Many banks and financial service providers are innovating, optimizing customer experience, digitizing and digitally transforming to adapt and, ideally, differentiate themselves in a hyper-connected market reality, further challenged by Fintech players. The battle for the consumer is on in retail banking (a.k.a. consumer banking) while the increasingly competitive and disruptive hyper-connected ‘digital’ information age in which it occurs, poses numerous challenges and requires various shifts.

Innovation, transformation, digitization and automation to respond to changing consumer demands, tackle the arrival of new market players, adhere to altering regulations and build a stable foundation for today and tomorrow isn’t enough though.

The question is how retail banks will truly become leaders in their market and avoid embracing or copying similar and easily replicable approaches of their competitors, while being “disruptors” or innovators instead of being the victims of large-scale disruption, as the WHOLE industry is innovating, digitalizing. and challenged by new entrants from other industries. In other words: how do retail banks make the difference, staying close to their mission, values, customers and stakeholders while developing the business competencies to improve, innovate, change, thrive and survive in times of accelerating transformation?

Developing customer-centric, connected and innovative competencies

Excelling at customer experience and customer service, offering the best mobile and digital experiences and speeding up processes and information flows to innovate better and faster are essential to succeed.

As usual, this is all easier said than done. With challenges on so many fronts gaining a clear understanding of what the challenges are and how they are (hyper-)connected is important. Moreover, it isn’t just about today: the next challenges and opportunities are around the corner and already being understood and acted upon by leaders and game changers. Change is perpetual and reality dynamic. It is even more so in this highly connected context of today and many years to come. Retail banks need to combine their efforts to optimize and innovate today with the creation of business competencies to act better and faster in the light of tomorrow’s challenges and opportunities. These competencies or innovation and transformation pillars become business pillars that make the organization agile enough to respond and ideally pro-spond in the future than they have been able to do so far.

Just as in other industries and even more so, most retail banks weren’t properly organized and fast enough to deal with changing business and consumer realities many failed to see. In more than one sense, digital transformation in retail banking is about catching up with these realities, rather than about innovating and truly leveraging the possibilities of digital technologies and information in a deep and ecosystem-wide way.

Legacy IT and back office challenges

So let’s take a look at some operational (processes), technological, contextual (ecosystem, economic, customer-related), behavioral and structural/cultural/organizational issues to tackle for retail banks and start with the challenges and opportunities regarding legacy IT and back office digitization and integration.

Legacy IT challenges: adapting to changing conditions

With a tradition of complex legacy IT systems, designed to meet the – very specific security and regulatory – requirements of banks before the current sea change in the industry, the back office and legacy systems are a challenge in more than one regard.

One of the challenges concerns legacy IT systems and business continuity on the level of system failure. As ample examples have shown over the past few years, legacy systems are not adapted to the changing and increasingly demanding digital evolutions and the processing and security challenges which are an inevitable consequence of them. It is even not so much a matter of cybersecurity but of sheer capacity and design of key back-office systems. Moreover, there are genuine risks involved with upgrading and connecting the legacy systems of banks to adapt to the demanding and non-stop processing requests and needs of consumer-oriented technologies and applications, for instance in the space of customer service, online banking and a mobile first world as it’s becoming a rapid reality in retail banking.

Obviously this shouldn’t stop banks from making the necessary changes and it doesn’t but even if most banks reduce risks through thorough testing there are several cases where it wasn’t through enough, leading to serious glitches. With ever more regulatory requirements and changes, technological evolutions and the ongoing changes in customer behavior and preferences, security and testing are of the utmost importance as it is clear that legacy systems will lead to an increasing number of issues as they’re simply not built, let alone adapted, to a digital and data-intensive reality.

Legacy IT challenges and the digitization of the back office

Customer experience is a keyword in back office automation and so are costs and agility:

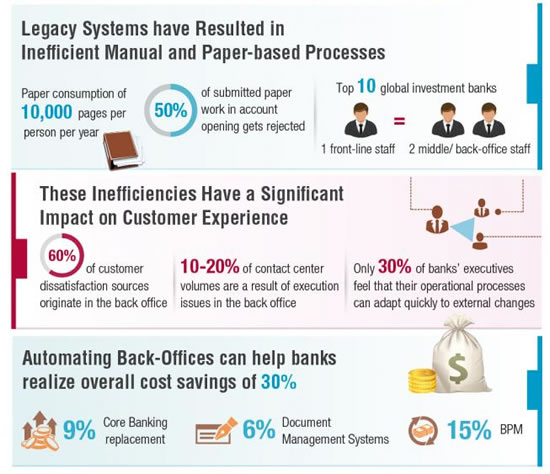

- Capgemini found that only 30 percent of bank’s executives feel that their operational processes can adapt quickly to external changes. A clear sign regarding agility and the capacity of responsiveness.

- On the cost side of things it’s clear that manual, paper-based and siloed equals high costs, among others on the level of labor, infrastructure maintenance and error and rework as is illustrated by Capgemini.

While the case for back-office automation goes for all industries there is work for retail banks who want to dispose of the business capacities needed to respond to challenging conditions. However, in July 2014 McKinsey stated that across Europe retail banks had only digitized 20 to 40 percent of their processes.

The need to bridge the back office and front end and connect divisions, information silos and processes

Securing’ and digitizing the back office is one thing, connecting it with the front office another. Banks are among the champions of working in very siloed ways, which is a challenge as consumer banking is a highly information-intensive industry in virtually all operations and across numerous business processes. Challenged and even disrupted by a digital and mobile first consumer, increasing competition and the advent of companies in various aspects of retail banking, coming from outside the industry, speed of processes and availability of information are competitive differentiators with information management maturity an essential key to enable it. While digitizing the back office is essential as explained previously, obviously it isn’t enough.

With the customer experience as a core goal, back-office and front-end processes and systems need to be connected. Obviously the same goes for various departments that are challenged by a disconnect between the efforts regarding customer experience management in the front end and slow processes on the back end whereby digitization of operations is missing and information management fails to serve customer and business value creation processes and goals. The consequence is an inability to meet customer service goals (60 percent of customer dissatisfaction sources originate in the back office), disjointed customer experiences from an end-to-end perspective, wasted investments on acquisition, high leakage rates and poor agility and innovation capacity.