IoT has become an essential component of digital transformation efforts across numerous industries with smart manufacturing remaining a top investment area even if IoT investments have been highest in the consumer segment for some years.

As previously mentioned in an update on European IoT spending, spending on IoT in manufacturing was more impacted by the pandemic in 2020 than some other verticals (except for several use cases in, among others, a ‘remote everything’ context).

However, globally manufacturing remains the second IoT spending area, and Industrial IoT inevitably will continue to drive Industry 4.0 projects, among others pushed by support programs of governments. The US and China continue to invest most in smart factory projects, while in Europe, it’s Germany that remains number one in the global digital manufacturing transformation race.

Scaling up remains one of the main priorities in a context of smart factories as platform adoption increases, rollouts among larger enterprises become more significant, and cross-industry partnerships enable to scale up with more integrated solutions and ecosystems.

The smart factory market in Germany pre-Covid-19 was one time and half the Chinese one; however, by 2025, the size of the two countries will match, crossing the 12 billion Euro mark and creating with the USA the triad leading the smart factory market, besides Japan and Korea.

For sure, some goals have become more critical since the pandemic with the mentioned focus on ‘remote everything’ models, sustainable production (often tied to government initiatives), and future of work oriented initiatives. Last but not least, for many manufacturers saving costs (automation) will remain a priority in these challenging times. So will rather essential initiatives, such as getting rid of paper where possible and upping data management capabilities, since data remains the glue in the end.

“Big-5” cluster smart factory spending exceeding $100 billion by 2025

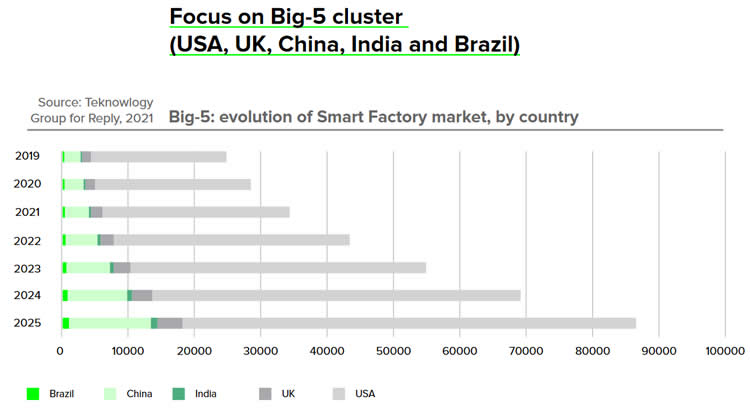

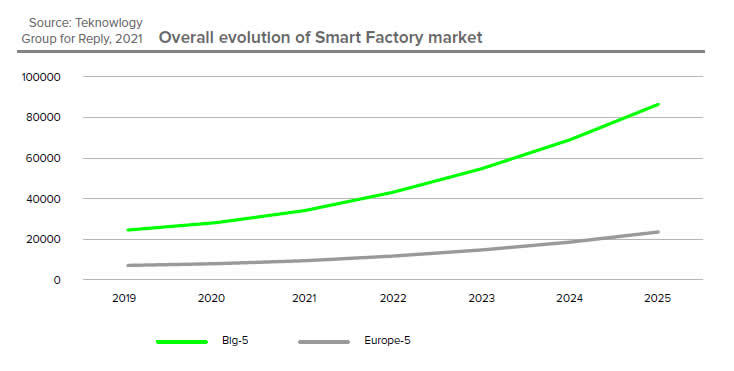

Research paints a rather rosy picture for smart factory investments for the coming years (until 2025). According to a new report, the smart factory market in the US, China, India, Brazil, and the UK (dubbed the “Big-5” cluster) should exceed €86 billion (approx. $101 billion) by 2025.

Among the significant investment areas in that cluster, we find platforms, predictive solutions, and remote monitoring.

If the smart factory market in these five countries effectively exceeds €86 billion by 2025, it will have increased by a whopping 205 percent (compared with 2020). The US and China are the biggest markets in the “Big-5” cluster.

Overall, the smart factory market of the “Big-5” cluster, led by the US, is expected to exceed €86 billion by 2025, with strong investments in platforms, predictive solutions and remote monitoring.

However, China benefited from faster recovery, and the difference with the US remains relatively large in terms of market size. The US alone is expected to reach €68 billion by 2025. By 2025, the US, China and Germany will be the triad leading the smart factory market, besides Japan and Korea per the authors. More on Germany next.

In another region the research looked at, the “Europe-5 cluster”, consisting of Germany, Italy, France, Belgium, and the Netherlands, the smart factory market is expected to nearly triple in all five countries and reach a total of over €23 billion in 2025.

Here, the leader remains Germany, followed by France that is expected to reach a market size of up to 7.3 billion Euro in 2025, compared with over 12 billion for Germany. In the “Europe-5 cluster”, platforms will grow more than anything else, with companies investing to improve quality management and reduce costs.

On the level of technologies there aren’t too many surprises. Mentioning IoT, cloud computing, and data as cornerstones of Industrial IoT, the report zooms in on, among others, the possibilities enabled by edge computing and 5G.

The paper, entitled “Industrial IoT: A Reality Check” also covers smart transport & logistics/ It aggregates several sources, also from third parties. For the forecasts and further analysis, REPLY, the company that commissioned it, worked with PAC (Teknowlogy Group).

A full version of the report can be downloaded here (registration required).