre-dominant form of communication. This is not just a challenge in retail banking but it certainly plays a crucial role. The increasing use of direct and digital channels is a very broad and radpidly evolving challenge as such.

- The changing role of the retail bank branch. It’s clear that the branch consolidation and branch shutdown will continue in many environments. This movement, among others driven by the need to cut costs and invest more in the customer experience and digital transformation, doesn’t mean branches will die. We’ll take a look at the changing role of the retail bank next.

The changing role of the retail bank branch: evolutions

Customers want omnichannel service and access to information on their terms. They also want to communicate on their terms. With the advent of a digital prosumer, used to (and wanting to) take decisions in their terms, the focus of the retail bank branch is shifting.

This often includes requires investment in offering digitization possibilities and digital experiences within the branch, while reconsidering the tasks and roles of various branch employees, depending on their typical visitor segments and their tasks, which again depends on a broader context (e.g. location). Many retail banks are also experimenting with co-branding, hybrid branches, immersive experiences within branches, design, etc.

These experiments and actual transformations in the role of the retail bank branch can lead to staffing changes as mentioned. An example: the mix of employees in the branch can move more towards supportive functions if customers dispose of more digital tools and services on the spot, while offering special spaces and slots for financial advice, even if here as well we see digital evolutions whereby the ‘expert’ is not physically on the spot.

It’s clear multiple options are possible and there is no one-size-fits-all. The key driver will be the evolution of the various typical customers, which can be steered with incentives and come with possible education and engagement initiatives. It’s also clear that the digital and physical interaction preferences will change and vary country per country (e.g. existing government-driven digital evolutions, use of mobile in banking and thus penetration), bank per bank (e.g. maturity, connected processes, legacy systems), branch per branch (e.g. rural versus city) and customer segment per customer segment, to sum up just a few parameters.

Finally, the nature and broader business ecosystem of the retail bank also plays a role (compare broad-offer banks with disruptive players, online pure players and retail bank services by postal services and even business that don’t have banking as a core business, for instance).

What’s for sure is that the role of the branch is changing and that this comes with a human toll. When Barclays announced 1,700 job cuts in the UK in 2013, it blamed the fact customers visit their branch twice a month, while using mobile services 18 times a month.

Customer first: segmenting the retail bank experience

However, the main contextual differentiator remains the customer and his overall preferences, needs and desired experiences.

In the previously mentioned research by the EFMA and McKinsey (and as the image shows), four distinct customer segments were defined with the so-called self-directed becoming by far the most important segment (80% by 2020).

However, the digitalization of transactions in the branch is at least as important for the so-called ‘branch lover’ segment, where banks will offer more digital possibilities. With unstructured data and digital information being key, this opens up plenty of new opportunities for retail banks to change the “experience” in their branches.

As Baudouin Thomas, Managing Director Accenture Belgium, says in an interview with Banking Boulevard: “customers should also benefit from this digital transformation when visiting their local bank branch”.

Shifts in the tasks and core business of retail banks

Making the branch a point of human/digital interaction and of digital information capturing and processing can start at the level of enabling customers to digitize their own documents or training branch employees to quickly do so themselves or assisting customers using state-of-the-art capturing and processing technologies, designed for use in customer-facing situations and the processes underlying them.

Various tasks in banking, which are done by the bank today, will be done by the customer tomorrow

In a paper, called “Inside Tomorrow’s Retail Bank” (PDF), AT Kearney also emphasized the evolutions in the behavior of different retail bank customer segments. The company divided customers into two major groups of retail bank customers: Generation Facebook and a large group of digital deniers, in practice and in developed markets the latter are often elderly people.

In the paper, AT Kearney also identifies some basic demands both groups (essentially both at the two extremes of digital savviness) and sums up some more evolutions retail banks witness in a mobile, social and digital era, with mobile and social being important phenomena in the retail bank, according to the company.

Interesting – and probably even more driving transformation in the industry – is the shift of the control regarding specific tasks in banking, some of which are done by the bank today and will be done by the customer tomorrow. Knowing that some of these tasks are key to the business of retail banks, analyzing these shifts is essential for banks.

Customer experience optimization in retail banking: end-to-end improvement, individual touchpoint challenges remain

Consumer banks have made important efforts to put customers at the center, develop digital banking possibilities and optimize the customer experience.

This seems to have paid off in the perception of retail bank customers since 2015-2016.

The good news: an improved banking experience

According to the World Retail Banking Report 2016’s Customer Experience Index, in over 85 percent of countries an improved banking experience was found.

In the 2015 edition of the report, there was still stagnation in this regard. So it indeed seems that overall customer experience is improving and consumers feem more valued.

They feel more at the center of banks’ efforts in many cases too.

Other research, Youbiquity Finance 2016, for instance found an increase by 74 percent of UK banking customers who feel that their bank puts customers at the hart of their business.

That is all good news indeed. However, does it also lead to increased revenues? While overall perceptions improve, banks are at the same time losing on opportunities to captitalize upon their efforts.

The bad news: poor user experience, disconnected process/information and a lack of interaction possibilities in self-service digital banking

Firstly, and as mentioned several times, often integration is still missing on the back end and front end level, leading to underwhelming experiences and challenges with regards to slow reaction times or broken processes.

This phenomenon can be seen on the level of individual touchpoints and moments of truth in banking, and in specific, sometimes very basic, tasks which consumers want to perform through digital and self-service.

The Youbiquity Finance 2016 research, which we cover in our article on the state of digital banking shows that, while basic banking interactions have been automated, even essential digital self-service interactions, such as trying to make an appointment to see a financial advisor or making a complaint, fail.

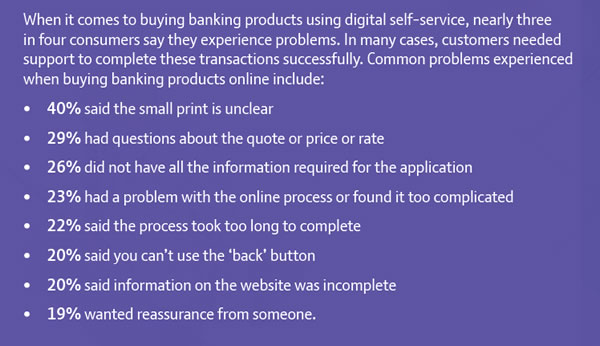

Worse, almost three in form consumers experience problems when buying banking products, requiring support to complete these transactions successfully.

This means investments in support (technological and human), broken transactions and negative experiences. Again: note that we are talking about buying banking products here, in other words: activities with a direct impact on revenues!

The research mentions some staggering data as you can see below. Among the causes we again have to mention gaps between front end and back office and certainly a failure in the integration of information/content and processes with a lack of an overall view. That is a recipe for digital transformation failure as you can read here and the research is partially tackled.

While in some cases it is good to add additional functionality (e.g. webchat, video) for complex financial interactions, it is clear that there is work to improve the user experience, information clarity and integration of digital (online and mobile) banking applications of the first generation. Especially as newcomers, fintechs and digital (customer experience) leaders are already moving past that first, initial stage.

What the research also indicates that digital banking shouldn’t be seen as a one-way street and that’s important from a customer service and guidance level, also with an impact on customer experience and topline revenue growth.

Consumers do expect interaction possibilities, depending on the context, even if you digitized something completely. Will that change? Not in the short run and that’s not just a matter of technology but also of human nature and the role of financial services in the lives of consumers as such.

FinTech and retail banking

An excellent barometer regarding the state of retail banking has always been the previously mentioned annual World Retail Banking Report. In the announcements, videos and infographics around the 2016 edition of the report two things stood out: customer experience and FinTech.

In more than one sense both are connected because what is attracting consumers to adopt FinTech services and products is, among others, the (digital) customer experience and speed of FinTech services.

The FinTech opportunities for retail banks

While FinTech is about more than retail banking, today it most of all affects retail banks. One of the challenges for FinTechs which are active in retail banking is regulation. Only a limited number of financial service activities be easily scaled across a broader geographical area.

For retail banks this is an opportunity. They have the regulatory know-how and the large customer base which is needed in many banking areas. It’s yet another of many reasons why we see increasing collaborations between banks and FinTechs.

But there is more. On top of being able to lower costs by working with FinTechs, banks can also tap into their customer experience know-how, up-to-date technology stacks and abilities to innovate fast.

Add to that the fact that FinTechs today appeal to an interesting audience and, together, banks and FinTechs, can come up with new revenue streams and value propositions, and the picture becomes clear.

As retail banks haven’t been able to turn their investments in digital, customer experience and customer service in profitable customer behavior yet, despite overall customer experience improvement in 2016, the attraction of working with (or investing in) FinTechs is high.

Collaborative evolutions in FinTech and retail banking

According to the World Retail Banking report 2016 65% of retail banking execs see FinTechs as partners instead of competitors.

There is no ignoring that the increasing collaboration between FinTechs and banks for all the mentioned reasons and far more; with different approaches, ranging from investment to collaboration and acquisitions, will continue. And of course there is competition too.

However, with 96 percent of bankers agreeing that the industry is evolving towards a digital ecosystem and the large majority saying their core systems can’t support it, competition is ineed evolving into acceptance as banks see opportunities for collaboration as the graphic of the World Retail Banking Report 2016 shows.

Moreover, the adoption of FinTech in retail banking is simply a fact with close to two-thirds of customers across the globe using retail banking FinTech products or services. The World Retail Banking Report advices banks not to underestimate the impact of Fintech firms on their customers as they tend to do now according to the report.

The opportunities to collaborate are simply too high to ignore and, on a technological level (think, for instance, APIs and new revenue streams) are even inevitable.

Additional resources on the ongoing digitization, digital transformation of retail banks

We will continue to update this page with additional evolutions, research and learnings regarding consumer banks and the shifts in consumer behavior, disruptive newcomers, research, examples and best practices. In the mean time below are some links to additional resources on this site.

The legacy system and retail banking IT challenge

Virtually all retail bank executives want to implement digital strategies. The leaders go a step further and respond to newcomers by transforming there business model and even launching fintech applications.

However, at the same time there are several legacy IT and back office challenges as we mentioned. Legacy IT systems in particular often stand in the way of better connected information, back end process and front end integration hurdles, which in turn stand in the way of agility and an optimal end-to-end customer experience.

Retail banking: the growing importance of direct and digital channels

Direct and digital channels are playing an increasing role in retail banking since many years now. However, there is still much room for improvement, depending on the context, geography and area of activities.

Direct and digital channels matter from all customer perspectives: from gathering information to gaining access to customer service. For retail banks, direct and digital channels are an essential part of the omnichannel strategy and play a role across several goals, from acquisition to support. When and how financial consumers use digital and direct channels depends on numerous factors. With the advent of more digital disruptions and transformations in the overall finance and banking reality, it’s essential to understand the growing role of digital and direct channels.

Back-office challenges in retail banking

The major part of digital efforts in retail banking revolved around the front end, predominantly optimizing the customer experience across several touchpoints and tools. However, as mentioned, optimizing the customer experience and improving other business processes, is not just a matter of the front end. It requires an integrated approach whereby the back office and front end are connected.

The consequences of not doing so? Among others inefficiencies that have a significant negative impact on customer experience as research shows. Or in other words: partial digit(al)ization whereby customer experience optimization investment on the front-end are outdone by poorly integrated overall processes.

Top image: Shutterstock – Copyright: Montri Nipitvittaya – All other images are the property of their respective mentioned owners.